Gift Of Equity Contract Example For Real Estate In Oakland

Description

Form popularity

FAQ

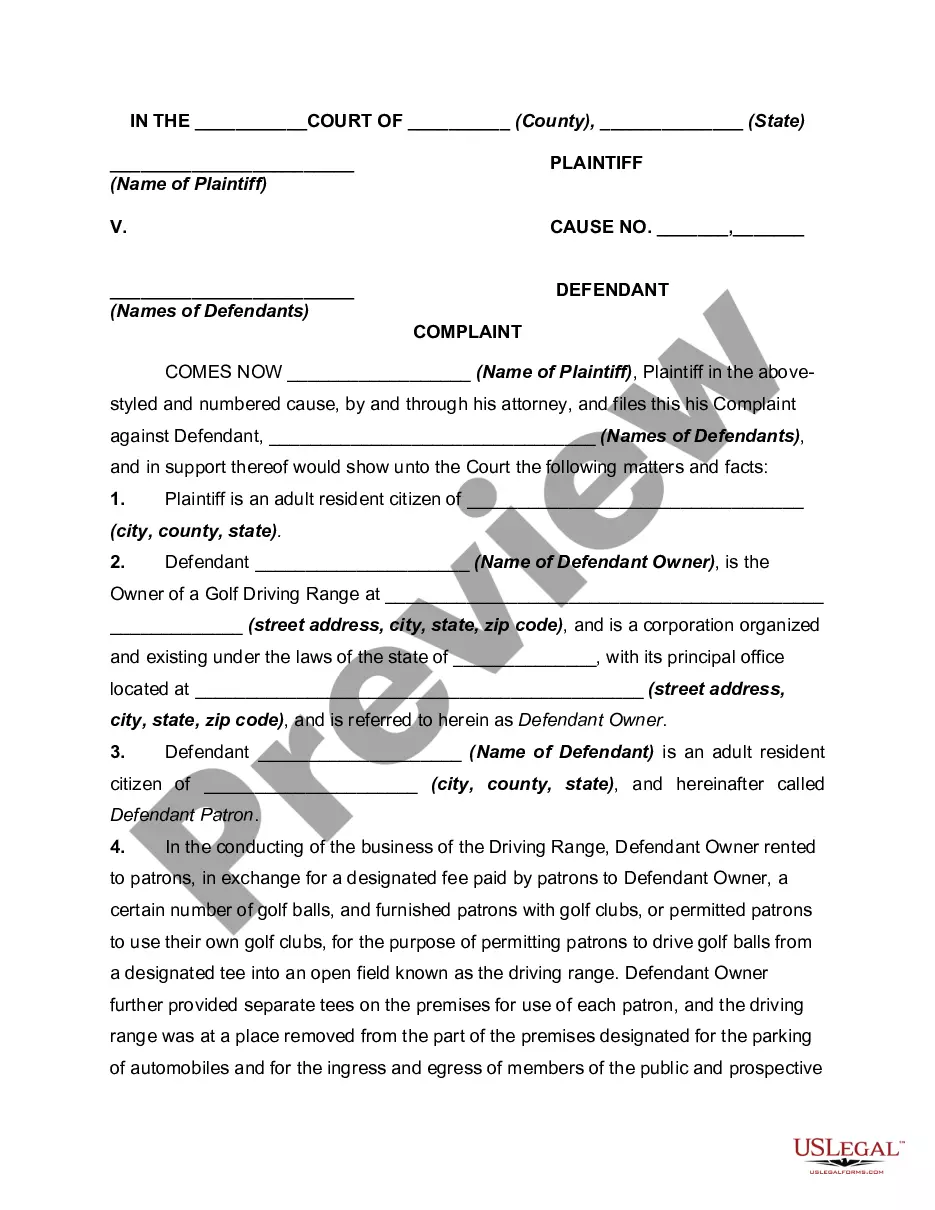

For example, if you own a home worth $300,000 and sell it to a family member for $200,000, they've received a gift of equity of $100,000. A gift of equity can occur if a home is given away for no compensation or if a discount is offered on its value.

