Equity Agreement Statement For Business In Bronx

Description

Form popularity

FAQ

An equity agreement is like a partnership agreement between at least two people to run a venture jointly. An equity agreement binds each partner to each other and makes them personally liable for business debts.

A company provides you with a lump sum in exchange for partial ownership of your home, and/or a share of its future appreciation. You don't make monthly repayments of principal or interest; instead, you settle up when you sell the home or at the end of a multi-year agreement period (typically between 10 and 30 years).

Draft the equity agreement, detailing the company's capital structure, the number of shares to be offered, the rights of the shareholders, and other details. Consult legal and financial advisors to ensure that the equity agreement is in line with all applicable laws and regulations.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

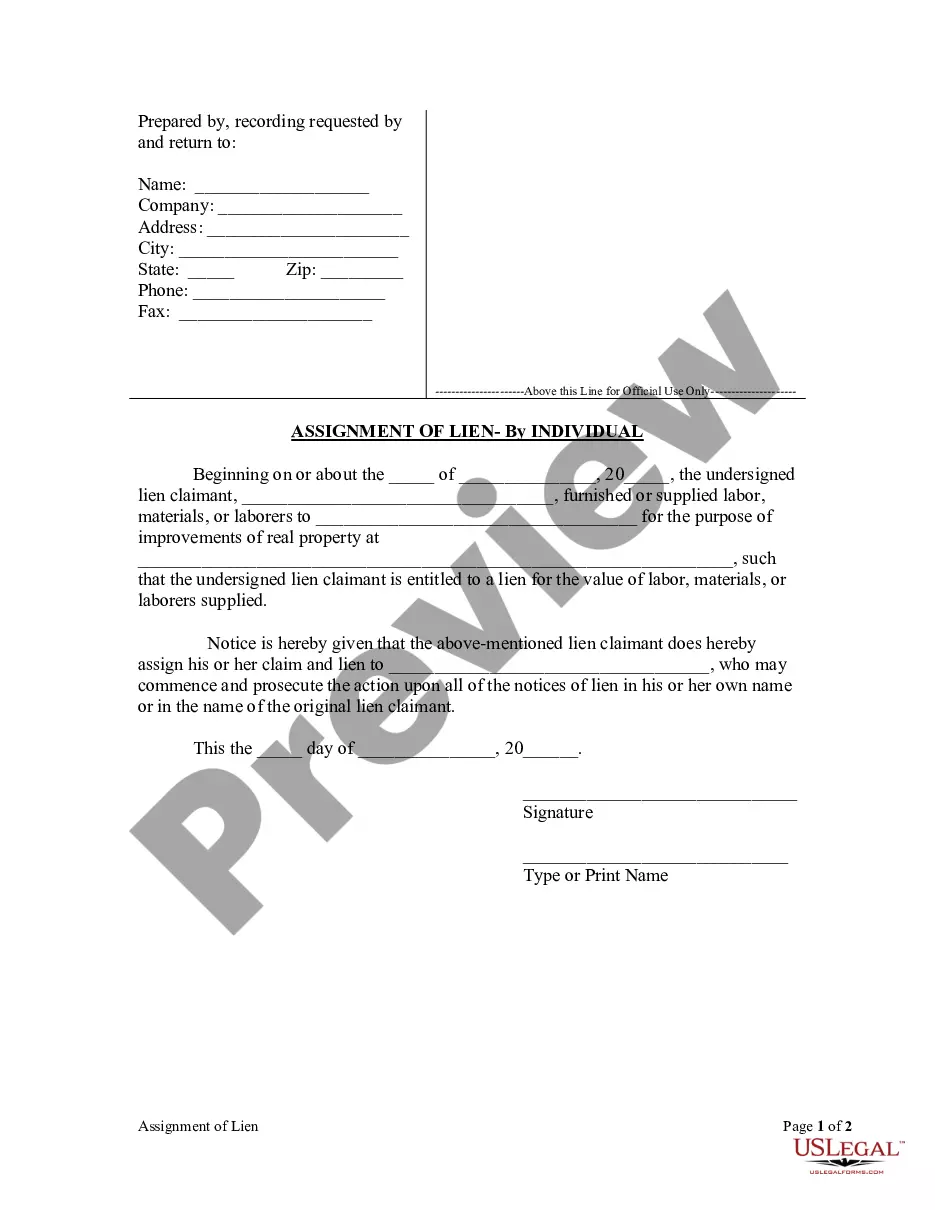

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

The notice must run once a week for six weeks and include a number of facts concerning the company and its formation. If an LLC doesn't fulfill the publication requirements, the company's authority to do business in New York can be suspended.

Domestic and foreign business corporations are required by Section 408 of the Business Corporation Law to file a Biennial Statement every two years with the New York Department of State.

A corporation or LLC that fails to file its Biennial Statement will be reflected in the New York Department of State's records as past due in the filing of its Biennial Statement.

New York doesn't administratively dissolve LLCs. Even if you stop doing business in New York, your LLC will remain active and in existence until you take steps to dissolve it. If you voluntarily dissolved your LLC but want to get it back into business, you'll have to start over and form a new New York LLC.

Uniform Commercial Code (UCC) Financing Statement shows a security interest in personal property including in a cooperative corporation. The Office of the City Register records Uniform Commercial Code (UCC) Financing Statements for co-ops. All other UCCs must be filed with the NYS Department of State.