Equity Agreement Form Template With Drop Down List In North Carolina

Description

Form popularity

FAQ

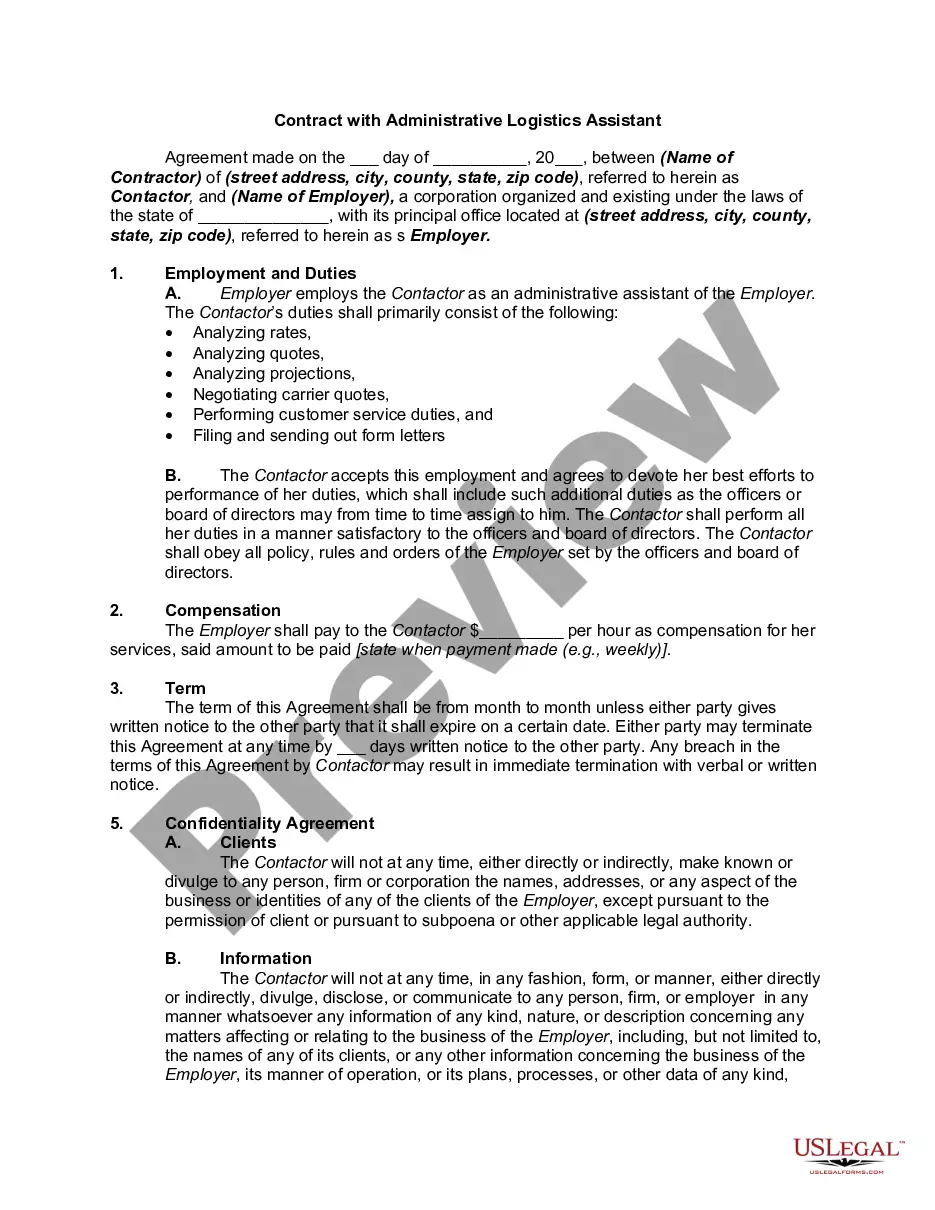

Draft the equity agreement, detailing the company's capital structure, the number of shares to be offered, the rights of the shareholders, and other details. Consult legal and financial advisors to ensure that the equity agreement is in line with all applicable laws and regulations.

Call the NC REALTORS® Legal Hotline at (336) 294-1415. Don't waste your time stressing over forms, disclosure or landlord/tenant law, call to get quick resolution for your business and your clients.

A company provides you with a lump sum in exchange for partial ownership of your home, and/or a share of its future appreciation. You don't make monthly repayments of principal or interest; instead, you settle up when you sell the home or at the end of a multi-year agreement period (typically between 10 and 30 years).

An equity agreement is like a partnership agreement between at least two people to run a venture jointly. An equity agreement binds each partner to each other and makes them personally liable for business debts.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

As a best practice, all parties should sign Form 220.

NOTE: Only use this form to create an agreement for cooperating compensation if a seller is represented by a licensed real estate broker. Form 220G contains guidance on this form. Use Form 150 instead of this form if working you are creating a compensation agreement with an unrepresented seller.

Although North Carolina's laws do not require LLCs to have operating agreements, you are still encouraged to have one to protect the operations of your business. Having an operating agreement is critical to ensure that your business is legally compliant and that all of the proper procedures and policies are followed.

When you draft an employment contract that includes equity incentives, you need to ensure you do the following: Define the equity package. Outline the type of equity, and the number of the shares or options (if relevant). Set out the vesting conditions. Clarify rights, responsibilities, and buyout clauses.

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.