Startup Equity Agreement Without In Hennepin

Description

Form popularity

FAQ

An equity agreement is like a partnership agreement between at least two people to run a venture jointly. An equity agreement binds each partner to each other and makes them personally liable for business debts.

How to negotiate equity in 9 steps Research the company. Review the company's financial potential. Research similar companies. Read the offer carefully. Evaluate the terms of the offer. Address your needs and the company's needs. Speak with the employer during negotiations. Keep your negotiations focused.

In summary, 1% equity can be a good offer if the startup has strong potential, your role is significant, and the overall compensation package is competitive. However, it could also be seen as low depending on the context. It's essential to assess all these factors before making a decision.

As a rule of thumb, a non-founder CEO joining an early-stage startup (that has been running less than a year) would receive 7-10% equity. Other C-level execs would receive 1-5% equity that vests over time (usually 4 years).

Founders typically give up 20-40% of their company's equity in a seed or series A financing. But this number could be much higher (or lower) depending on a number of factors that we will discuss shortly. “How much equity should we sell to investors for our seed or series A round?”

Here are 10 alternative funding sources for startups: Bootstrapping. Friends and family. Startups grants. Rewards-based crowdfunding. Angel investors. Venture Capital. Bank loans. Invoice financing for startups.

1. Request A Proof Of Funds Letter From Your Bank. To request a POF letter, make a written request, head down to your local bank branch or call customer service.

How to prepare a statement of owner's equity Step 1: Gather the needed information. Step 2: Prepare the heading. Step 3: Capital at the beginning of the period. Step 4: Add additional contributions. Step 5: Add net income. Step 6: Deduct owner's withdrawals. Step 7: Compute for the ending capital balance.

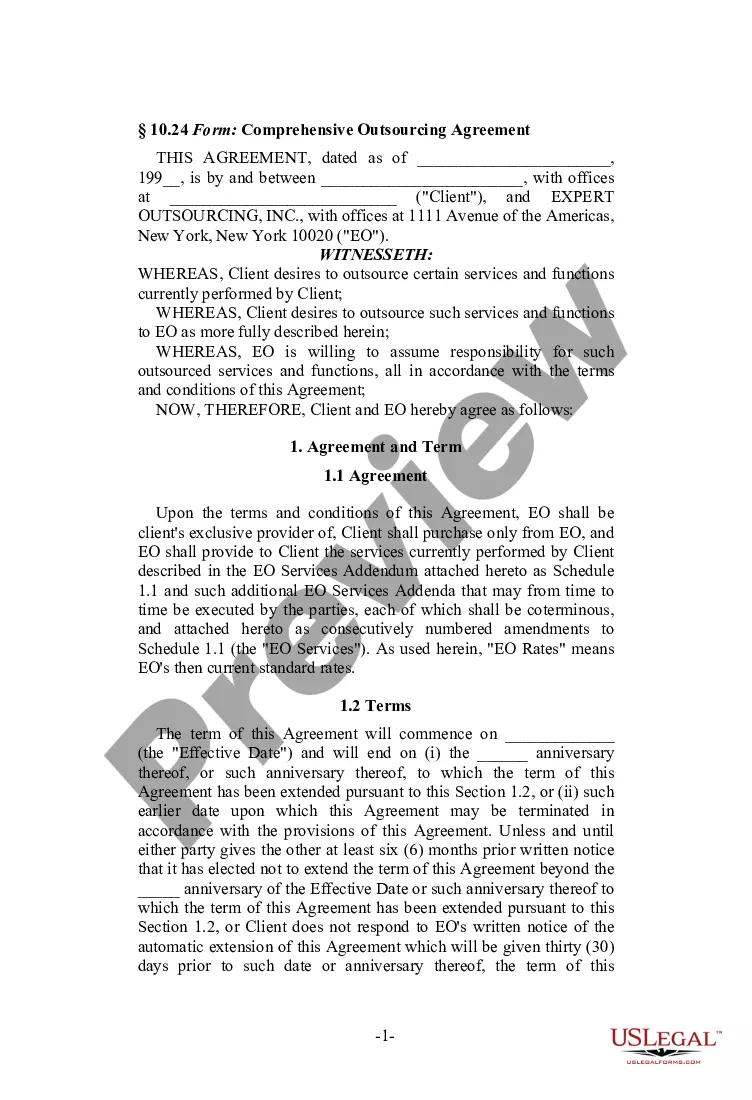

Draft the equity agreement, detailing the company's capital structure, the number of shares to be offered, the rights of the shareholders, and other details. Consult legal and financial advisors to ensure that the equity agreement is in line with all applicable laws and regulations.

If you bought the security through a brokerage firm, contact the firm and ask if they have a record of your ownership. Brokerage firms are required to keep records for only six years. Copies of confirmations are only required to be kept for three years.