Equity Share Agreement Template For Nonprofit Organizations In Illinois

Description

Form popularity

FAQ

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

Not all nonprofits offer equity to their employees, and some may have restrictions or limitations on who can receive it and how much. For example, some nonprofits may only offer equity to senior executives or key personnel, while others may have a cap on the total amount of equity they can distribute.

Equity is a fancy way of saying "net assets." If you need a refresher, net assets in nonprofit accounting are the result of subtracting your liabilities from your gross assets.

Under Illinois law, purchases by not-for-profit organizations are generally exempt from sales and use tax in Illinois, but the organization must have and provide their active state exemption certificate.

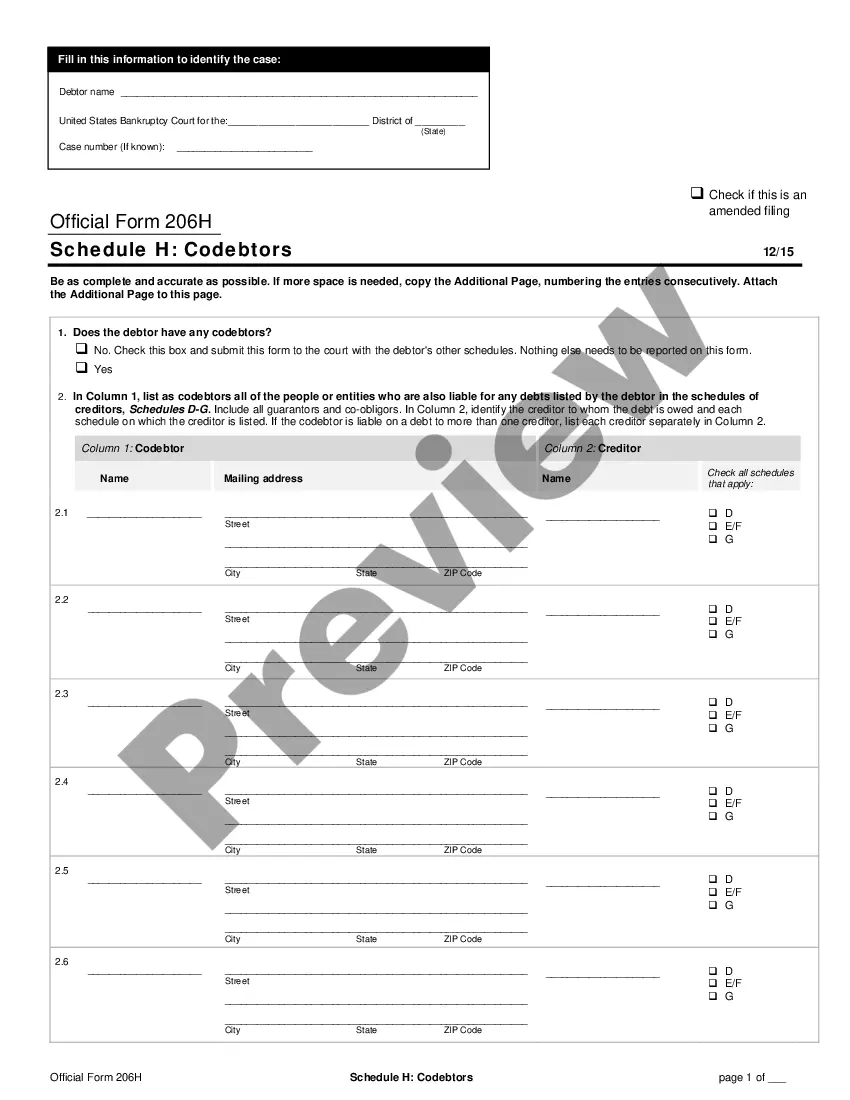

Nonprofits do not have owners. As a result, nonprofits do not nave owner equity. In both cases, net assets equal the difference between the total assets and total liabilities. However, nonprofits generate the Statement of Financial Position which only presents revenue, assets and liabilities.

Illinois doesn't require your LLC to have an operating agreement. Though not required, it's strongly recommended that your LLC as one. An operating agreement is an internal document that establishes how you'll run your LLC.

Nonprofits can not have owners. Most charitable organizations are formed as non-stock nonprofit corporations or LLCs that are ownerless entities.