Lease Agreement With Guarantor In Riverside

Description

Form popularity

FAQ

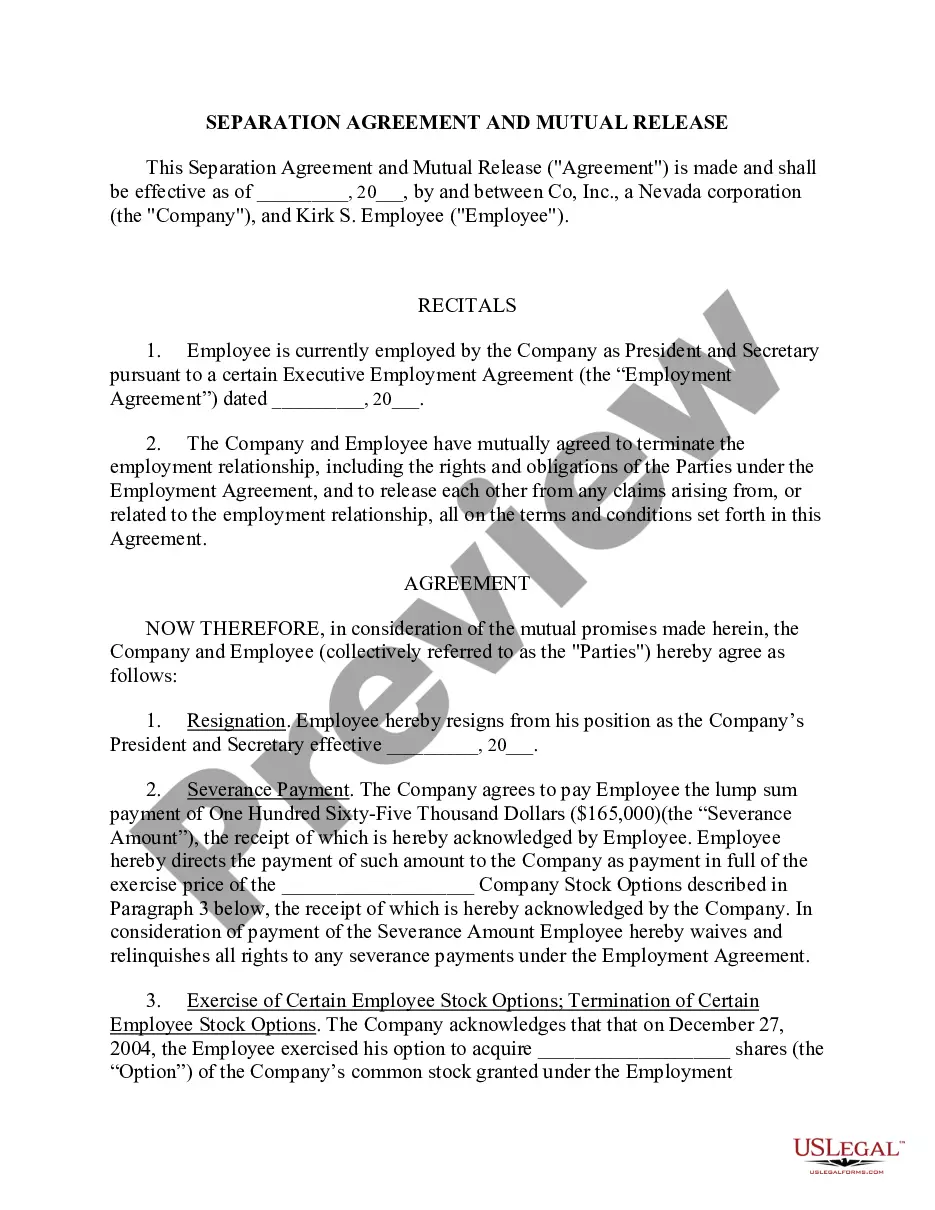

Some landlords may allow a cosigner or guarantor to sign a lease remotely but will usually require the document notarized.

Typically, rent guarantors are parents, relatives or close friends of the tenant. To qualify as a guarantor, you will need to provide the landlord with proof of income (such as paystubs), bank statements, and your Social Security number for a credit and background check.

