Shared Equity Agreements For Sale In Maricopa

Description

Form popularity

FAQ

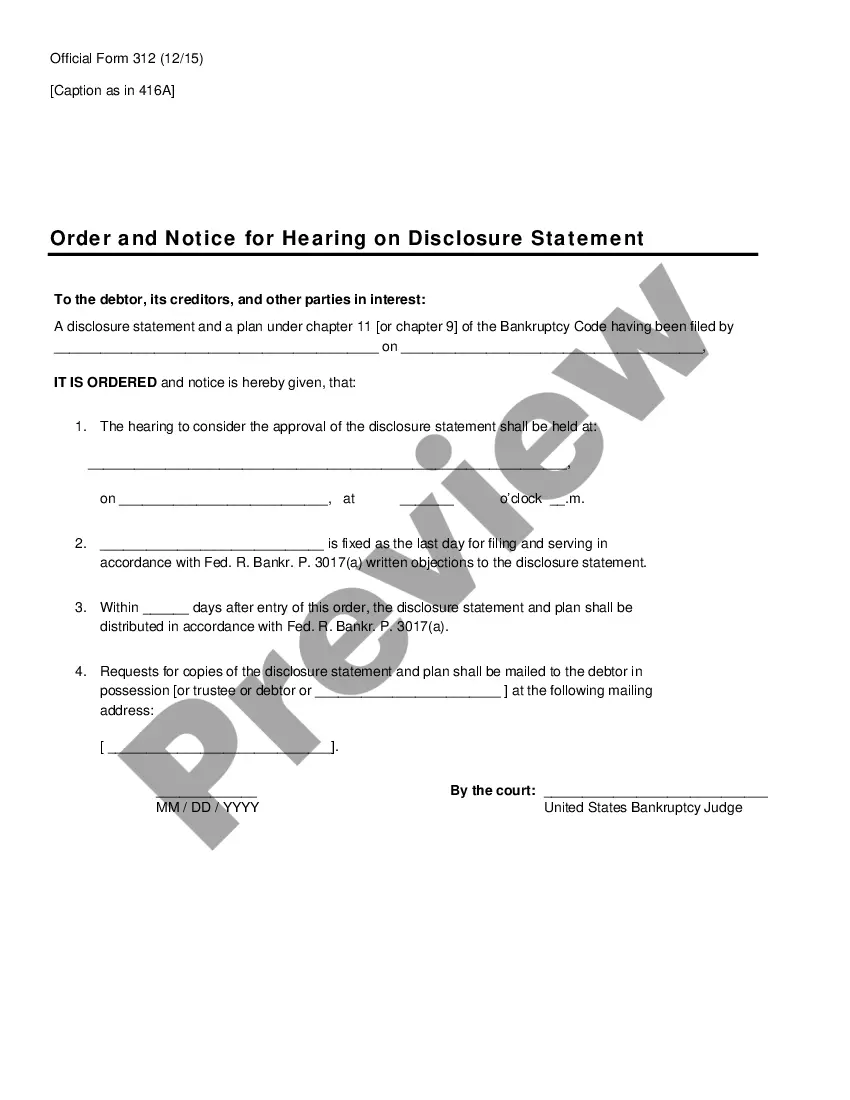

Term length. Point offers a much longer term than Unlock—30 years compared to 10, respectively. Those two extra decades could prove invaluable if you don't intend to sell your home and need to save up for a buyout. But with Point, what you'll gain in time you'll lose in flexibility.

The Close's top picks for the best home equity sharing companies Home Equity Sharing CompanyHome Equity Investment (HEI) Terms Visit Splitero Get between $30,000-500,000 or up to 15% of your home's value 10-30 year term Visit Unison Get up to $500,000 10-year term Receive funding in two to six weeks8 more rows •

How our HEI process works Get your initial offer and apply. See if you qualify in 60 seconds or less and get your initial offer with no obligation and no effect on your credit. Verify information and receive a home appraisal. Gather the documents you'll need and submit them online. Get your funds.

Home equity sharing agreements involve selling a percentage of your home's value or appreciation to an investor in exchange for a lump sum upfront. The agreement typically is settled, with the homeowner paying back the investor, after the home is sold or at the end of a 10- to 30-year period.

