Good Faith Estimate Template Excel With Payment In Texas

Description

Form popularity

FAQ

IMPORTANT: You aren't required to sign this form and shouldn't sign it if you didn't have a choice of health care provider before scheduling care.

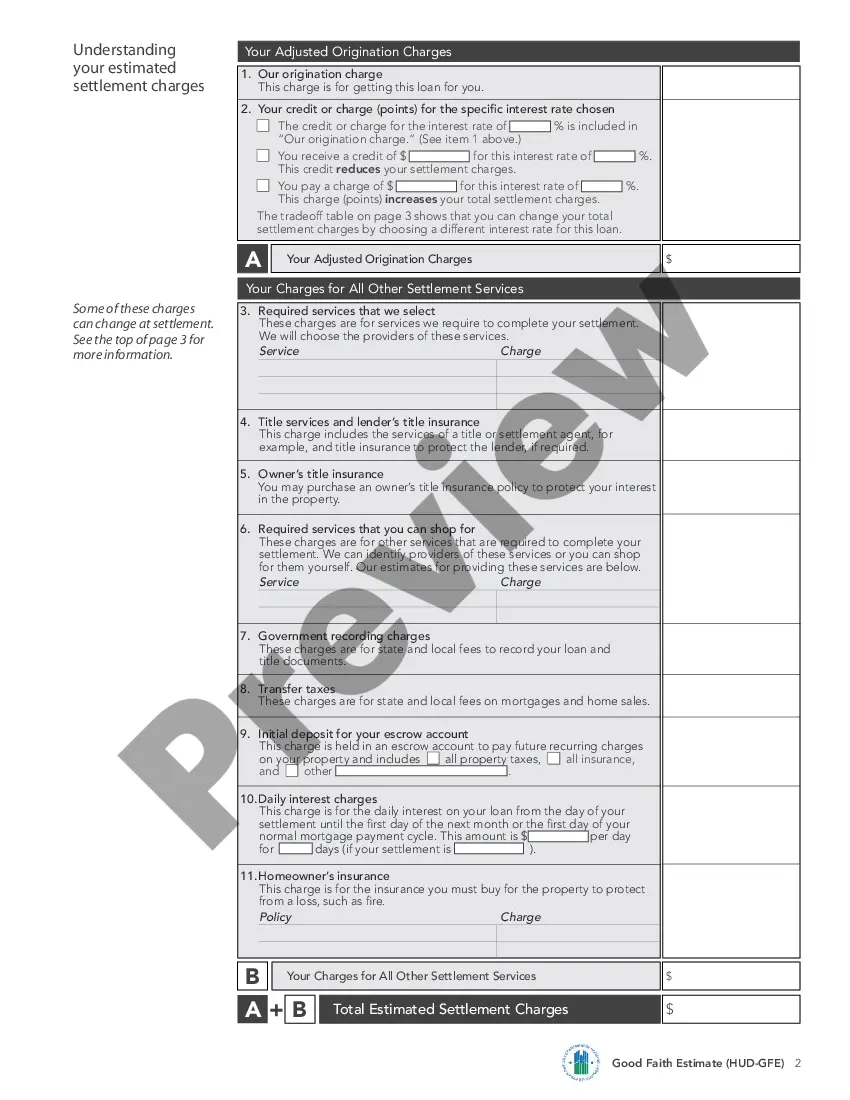

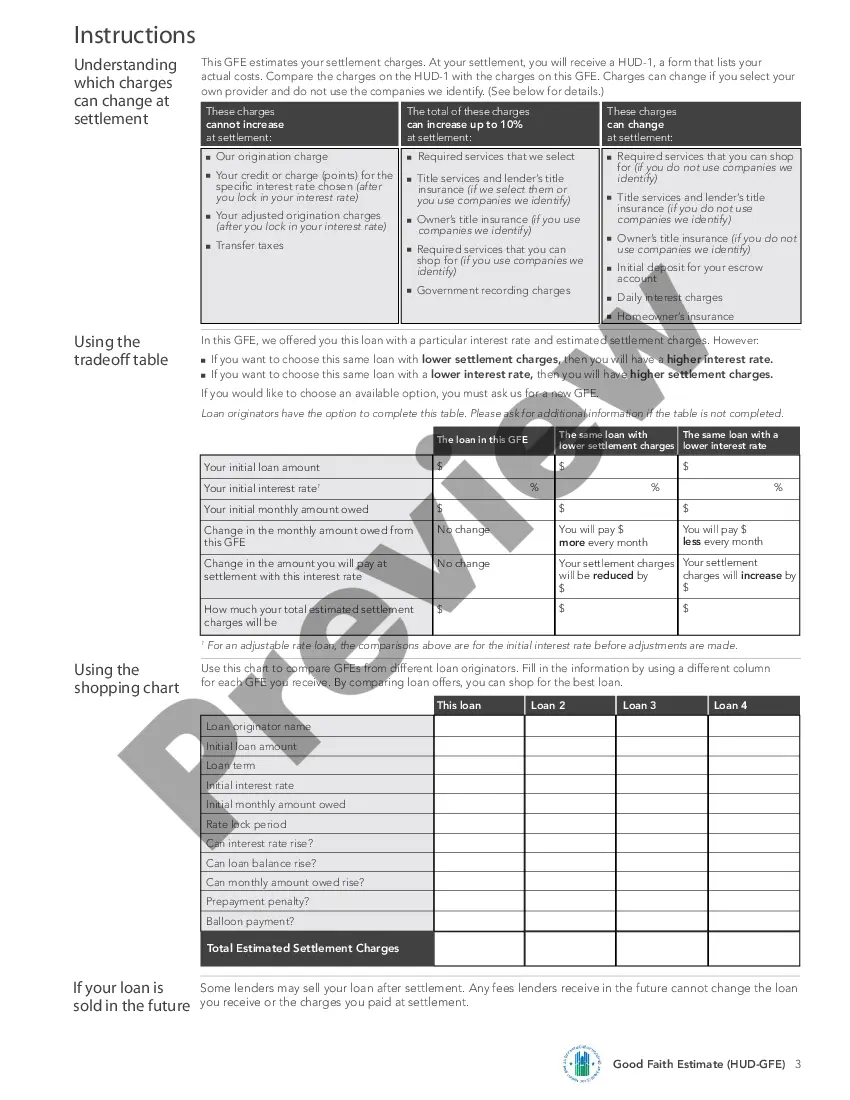

A good faith estimate should include expected charges for the scheduled health care items and services, including facilities fees, hospital fees, and room and board provided by the provider or facility. Good faith estimates only list expected charges for a single provider or facility.

A good faith estimate should include expected charges for the scheduled health care items and services, including facilities fees, hospital fees, and room and board provided by the provider or facility. Good faith estimates only list expected charges for a single provider or facility.

A diagnosis is required on the Good Faith Estimate once it's saved to the client's Overview page. There isn't a way to remove it from this document.

The good faith estimate must include a number of disclaimers. For example, it must state that the estimate is based on information known at the time it was created. Therefore, it won't include any costs for unanticipated items or services that are not reasonably expected and that could occur due to unforeseen events.

The Section 1.304 duty of good faith differs from the common law duty applicable to Texas special relationships in that its violation does not amount to a separate cause of action in tort; rather, it aids in determining whether the conduct in question contravenes an existing contractual obligation, supporting a claim ...

A person or gleaner shall not be subject to civil or criminal liability arising from the nature, age, packaging, or condition of apparently wholesome food or an apparently fit grocery product that the person or gleaner donates in good faith to a nonprofit organization for ultimate distribution to needy individuals, ...

If you are insured, you also may request a good faith estimate of the amount you will be billed for non-emergency items and services that you might like to schedule.

The estimate must: Include an itemized list with specific details and expected charges for items and services related to your care. For example: you're scheduled for surgery. You should request 2 good faith estimates: one from the surgeon, and one from the hospital.