Equity Agreement Form For Car In Illinois

Description

Form popularity

FAQ

If you had the vehicle titled in another state for more than three months, no Illinois tax is due, but you still must file Form RUT-50 to reflect that fact. On Forms RUT-25 and RUT-50, the exemption for using the vehicle outside Illinois for more than three months applies only to individuals moving into Illinois.

So do not touch that part. And that's it so you sign your title it is now transferable. You do notMoreSo do not touch that part. And that's it so you sign your title it is now transferable. You do not mean to flip your title over and touch the back that is for us.

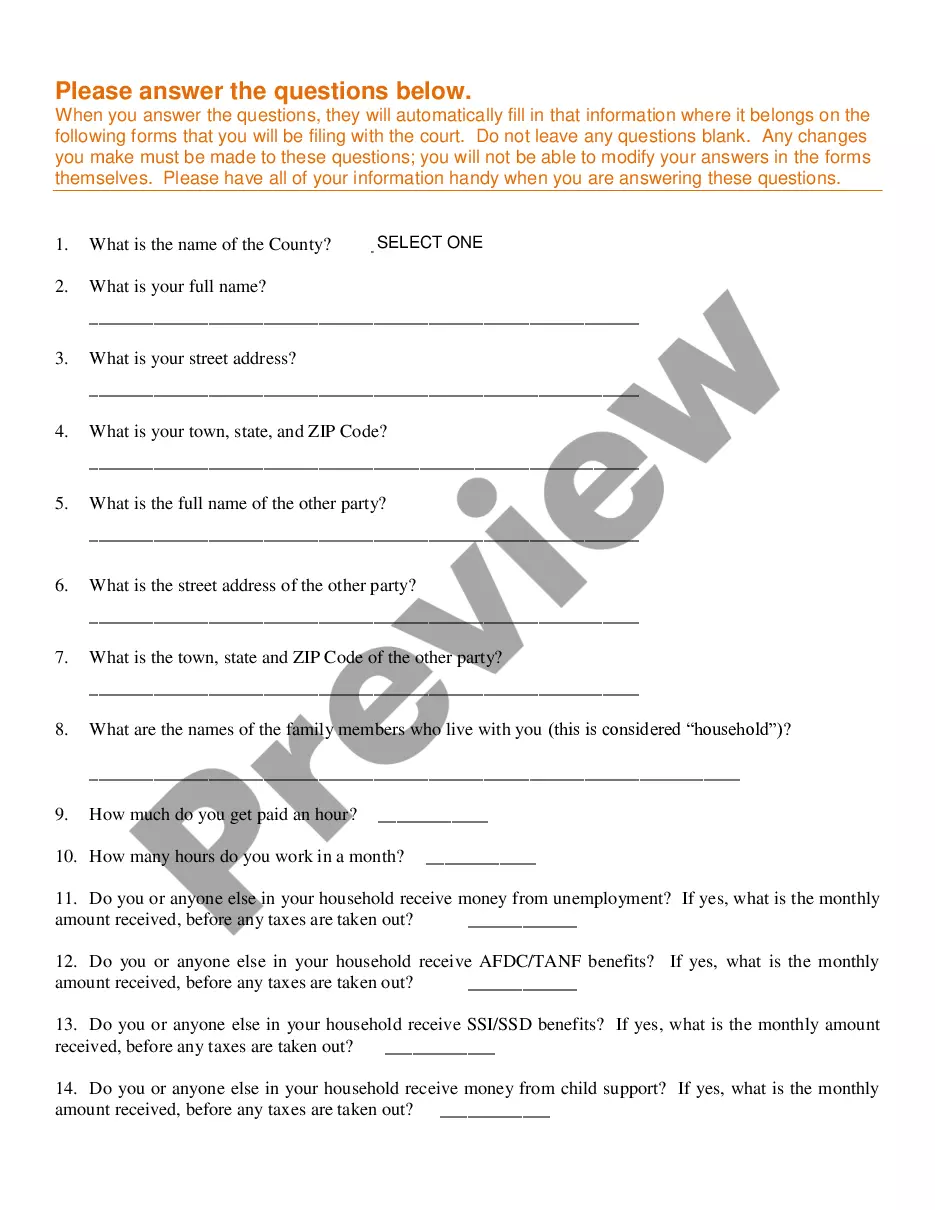

How to fill out vsd 190 illinois? To fill out the VSD 190 form for Illinois, you will need to provide your name, address, driver's license number, and date of birth. You will also need to provide information regarding your vehicle, including the make, model, year, and license plate number.

