Investor Term Sheet Template For Llc In Allegheny

Description

Form popularity

FAQ

Once you're certain the investors offering you a term sheet are a good match, go beyond the obvious. Investment dollars and valuation are critical, of course, but don't overlook important details like option pools, liquidation preferences and the composition of your board.

In as little as 500 words, a VC's term sheet lays out the financial terms of the investment, how much your startup will be worth, who will control it and who will profit the most if the company is sold or goes public. The term sheet is akin to a letter of intent.

The key clauses of a term sheet can be grouped into four categories; deal economics, investor rights and protection, governance management and control, and exits and liquidity.

CohnReznick's Beth Mullen looks at several important points in a deal term sheet. Credit delivery amount and timing. Guarantees. Reserves. Year 15 exit options. Implied costs for third-party reports.

A term sheet is a non-binding document outlining the basic terms and conditions of a potential investment. It serves as a preliminary agreement between the startup and the investor, setting the stage for the more detailed and legally binding documents that will follow, such as the definitive investment agreement.

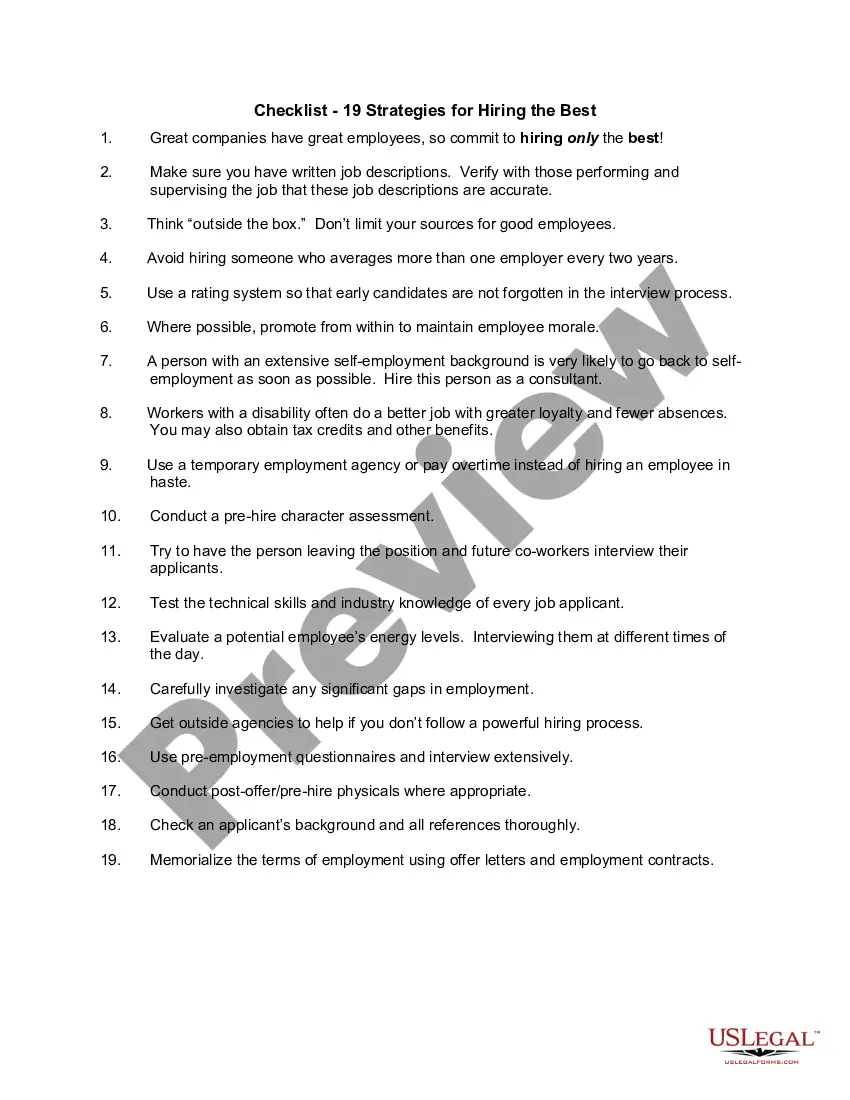

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

What is it? A term sheet is a summary document containing the key terms of a contract. It provides an overview of the most important commercial and other terms of a transaction or relationship. It can be called Key Terms or Heads of Terms, or sometimes a Letter of Intent.

How to set up an investment LLC: step-by-step Select an incorporation state. Chose a business name. Appoint a registered agent. Select a management structure. File articles of organization with the Secretary of State. Draft an operating agreement. Register your LLC for tax purposes. Obtain business licenses and permits.

Viewed thus, the negotiation of a term sheet is a matter of adjustment of contractual rights and obligations on the various sides of a proposed investment transaction. The key players are obviously the investors, on the one hand, and the founder or the promoters, on the other.

A term sheet may be prepared by either party – the investor or the founder. Usually, if a venture capital firm is investing, the VC offers a term sheet.