Equity Agreement Form For Nonprofit Organizations In Nassau

Description

Form popularity

FAQ

Equity is a fancy way of saying "net assets." If you need a refresher, net assets in nonprofit accounting are the result of subtracting your liabilities from your gross assets.

What Is Equity? Equity is a fancy way of saying "net assets." If you need a refresher, net assets in nonprofit accounting are the result of subtracting your liabilities from your gross assets.

Nonprofits have no owners or stakeholders, so they have no equity or distributed profits. These differences ultimately reflect the different missions for nonprofit and for-profit companies.

The CHAR500 application portal lets charities in New York State file their annual financial disclosures online. If you are a first-time user of CHAR500, you need to create a new online account.

How many board members does a charitable corporation have to have? A corporation formed in New York must have at least three board members.

Charities Bureau The Office of the New York State Attorney General regulates nonprofit organizations and fundraisers and provide them with helpful resources. In addition, we protect nonprofits and their donors from fraud and ensure that charitable donations are used as the donor intended.

Federal law requires a tax-exempt charitable nonprofit that is dissolving to distribute its remaining assets ONLY to another tax-exempt organization or to the federal government or a state or local government for a public purpose.

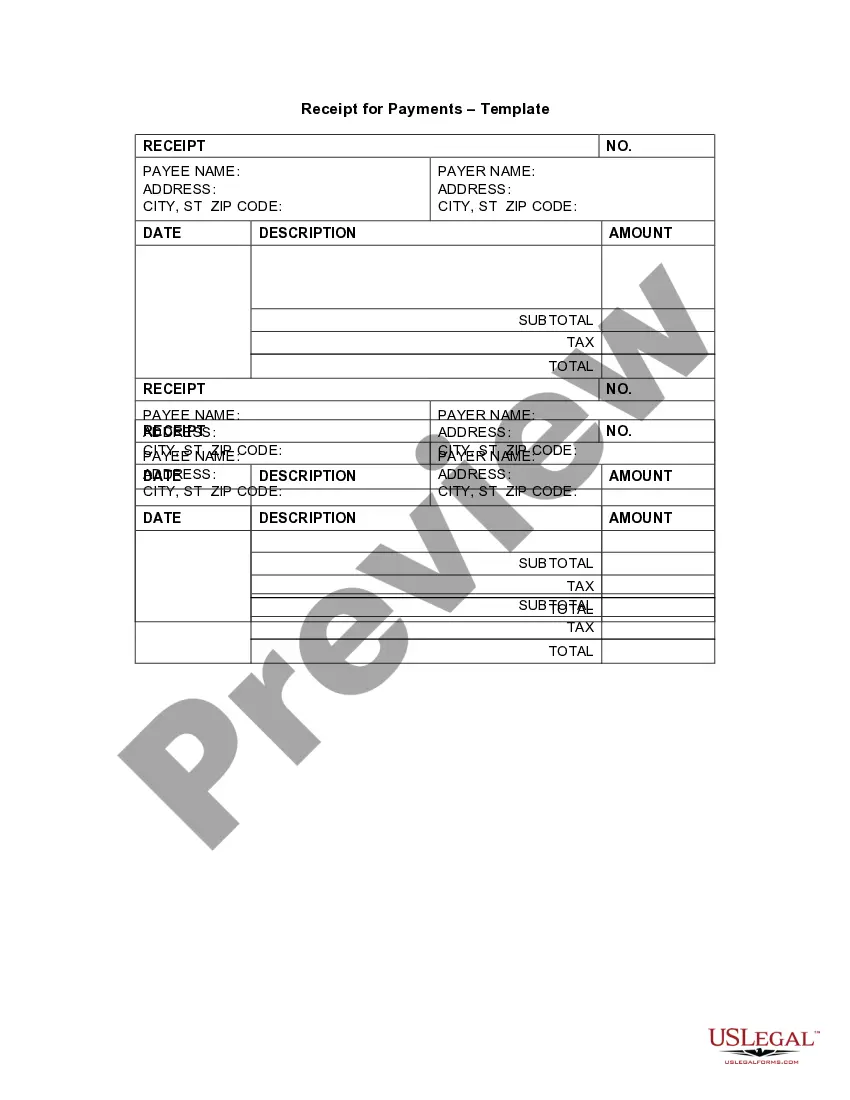

July 9, 2021 Gross Annual Revenue and SupportRequired Filing Less than $250,000 Unaudited Financial Report More than $250,000 but not more than $1 million Financial report with independent CPA's review report In excess of $1 million Financial report with CPA audited financial statement

Charities, Nonprofits & Fundraisers. All charitable organizations operating in New York are required by law to register and file annual financial reports with the Office of the New York State Attorney General.