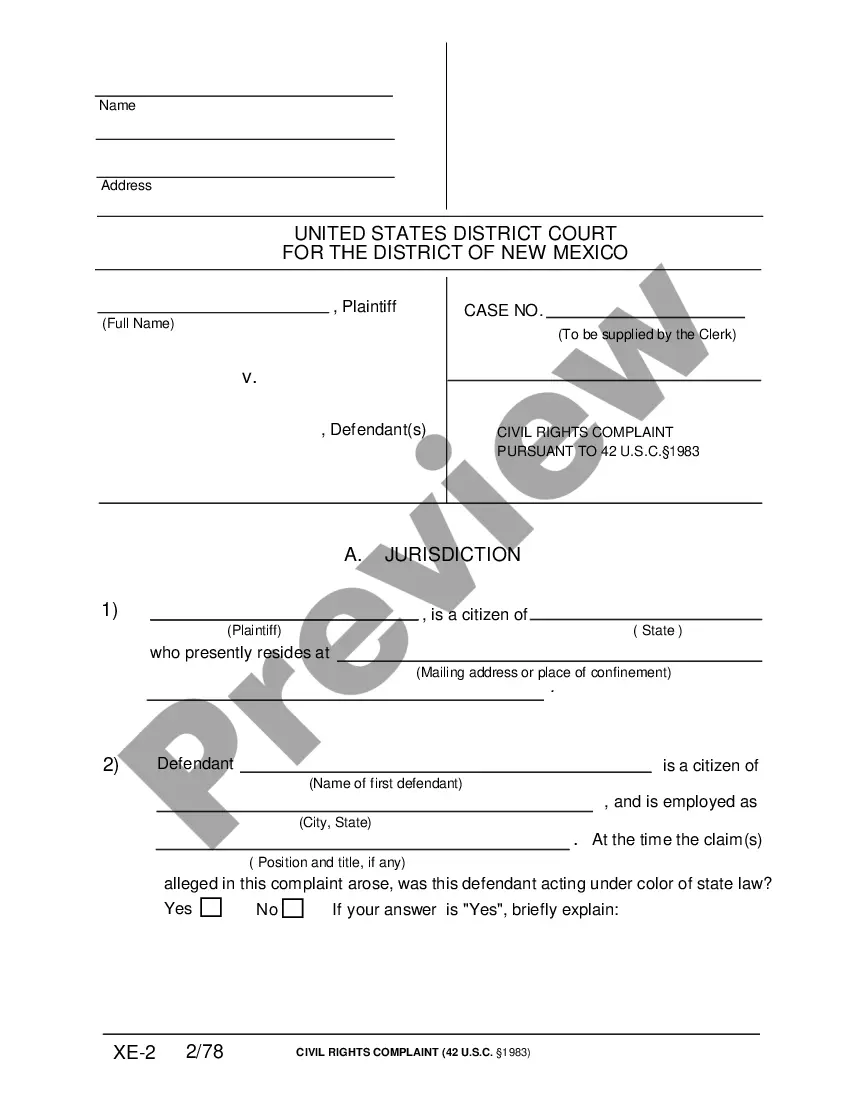

This form is a Complaint. This action was filed by the plaintiff due to a strip search which was conducted upon his/her person after an arrest. The plaintiff requests that he/she be awarded compensatory damages and punitive damages for the alleged violation of his/her constitutional rights.

Search Amendment Withholding In Massachusetts

Description

Form popularity

FAQ

Because claiming Exempt has a clearly falsifiable attestation (that you had no tax liability in the prior year), it is generally a Bad Idea to falsely claim Exempt.

You can claim exemption from withholding only if both the following situations apply: For the prior year, you had a right to a refund of all federal income tax withheld because you had no tax liability. For the current year, you expect a refund of all federal income tax withheld because you expect to have no liability.

Ing to the IRS Tax Topic 751 on withholding, to claim exempt, you must have had no federal income tax liability last year and expect to have no federal income tax liability this year.

You can claim either 0 or 1 on your W-4. It won't create problems with the IRS, it will just determine how much you'll get back on your tax return next year. If you claim 0, you will get less back on paychecks and more back on your tax refund.

Summary. The Massachusetts Department of Revenue announced withholding tables for the fiscal year beginning January 1, 2024. The new withholding method includes a surtax on earnings of $1,053,750 or more. While income under $1,053,750 is taxed at 5%, annual income above $1,053,750 will be taxed at 9%.

As an employer, you must withhold state income taxes from salaries or payments made to employees who live in or are employed in Massachusetts and you must send them in, along with the appropriate form or electronic return, on time.

For questions about federal backup withholding or information reporting, contact the IRS Information Reporting Program Centralized Customer Service Site at (866) 455-7438 or by E-Mail at mccirp@irs.

The Massachusetts Department of Revenue announced withholding tables for the fiscal year beginning January 1, 2024. The new withholding method includes a surtax on earnings of $1,053,750 or more. While income under $1,053,750 is taxed at 5%, annual income above $1,053,750 will be taxed at 9%.

Mail your Form W2 along with Form M-3 to the following address: Massachusetts Department of Revenue, PO Box 7015, Boston, MA 02204.