Cost Sharing Contract Example Withholding Tax In Riverside

Category:

State:

Multi-State

County:

Riverside

Control #:

US-00036DR

Format:

Word;

Rich Text

Instant download

Description

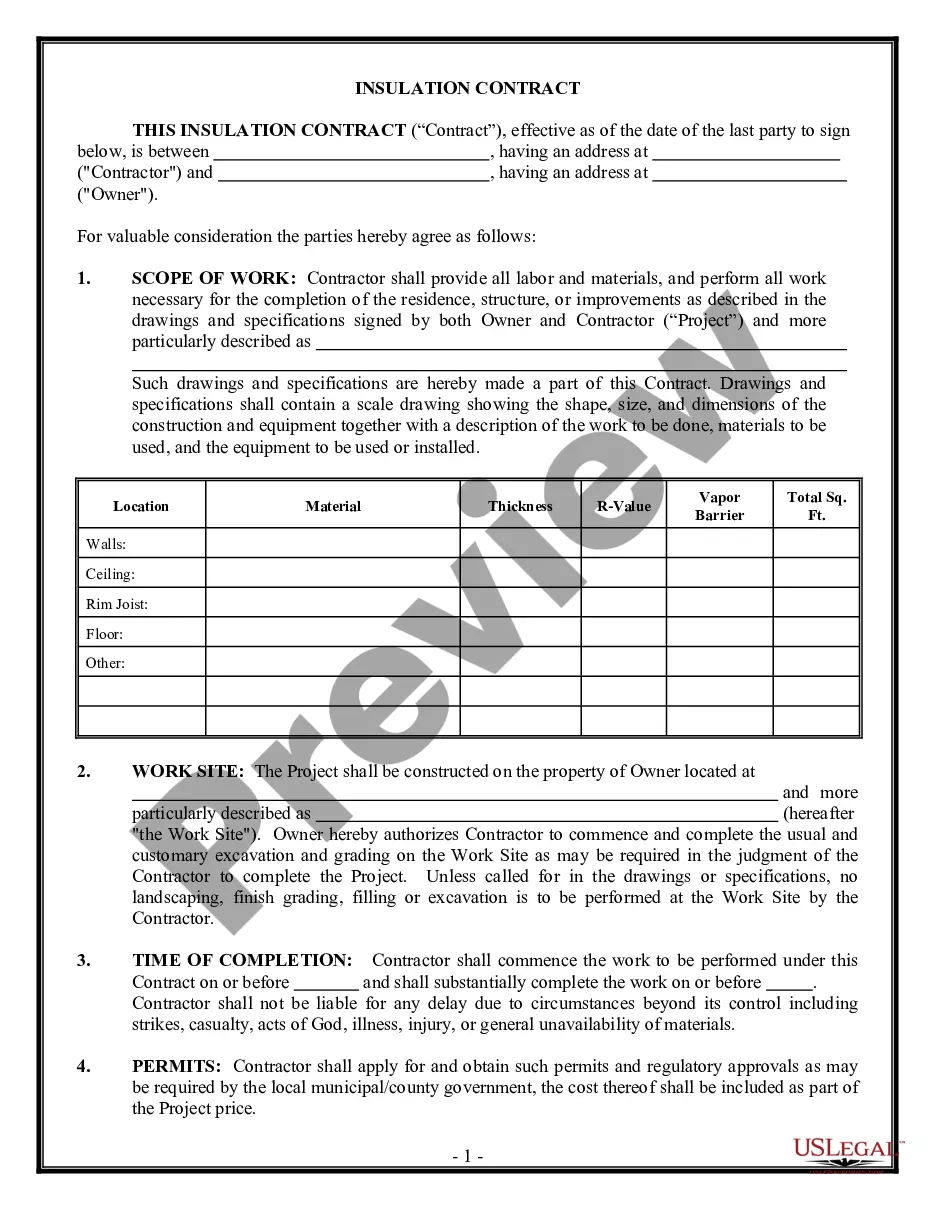

The Cost Sharing Contract example withholding tax in Riverside provides a detailed framework for parties engaging in an equity-sharing venture regarding real estate investment. It outlines the contributions from each party, specifies terms related to property purchase, and delineates the distribution of proceeds upon sale. Key features include the establishment of an equitable ownership structure, responsibilities for loan financing, and provisions for maintenance and tax distribution. Filling and editing instructions emphasize clarity in the input of personal and financial details while ensuring mutual agreement is documented. Target audience members such as attorneys, partners, owners, associates, paralegals, and legal assistants can find utility in this form when facilitating agreements, advising clients on property investments, or ensuring compliance with tax regulations. The contract also serves as a resource for mediating disputes and ensuring that shared expenses and income are equitably managed. Additionally, it includes provisions for mandatory arbitration and modifications, making it adaptable for both parties' needs.

Free preview

Form popularity

FAQ

Tax Sharing Agreements This allows companies leaving the tax group (for example on a sale to a third party) to rely on the 'clear exit' rule which limits that leaving company's exposure to the joint and several tax liabilities of the whole group.