Equity Agreement Form For 501 In Fairfax

Description

Form popularity

FAQ

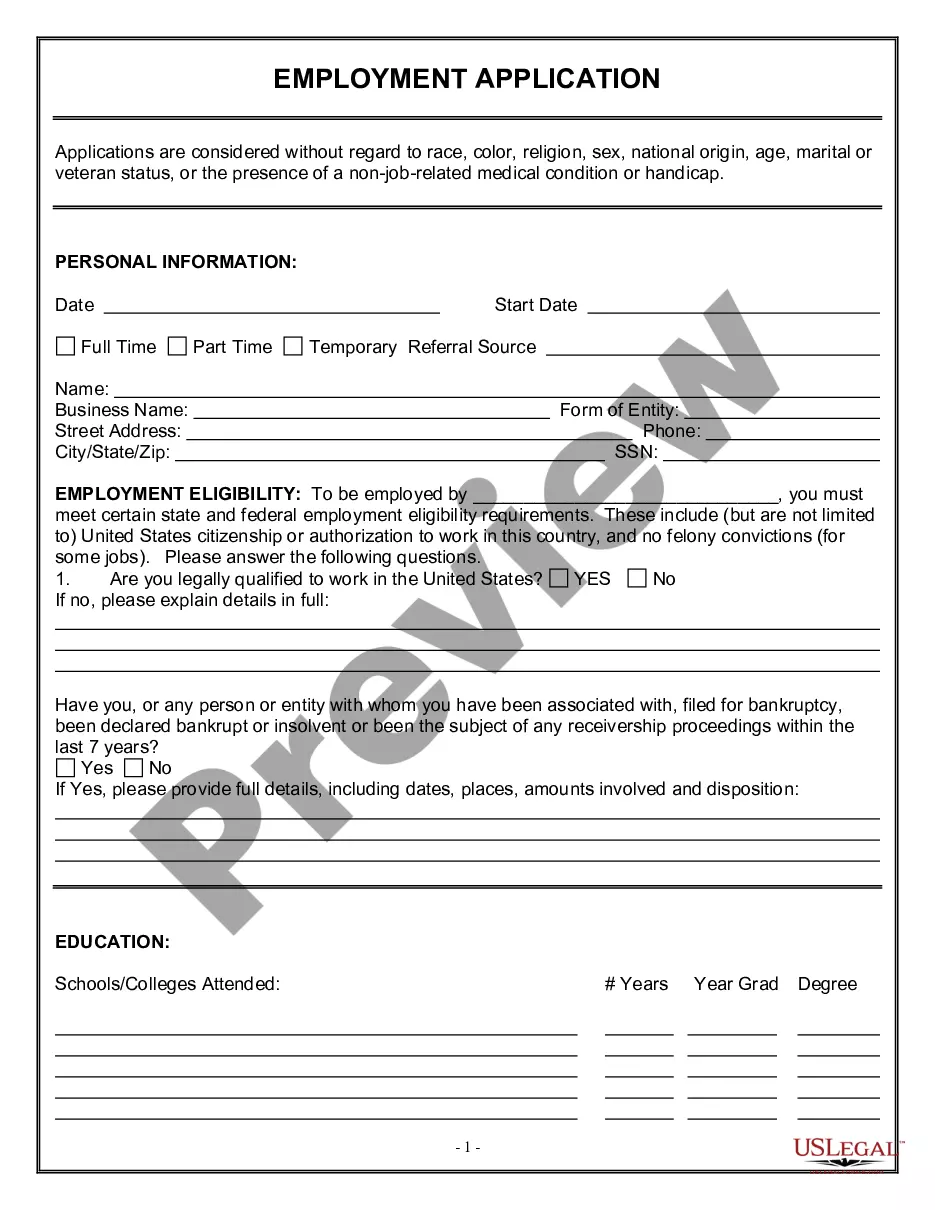

The Virginia Human Rights Act (Title 2.2, Chapter 39 of the Virginia Code) protects employees against employment-based discrimination on the basis of certain characteristics, such as race, national origin, and pregnancy.

The One Fairfax Policy establishes shared definitions, focus areas, processes and organizational structure to help county and school leaders to look intentionally, comprehensively and systematically at barriers that may be creating gaps in opportunity.

