Tort Negligence Liability With Insurance In Allegheny

Description

Form popularity

FAQ

A tort is a wrongful act or civil wrong that gives rise to injury. Full Tort insurance coverage simply means “full recovery” or “full right to sue” for all damages that have always been available under the law, including pain and suffering, lost wages, medical expenses, future medical expenses, etc.

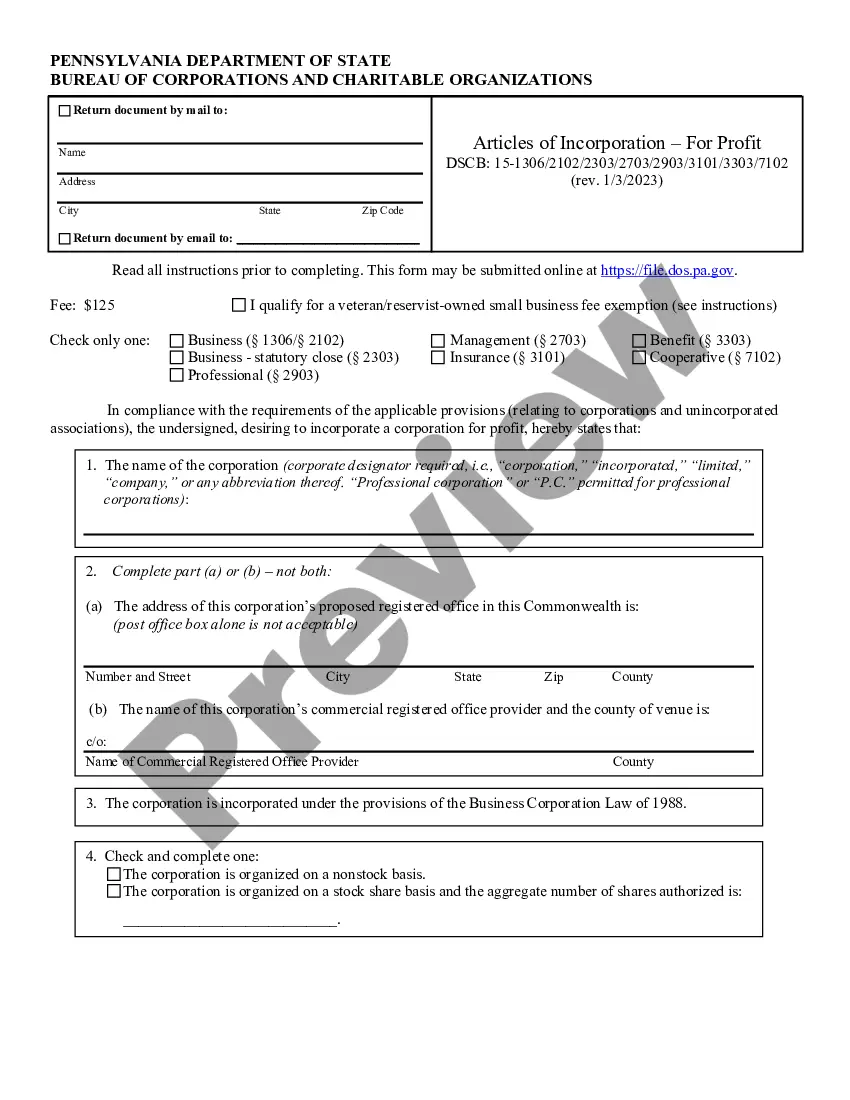

The Pennsylvania Tort Claims Act (“PTCA”) abrogates sovereign immunity in enumerated instances of negligence “where the damages would be recoverable under the common law or a statute creating a cause of action if the injury were caused by a person not having available the defense of sovereign immunity.” 1 Unfortunately ...

In Pennsylvania, insurance companies offer full tort coverage, which gives covered individuals the right to sue in court for full damages, and limited tort coverage which restricts the ability to sue for pain and suffering.

Simply put, Pennsylvania's tort insurance allows the injury victim to be compensated following a car accident in Pennsylvania. Pennsylvania is a “choice no-fault” insurance state. This means the driver is given the choice of either a no-fault insurance policy or an at-fault insurance policy.

Always File a Claim, Regardless of Who Was At-Fault One of the primary questions we receive from clients who have been in an accident is whether they should report the accident to their own auto insurance carrier, particularly when the accident was not their fault. And the answer to that question is: always.

It's better if you file a third party claim directly with the other person's insurance. That will keep your insurance rates from rising (yes, your rates can rise if you file a claim with your own insurance even if you're not at fault.) You can't use a delay in processing the claim as an excuse to run up more expenses.

The four elements of negligence in Pennsylvania are: Duty of care: The legal requirement to act safely. Breach of duty of care: Failing to meet the duty of care – acting negligently. Proximate cause: The person's negligence causing harm.

How to make a general liability insurance claim Contact your insurance agent or provider. As soon as an accident happens, you should contact your insurance broker. Collect the details and review your policy. Ask questions. Keep detailed records. Weigh your options.

How to make a general liability insurance claim Contact your insurance agent or provider. As soon as an accident happens, you should contact your insurance broker. Collect the details and review your policy. Ask questions. Keep detailed records. Weigh your options.

To file a claim, complete these steps: Complete Standard Form 95. Explain in detail what happened, using additional pages if necessary. Attach all documents that support your claim, which may include the following. Submit the completed Standard Form 95 and supporting documents to the OPM Office of the General Counsel.