Simple Cost Sharing Agreement With 100 In Chicago

Description

Form popularity

FAQ

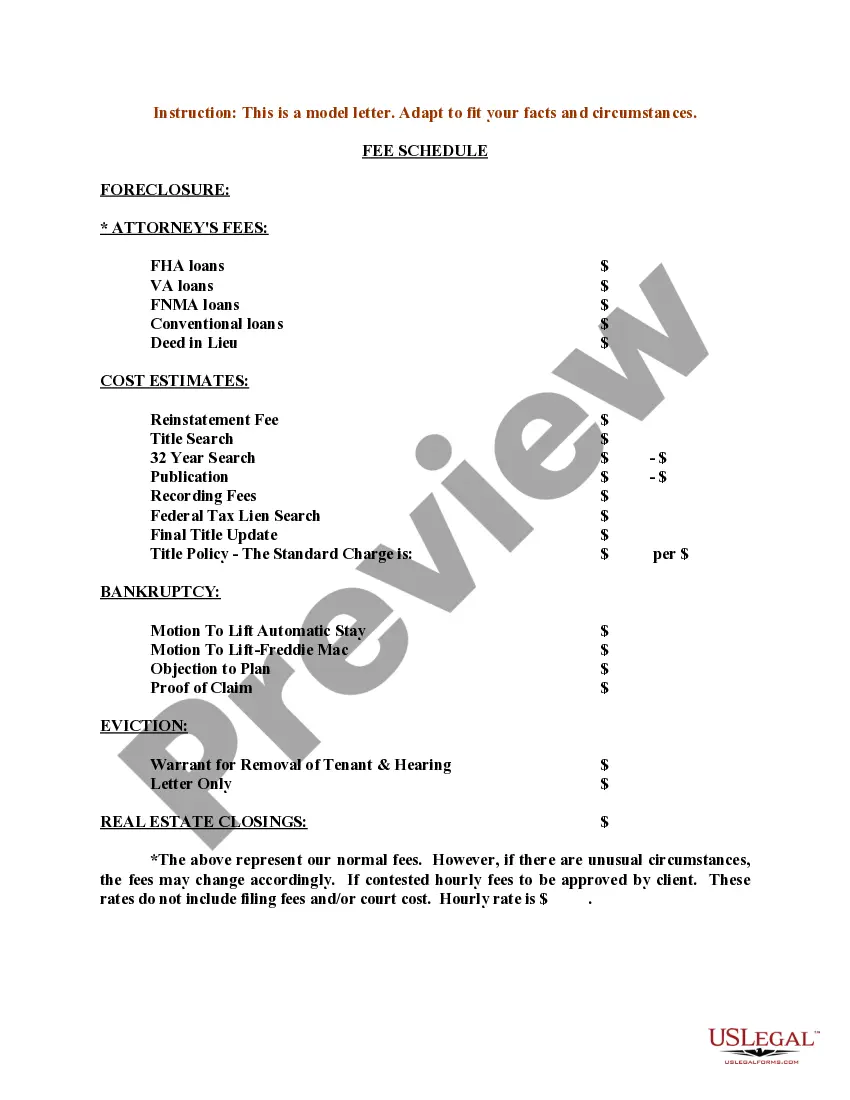

How to create a profit-sharing plan Determine how much you want your PSP amount to be. Profit allocation formula. Write up a plan. Rules. Provide information to eligible employees. File IRS Form 5500 annually. Details your contribution plan and all participants in it. Keep records (e.g., amounts, participants, etc.)

Generally, profit sharing percentages range from 5% to 15% of an employee's annual salary or of the company's pre-tax profits divided among all eligible employees.

The five most important considerations when creating a ProfitSharing Agreement Clarify expectations. Define the role. Begin with a fixed-term agreement. Calculate how much and when to share profits. Agree on what happens when the business has losses.

Profit Distribution A well-crafted profit-sharing agreement should clearly define the methodology used to calculate and distribute profits among the parties involved. This includes outlining the specific formula or criteria for determining each party's share of the profits.

This ratio is usually based on each partner's investment, effort, or other factors agreed upon by the partners. Divide the total profit by the sum of the ratio values to find the value of one share. Multiply the value of one share by each partner's ratio value to find their individual profit share.