Lease Agreement With Purchase Option In Clark

Description

Form popularity

FAQ

It's great as an affordability strategy for the renter (eventual homebuyer) as they are able to lock in todays prices plus inflation and don't have to worry about saving more downpayment with each passing year as prices are skyrocketing.

Proper notice is essential when breaking a lease to avoid legal and financial consequences. Check your lease agreement for the required notice period, often around 30 days. Providing written notice, stating your intent, move-out date, and new address, is advisable for clarity and documentation.

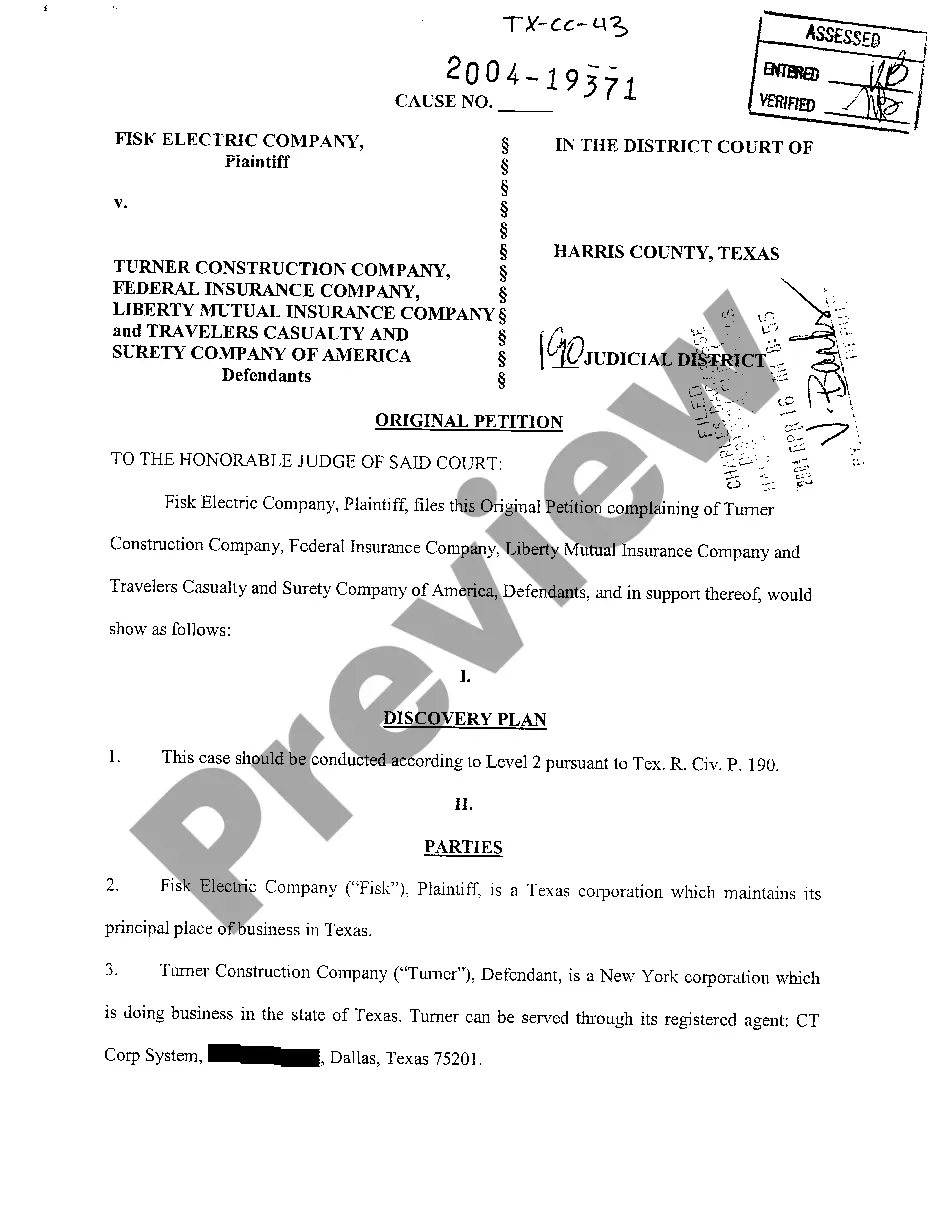

The contract specifies the terms and conditions under which the lessor grants the lessee the right to use the asset. Under FASB ASC 842, a lease is defined as a contract or part of a contract that conveys the right to control the use of an identified property, plant, or equipment for a period of time.

Rent-to-own could be a good option if your credit score is so low that you either can't qualify for a mortgage or you can only qualify for one with high interest rates. You can take the steps necessary to improve your credit score while leasing the home you'll eventually buy.

How To Structure A Lease Purchase Agreement Set The Lease Period. The lease should outline how long the lease period will be and the monthly rent amount. Include Special Clauses. Allocate Portion Of Rent To The Down Payment. Include A Contract Of Sale. Have A Professional Review Your Contract.

Typically, a tenant is required to give written notice of their exercise of the option several months before the current term of the lease expires — typically a period of time ending three to six months before expiration of the current term of occupancy.

How To Structure A Lease Purchase Agreement Set The Lease Period. The lease should outline how long the lease period will be and the monthly rent amount. Include Special Clauses. Allocate Portion Of Rent To The Down Payment. Include A Contract Of Sale. Have A Professional Review Your Contract.

Lease-to-own agreement is a good idea when: Tenants have less-than-ideal credit scores that prevent them from securing a mortgage. Lease-to-own arrangements require less stringent credit checks, enabling individuals to secure a home and gradually improve their financial standing during the lease period.

How To Structure A Lease Purchase Agreement Set The Lease Period. The lease should outline how long the lease period will be and the monthly rent amount. Include Special Clauses. Allocate Portion Of Rent To The Down Payment. Include A Contract Of Sale. Have A Professional Review Your Contract.

A lease buyout is an agreement in which a tenant or landlord pays to break the lease for the remainder of its term. For example, if a tenant has a one year lease, but they need to move out after six months, they can agree to a lease buyout with the landlord to break their lease.