Lease Agreement With Guarantor In Orange

Description

Form popularity

FAQ

Format of a Guarantor Letter Address the letter to the company requiring the guarantee (not to an individual). Introduce yourself and state your relationship to the person you're guaranteeing. State what you will guarantee in your own words (like co-signing a lease).

Typically, a Guarantor Agreement is appended to the end of a lease agreement as an addendum. If, for whatever reason, you need to add a guarantor to a lease that has already been signed, be sure to have all tenants sign the agreement as well as the guarantor.

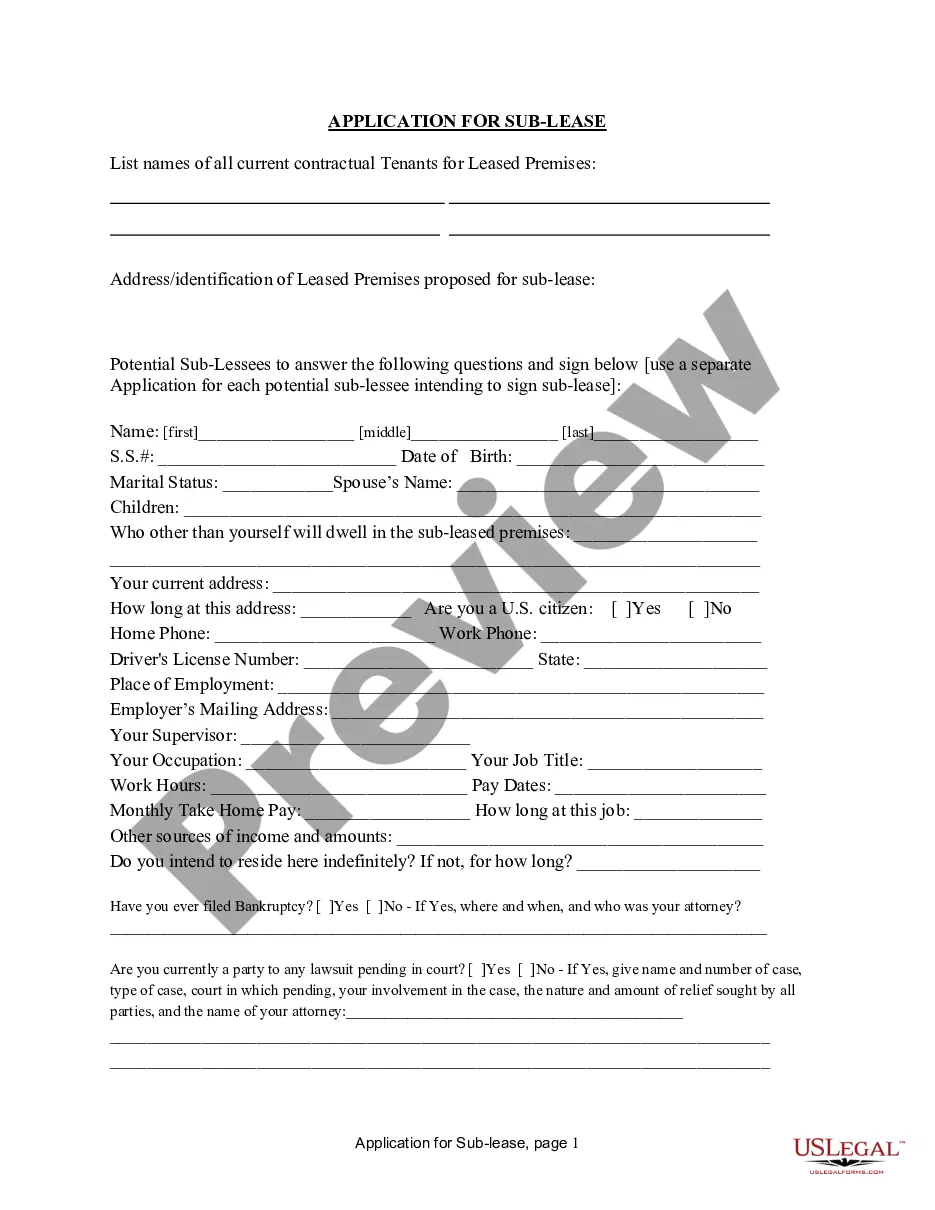

How do I fill this out? Read the form instructions carefully. Fill in your personal details including name and address. Attach photocopies of your official ID. Provide details of the applicant you are guaranteeing. Sign and date the form appropriately.

Typically, a Guarantor Agreement is appended to the end of a lease agreement as an addendum. If, for whatever reason, you need to add a guarantor to a lease that has already been signed, be sure to have all tenants sign the agreement as well as the guarantor.

Yes, the guarantor is put on the lease because they are vouching for the tenant. Often, many landlords draw up a separate lease agreement for the co-signer because they have a lesser involvement here.

How to Add a Guarantor to a Lease Talk With Tenant – Landlords should start by letting the tenant know that a guarantor is needed. Perform Background Check – After the tenant finds someone to co-sign, the landlord should screen the guarantor and conduct a credit check to verify their financial reliability.

How to Add a Guarantor to a Lease Talk With Tenant – Landlords should start by letting the tenant know that a guarantor is needed. Perform Background Check – After the tenant finds someone to co-sign, the landlord should screen the guarantor and conduct a credit check to verify their financial reliability.

Your guarantor will have to sign a contract with the letting agent or landlord. This will set out the terms of the guarantor and their responsibilities to the property. Most contracts will state that a guarantor is liable to cover any unpaid rent for the length of the tenancy.

Navigating the apartment rental market can be a challenging task, especially if your credit score or income isn't up to par. For many renters, securing an apartment lease often requires the support of a guarantor, also known as a co-signer.

Typically, rent guarantors are parents, relatives or close friends of the tenant. To qualify as a guarantor, you will need to provide the landlord with proof of income (such as paystubs), bank statements, and your Social Security number for a credit and background check.