False Us For Verification Code In Chicago

Description

Form popularity

FAQ

If you are sure you never requested the verification code, that could mean someone has tried to login to your account using your email and password. In this case, you should change your password. Maybe your username and password are still secure, but a cybercriminal is trying to rattle you.

While these verification codes are a security feature designed to protect your account, they may also indicate that someone is attempting to gain access without your permission. Regularly changing your passwords and using 2FA are essential steps in maintaining the security of your Google account.

Apps like Burner, Hushed, and 2ndLine allow you to create temporary phone numbers that can be used for a specific period or purpose. Once you have received the verification code, you can discard the temporary number without compromising your privacy.

The most likely reason is that someone is trying to access your account. That's the whole reason these verification codes are sent. Someone is logging in to something that requires verification and the code is being sent to your phone. It's also p...

Someone probably just used the wrong phone number for some verification they were doing. Ignore it, but do NOT give anyone the verification code should they contact you.

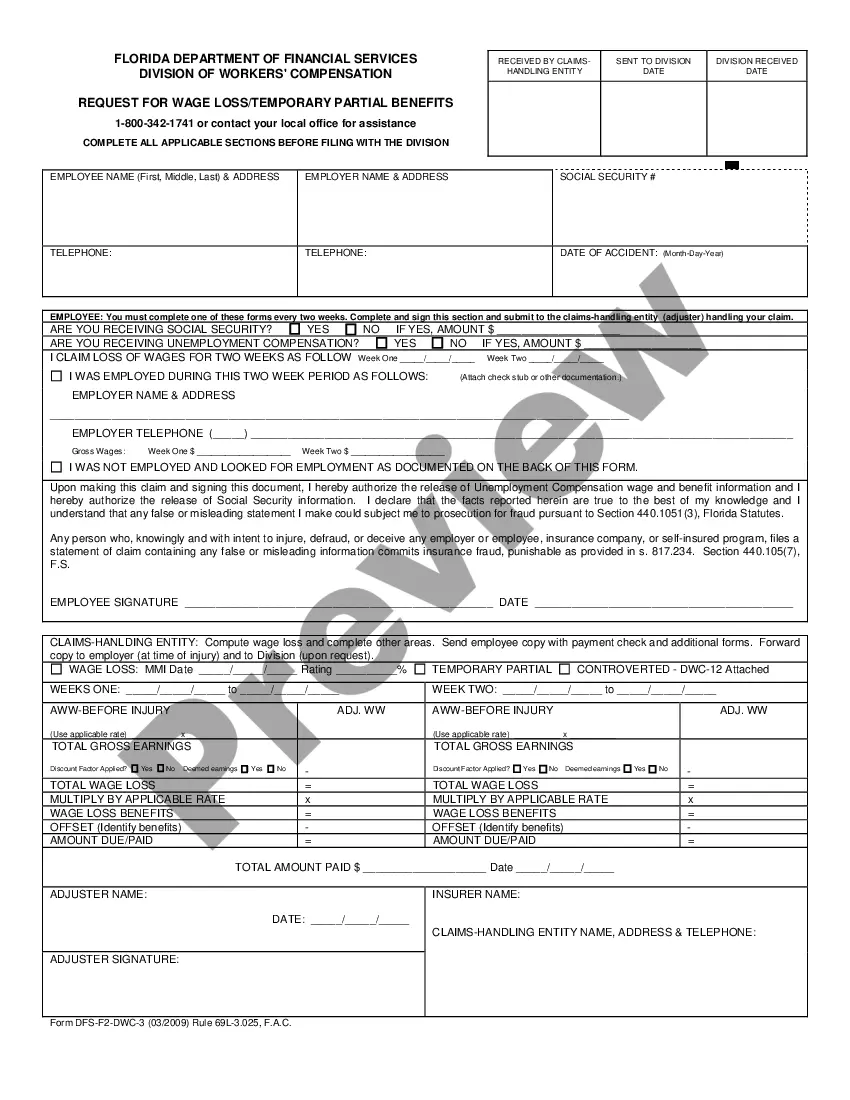

The IRS sends a 5071C letter when it receives a tax return with your name and tax identification number, but believes the return to be fraudulent. A Letter 5071C will ask you to complete an online identity verification process to confirm your identity.

Taxpayers and tax professionals will be able to prove their identity with ID.me by uploading government documents, taking a video selfie, and filling out personal information. Once complete, taxpayers can access the IRS application for which they verified.

What happens after I successfully verify? We'll process your tax return. It may take up to 9 weeks to receive your refund or credit any overpayment to your account. However, if we find other problems, we'll contact you again and this may delay your refund.

It means the IRS has pulled your return for review but it is not an audit. They are verifying the information reported on your tax return and matching documents they received from payers such as employers, banks and others.

IL-425 Identity Verification Documents. Note: Please use this form to submit your Identity Verification to the Illinois Department of Revenue if you do not have the letter we sent you. If you have the letter we sent you, please use the letter to respond online at MyTax.Illinois.