Equity Shares For Short Term In Harris

Description

Form popularity

FAQ

Capital gains are categorized by holding period. Long-Term Capital Gains (LTCG) arise from assets held beyond 12 months (e.g., listed equity shares, equity mutual funds), offering favorable tax benefits. Short-Term Capital Gains (STCG) result from assets sold within 12 months, typically taxed at higher rates.

STOCKS FOR SHORT TERM BUYING S.No.NameCMP Rs. 1. Easy Trip Plann. 15.51 2. One Point One 54.56 3. Motherson Wiring 59.47 4. Nova Agritech 63.3622 more rows

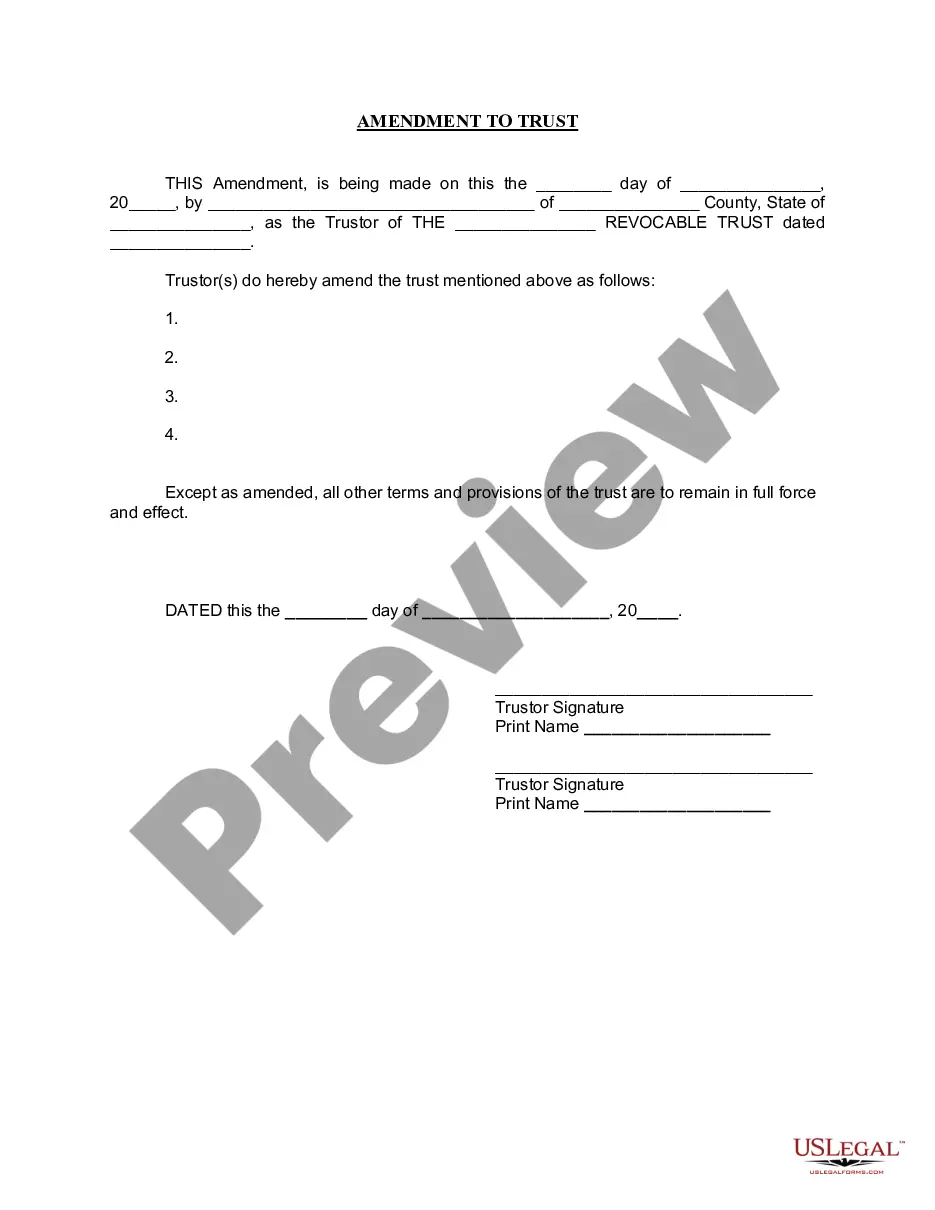

How to fill out the Share Application Form for Equity and Preference Shares? Fill in the personal details of all applicants in the specified sections. Indicate the type and number of shares you are applying for. Specify the amount payable per share as well as the total amount.

Strong Earnings Reports: Companies with positive and strong earnings reports are attractive short term stocks. Investors look for firms that show consistent quarterly growth. Sector Trends: Short term stocks often align with current market and sector trends.

Short-Term Capital Gains (STCG) on listed shares and equity-oriented mutual funds were subject to a concessional rate of 15% for transfers made on or before July 22, 2024. However, starting July 23, 2024, this rate has been increased to 20%.