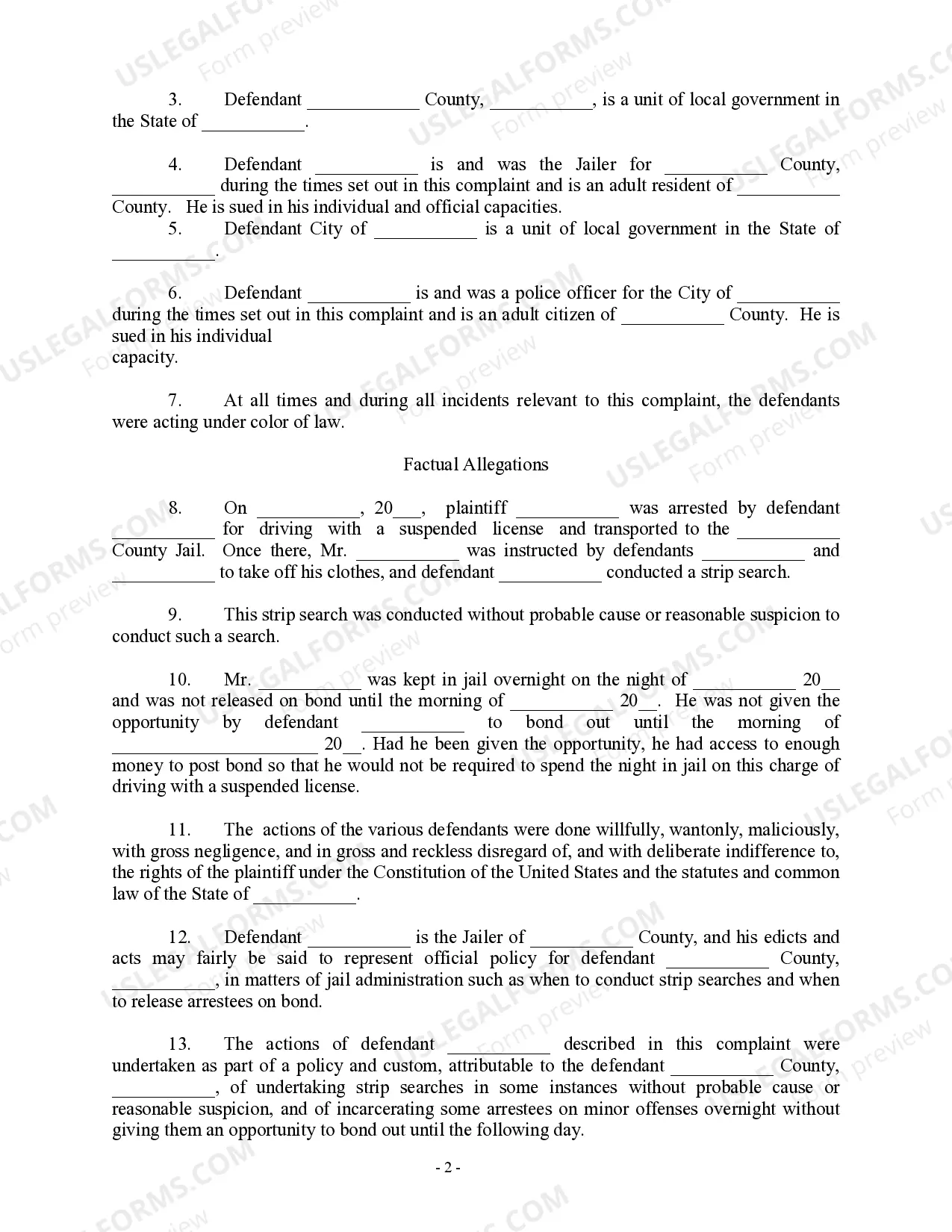

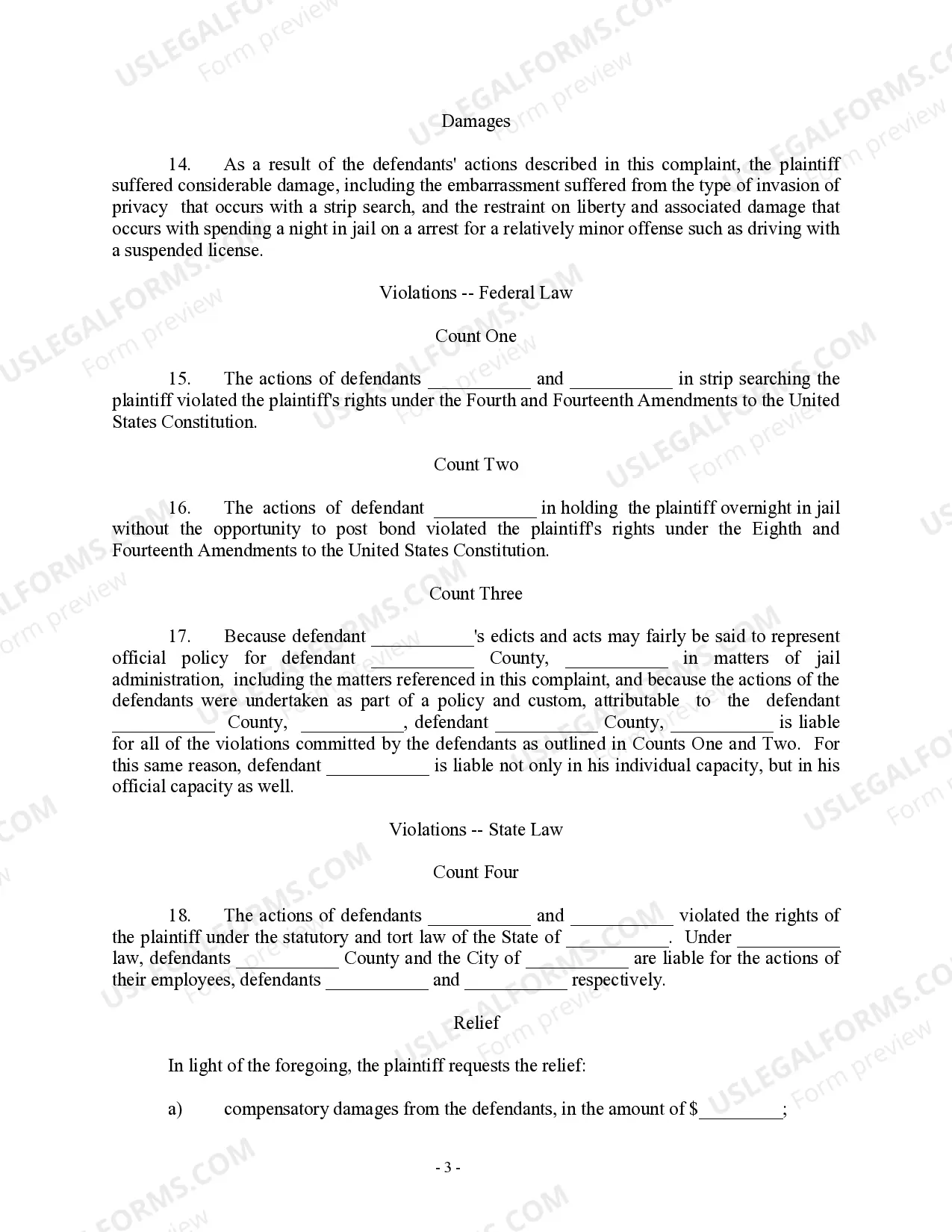

This form is a Complaint. This action was filed by the plaintiff due to a strip search which was conducted upon his/her person after an arrest. The plaintiff requests that he/she be awarded compensatory damages and punitive damages for the alleged violation of his/her constitutional rights.

Search Amendment Withholding In Salt Lake

Description

Form popularity

FAQ

Freedom of speech and of the press -- Libel. No law shall be passed to abridge or restrain the freedom of speech or of the press.

To file by mail, all payments must be submitted with a Form TC-941PC. For questions about withholding tax payments, contact the Utah State Tax Commission at 801-297-2200 or email taxmaster@utah.

This Amendment prohibits unreasonable searches and seizures by law enforcement in places where a person has a reasonable expectation of privacy.

Unreasonable searches forbidden -- Issuance of warrant.

No State shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States; nor shall any State deprive any person of life, liberty, or property, without due process of law; nor deny to any person within its jurisdiction the equal protection of the laws.

Article I describes the design of the legislative branch of US Government -- the Congress. Important ideas include the separation of powers between branches of government (checks and balances), the election of Senators and Representatives, the process by which laws are made, and the powers that Congress has.

SEC. 14. Felonies shall be prosecuted as provided by law, either by indictment or, after examination and commitment by a magistrate, by information.

Tax Rates Date RangeTax Rate January 1, 2023 – December 31, 2023 4.65% or .0465 January 1, 2022 – December 31, 2022 4.85% or .0485 January 1, 2018 – December 31, 2021 4.95% or .0495 January 1, 2008 – December 31, 2017 5% or .052 more rows

Generally, you want about 90% of your estimated income taxes withheld and sent to the government. 12 This ensures that you never fall behind on income taxes (something that can result in heavy penalties) and that you are not overtaxed throughout the year.

How to fill out a W-4 Step 1: Enter your personal information. Fill in your name, address, Social Security number and tax filing status. Step 2: Account for multiple jobs. Step 3: Claim dependents, including children. Step 4: Refine your withholdings. Step 5: Sign and date your W-4.