In equity sharing both parties benefit from the relationship. Equity sharing, also known as housing equity partnership (HEP), gives a person the opportunity to purchase a home even if he cannot afford a mortgage on the whole of the current value. Often the remaining share is held by the house builder, property owner or a housing association. Both parties receive tax benefits. Another advantage is the return on investment for the investor, while for the occupier a home becomes readily available even when funds are insufficient.

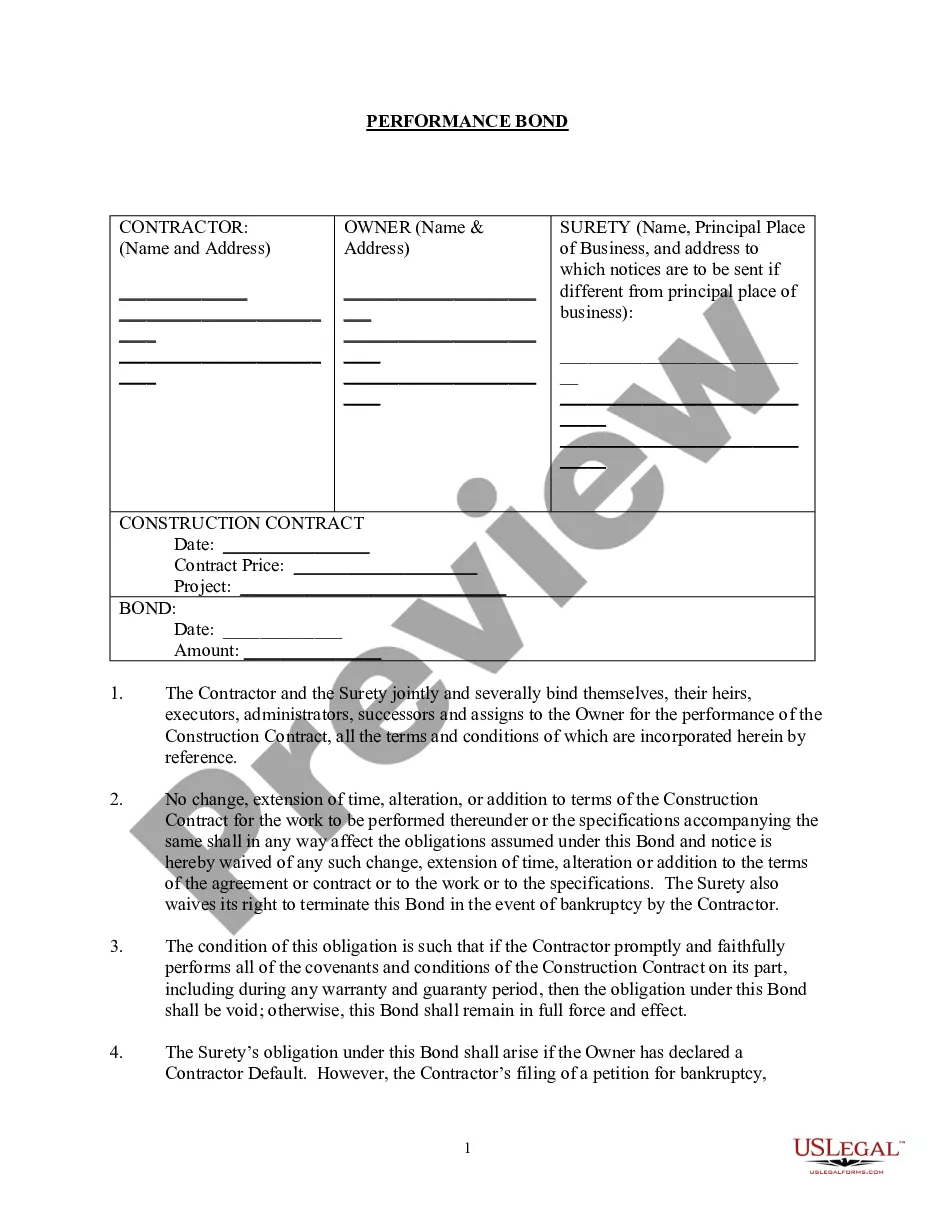

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.