Writing the Gift Letter: Step-by-Step Step 1: Begin with the Date and Contact Information. Step 2: Clearly State the Gift. Step 3: Include Vehicle Details. Step 4: Explain the Relationship between Giver and Receiver. Step 5: Declare No Expectation of Repayment. Step 6: Signatures and Notarization.

You must complete Form RUT-25, Vehicle Use Tax Transaction Return, if you are titling or registering in Illinois a motor vehicle (including all-terrain vehicle (ATV)), trailer, manufactured (mobile) home, watercraft, aircraft, or snowmobile that you purchased from an unregistered out-of-State dealer or retailer.

To gift someone a vehicle, you must transfer the vehicle title to their name and create a bill of sale. Selling a vehicle for $1 instead of gifting it could result in your recipient paying sales tax based on the car's fair market value — it's better to stick with the official gifting process.

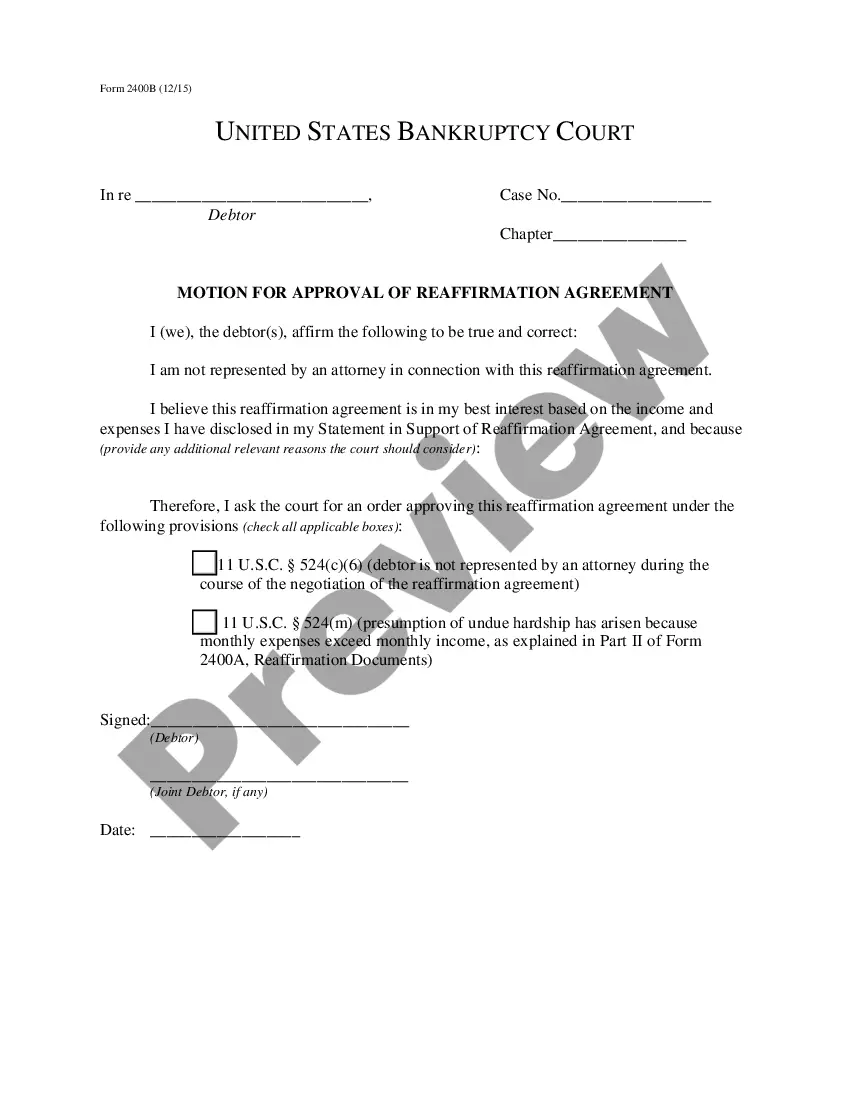

A Equity Interest Transfer Agreement is a legal document used to transfer ownership of equity interests in a company.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

A company provides you with a lump sum in exchange for partial ownership of your home, and/or a share of its future appreciation. You don't make monthly repayments of principal or interest; instead, you settle up when you sell the home or at the end of a multi-year agreement period (typically between 10 and 30 years).

A transfer agreement is a legally binding document that conveys ownership from one person or entity to another. Transfer agreements are used to sell real estate, businesses, and other tangible assets as well as intellectual property such as computer code, song lyrics, and industrial processes.