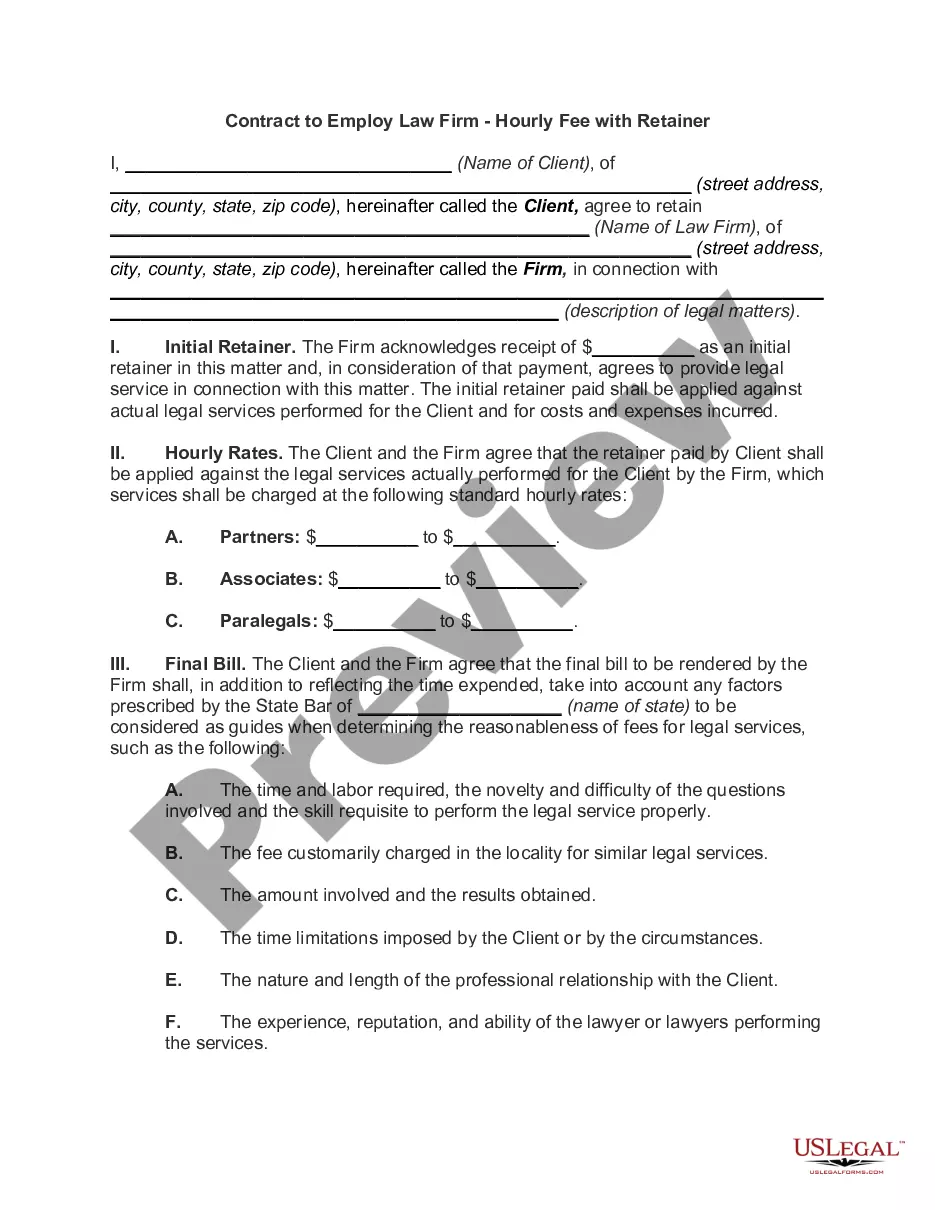

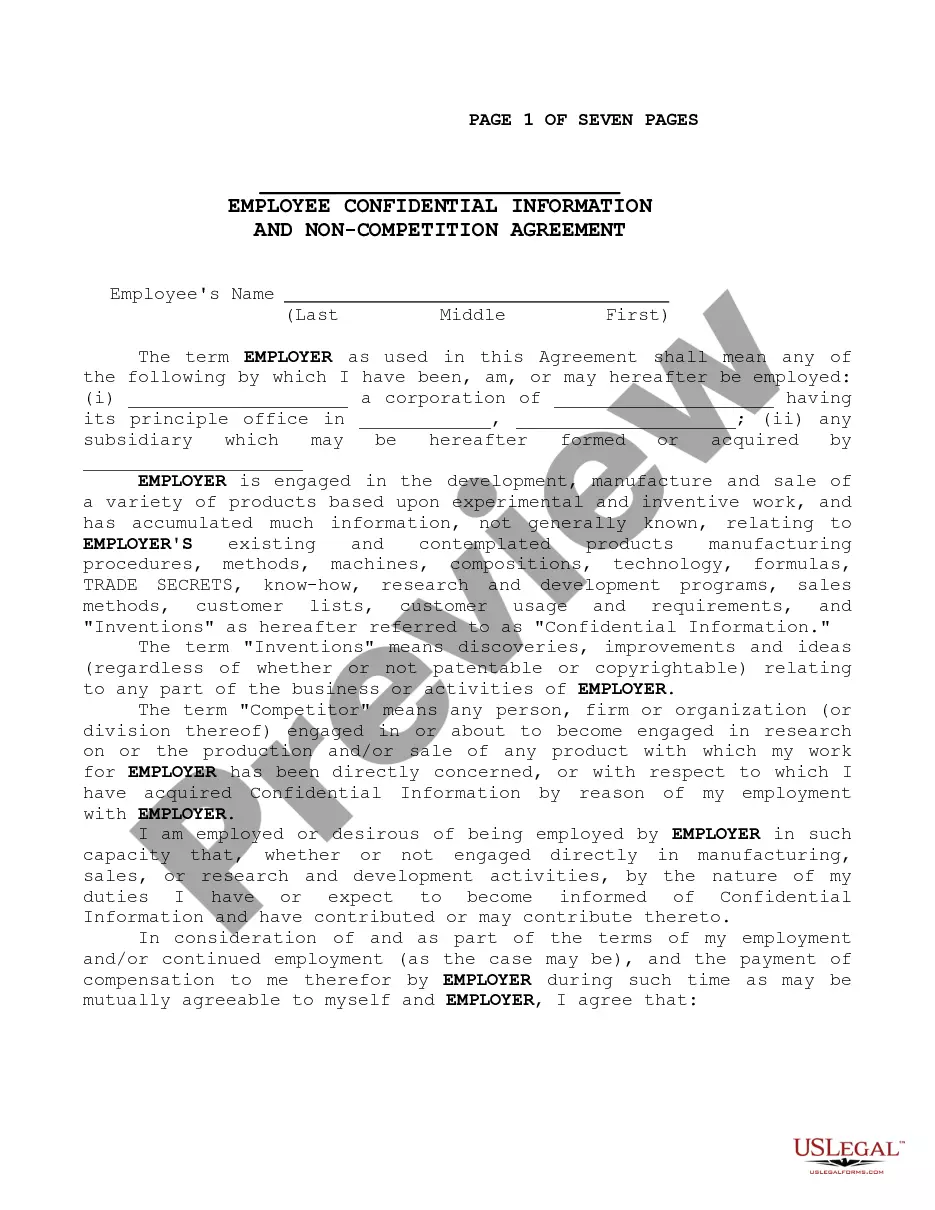

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

Equity shares are long-term financing sources for any company. These shares are issued to the general public and are non-redeemable in nature. Investors in such shares hold the right to vote, share profits and claim assets of a company.

Investing in equity shares is a great idea. The reason is that an equity share indicates that you have a certain percentage of equity in the company. Thus, the returns you get are directly linked to the profits of the company. This makes it a great option as the opportunity to earn a good return is high.

A company provides you with a lump sum in exchange for partial ownership of your home, and/or a share of its future appreciation. You don't make monthly repayments of principal or interest; instead, you settle up when you sell the home or at the end of a multi-year agreement period (typically between 10 and 30 years).