How to Add a Guarantor to a Lease Talk With Tenant – Landlords should start by letting the tenant know that a guarantor is needed. Perform Background Check – After the tenant finds someone to co-sign, the landlord should screen the guarantor and conduct a credit check to verify their financial reliability.

Guarantors may need to give information to a landlord or letting agency to show they can take on the responsibility of being a guarantor: Proof of identity, like a passport or driving licence. There will be credit checks that they need to pass. Applicants will have to show wage slips or proof of income if retired.

State laws on leases and rental agreements can vary, but a landlord or property management company should provide you with a copy of your signed lease upon request. You should make your request in writing, so you have proof if there is a dispute later.

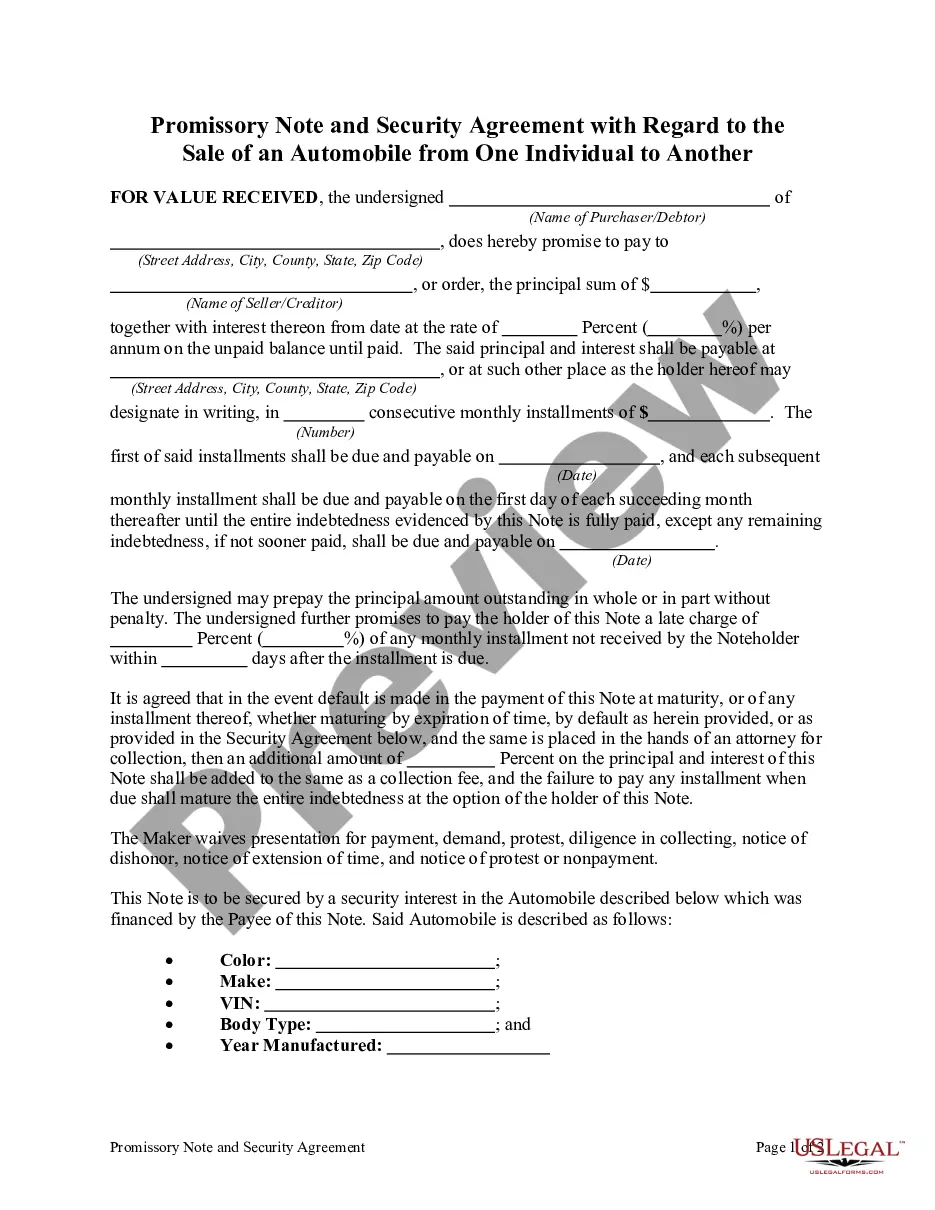

Financial Requirements For example, if the rent is $1,500 a month, the guarantor might need to earn at least $120,000 a year. Credit Score: As we mentioned above, a good credit history is crucial for guarantors. Landlords often look for a credit score of 700 or higher.