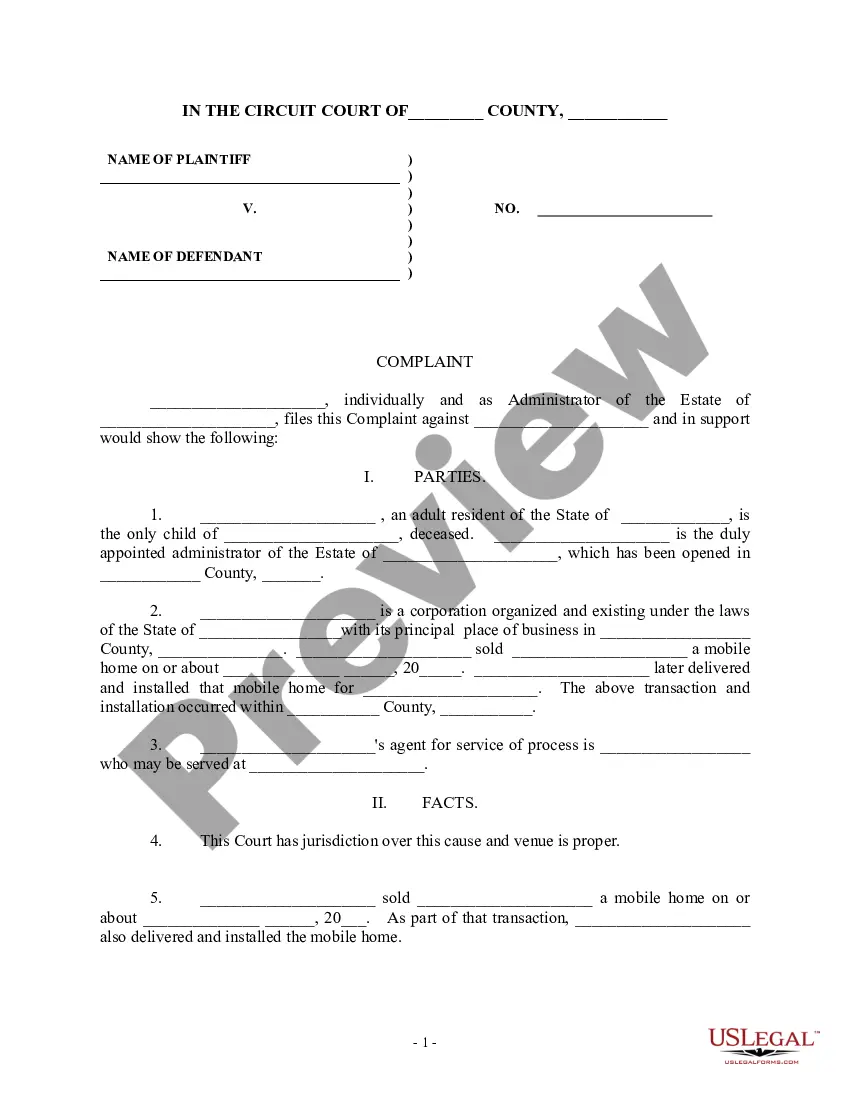

Complaints under state law must be filed within 180 days of the date you became aware you were being discriminated against or the date of the alleged illegal act. You may file a complaint with the Commission by calling (804) 225-2292, visiting the office at 900 E.

The County Executive's Office focuses on strategic planning, ensuring and valuing excellence in public service, fostering partnerships with our residents and community leaders, preparing the annual budget and executing all resolutions and orders of our elected Board of Supervisors.

If you have any questions or need assistance completing the form, please email DTAREDsurveys@fairfaxcounty.

Section 4-7.2-1. (B) Gross receipts do not include revenues that are attributable to taxable business activity conducted in another jurisdiction within the Commonwealth of Virginia and the volume attributable to that business activity is deductible pursuant to Code of Virginia Sections 58.1-3708 and 58.1-3709.

To qualify for real estate tax deferral, you must be at least 65 years of age or permanently and totally disabled. Applicants who turn 65 or become permanently and totally disabled during the year of application may also qualify for tax deferral on a prorated basis.

You may view your tax information online or request a copy of the bill by emailing DTARCD@fairfaxcounty or calling 703-222-8234, TTY 711.

You need the Virginia State's Division of Motor Vehicles website. How can I obtain information about personal property taxes? You can call the Personal Property Tax Division at (804) 501-4263 or visit the Department of Finance website .