Bail With Surety In Chicago

Description

Form popularity

FAQ

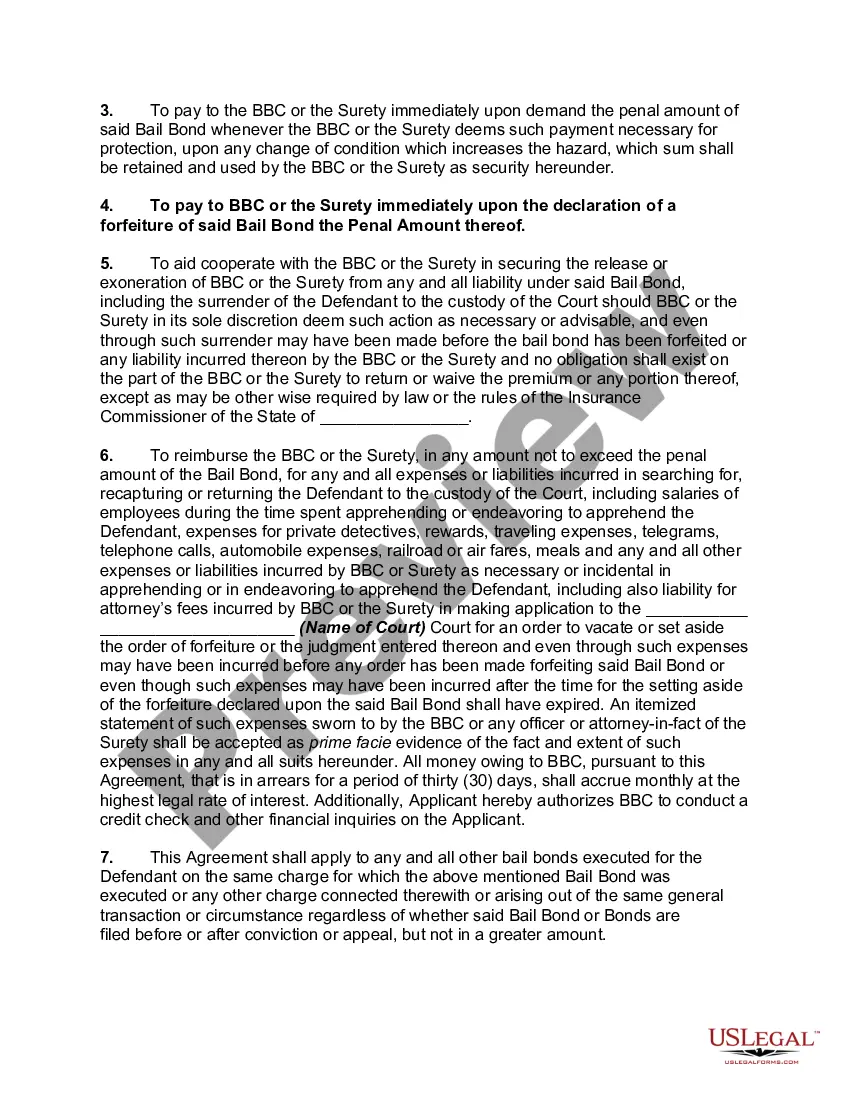

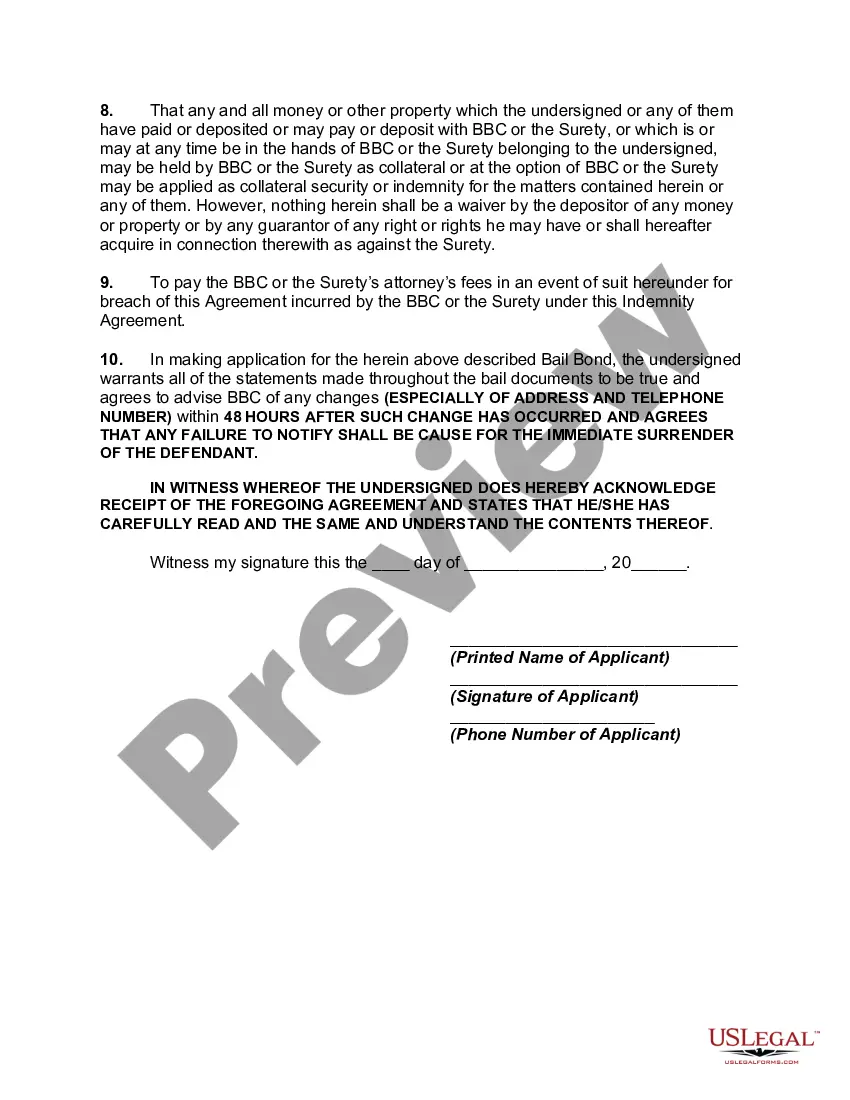

How to Get a Surety Bond in 4 Steps Step 1: Determine which bond you need. The bond you need will depend on your business or personal circumstances as well as your location. Step 2: Gather your application information. Step 3: Purchase your bond from a surety agency. Step 4: File your bond with the obligee.

A person can remain on bail for the amount of time that their case is proceeding before the Court. What is a 'surety' in bail? A surety is a person who guarantees the defendant will attend their court date after being granted bail.

A person can remain on bail for the amount of time that their case is proceeding before the Court. What is a 'surety' in bail? A surety is a person who guarantees the defendant will attend their court date after being granted bail.

One thing to note is that getting a surety bond may be difficult for certain individuals. If you have a history of claims made against any previous bonds, or if you have a low credit score, it may be more difficult to get a surety bond since surety companies see this as a signal of increased risk.

The surety bond protects the obligee against losses resulting from the principal's failure to meet the obligation. The person or company providing the promise is also known as a "surety" or as a "guarantor".

Many public and private contracts require surety bonds, which are offered by surety companies. SBA guarantees surety bonds for certain surety companies, which allows the companies to offer surety bonds to small businesses that might not meet the criteria for other sureties.

List of surety bond partners American Contractors Indemnity Co (Tokio Marine/HCC) Los Angeles, CA. Antilles Insurance Company. Atlantic Specialty Insurance Company (Intact) ... Berkley Insurance Company. Bondex Insurance Company. Cincinnati Insurance Company. Contractors Bonding & Insurance Company. FCCI Insurance Company.

Most surety bonds are created on behalf of those contractors by insurance companies (either directly or through brokers), or by banks in the form of bank guarantees.

How to make a surety bond claim Step #1: Find out who bonded the offender. Step #2: Make contact with the bonding company, specifically their Claims Department. Step #3: File the surety bond claim as the surety company requires. Step #4: Once your claim is received, maintain contact with the surety company.