Typically, rent guarantors are parents, relatives or close friends of the tenant. To qualify as a guarantor, you will need to provide the landlord with proof of income (such as paystubs), bank statements, and your Social Security number for a credit and background check.

Here's how it works: the guarantor is someone who agrees to repay the loan if you can't. Typically, the guarantor needs to have a stable income, a strong credit score, and good financial standing. To get started, find a willing guarantor--often a family member or close friend.

Typically, rent guarantors are parents, relatives or close friends of the tenant. To qualify as a guarantor, you will need to provide the landlord with proof of income (such as paystubs), bank statements, and your Social Security number for a credit and background check.

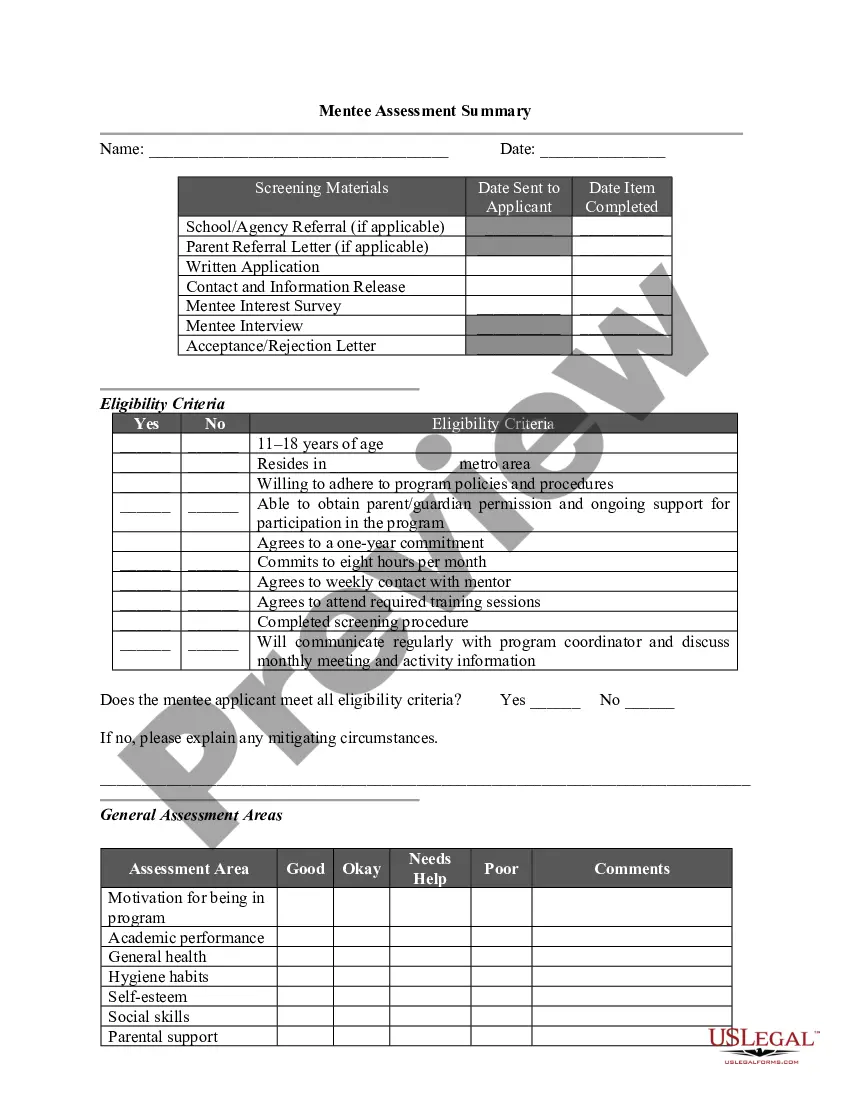

A guarantor's form should include a space to fill in the home address, work address, phone number, and email address. The contact details are what will be used to contact the guarantor in the future if the principal fails to meet agreement terms. This is a very important feature of the guarantor's form.