Angel Investment Form For Early Stage Entrepreneurs In Middlesex

Description

Form popularity

FAQ

Angel investing is only suitable for those with stable income streams and minimum investable assets of $1 million — $2 million. Consider if: You have at least six months of living expenses set aside in savings as an emergency cushion. Investing surplus minimizes financial disruption if some startups fail.

Angel investors typically seek a 10%-30% equity stake in a company. This percentage is negotiated based on your startup's valuation, the funding amount and the perceived risk. It's essential to strike a balance that reflects your company's current value and future potential.

Venture capital involves providing early stage funding to growing companies with promising potential, while angel investing typically involves one or a few individuals making a personal investment in a business in exchange for equity. Both methods of investment carry risks, but also offer potentially high returns.

12 Places to find angel investors right for your startup Leverage online platforms. Attend industry-specific conferences. Join local entrepreneurship groups. Participate in pitch competitions. Explore alumni networks. Engage with accelerators and incubators. Utilize LinkedIn strategically. Attend angel investor meetups.

To be an angel, you need to qualify as an accredited investor, defined by the SEC as $1 million of net worth or annual income over $200,000.

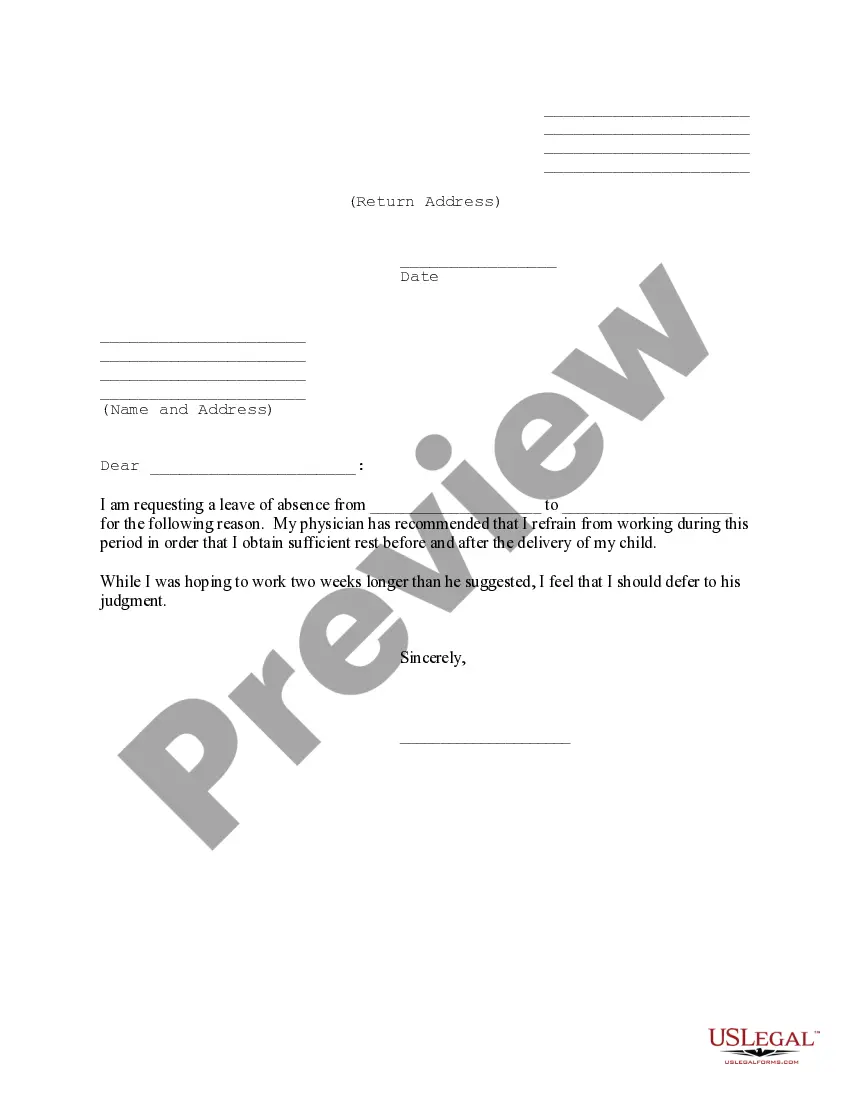

Keep your letter brief. The first paragraph should establish your credibility within the industry as well as the other members of your team as assets that can aid in your success. Your second paragraph should lay out your plan to use the funding and what each investors can provide to the business.

Three key things to bear in mind: Show them why your startup is a good match. Build a personal connection – explain why you're emailing them and not other investors. Highlight key figures such as your current revenue and growth, market potential, and what kind of funding you're seeking.

Individual Investors: To qualify as an angel investor, an individual must possess net tangible assets of at least INR 2 crore, excluding their principal residence. Additionally, they should have experience in early-stage investments, be a serial entrepreneur, or have a minimum of 10 years in a senior management role.