The seller must obtain an official home appraisal to ascertain fair market value and also sign a gift letter that describes the buyer-seller relationship and states that the equity is a gift the buyer is not obligated to repay. The buyer must follow the typical process for buying a home.

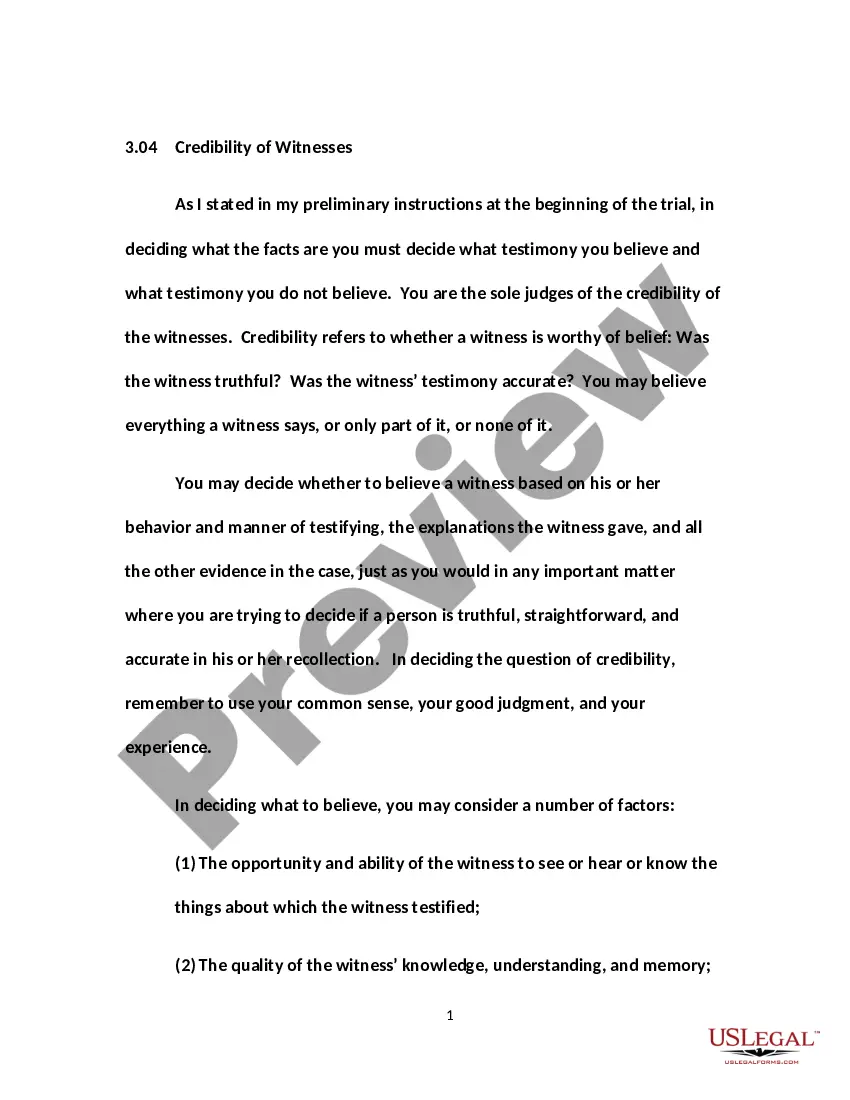

Gifts of equity, like other gifts, aren't taxable to the recipient. The seller might have to file a gift return. They're allowed to give $15,000 per person each year without having to file a gift return. So, if the gift of equity they gave you is less than $30,000, they don't have to file the return.

Non-Family Members – In some cases, individuals with a close personal relationship may also be able to gift equity. This can include close friends or individuals with a significant personal connection.