Spousal Support With Child Formula In Massachusetts

Description

Form popularity

FAQ

40% of the high earner's net monthly income minus 50% of the low earner's net monthly income. For instance, if Spouse A earns $5,000 per month and Spouse B earns $2,500 per month, temporary spousal support might be calculated as follows: 40% of $5,000 = $2,000. 50% of $2,500 = $1,250.

A parent, not a stepparent, has the primary duty to support his or her child. However, either parent's remarriage may still affect child support obligations. A new spouse's income and assets are relevant to a parent's ability to provide support.

It depends. If used by an experienced family law attorney who knows what they are doing, it may provide a range of potential numbers. But this requires program tweaking—something that online California alimony calculators generally cannot do.

The formula is simple: Divide the Wife's annual amount by the interest rate: $100,000 divided by . 10 = $1 million. The formula is known as the present value of a perpetuity because it continues in perpetuity.

40% of the high earner's net monthly income minus 50% of the low earner's net monthly income. For instance, if Spouse A earns $5,000 per month and Spouse B earns $2,500 per month, temporary spousal support might be calculated as follows: 40% of $5,000 = $2,000. 50% of $2,500 = $1,250.

Child support is calculated by adding up the parents' combined incomes and splitting support proportionally between the parents. In other words, if the parents earn $6,000 and $4,000 per month, then their proportional support responsibilities will be 60% and 40%, respectively.

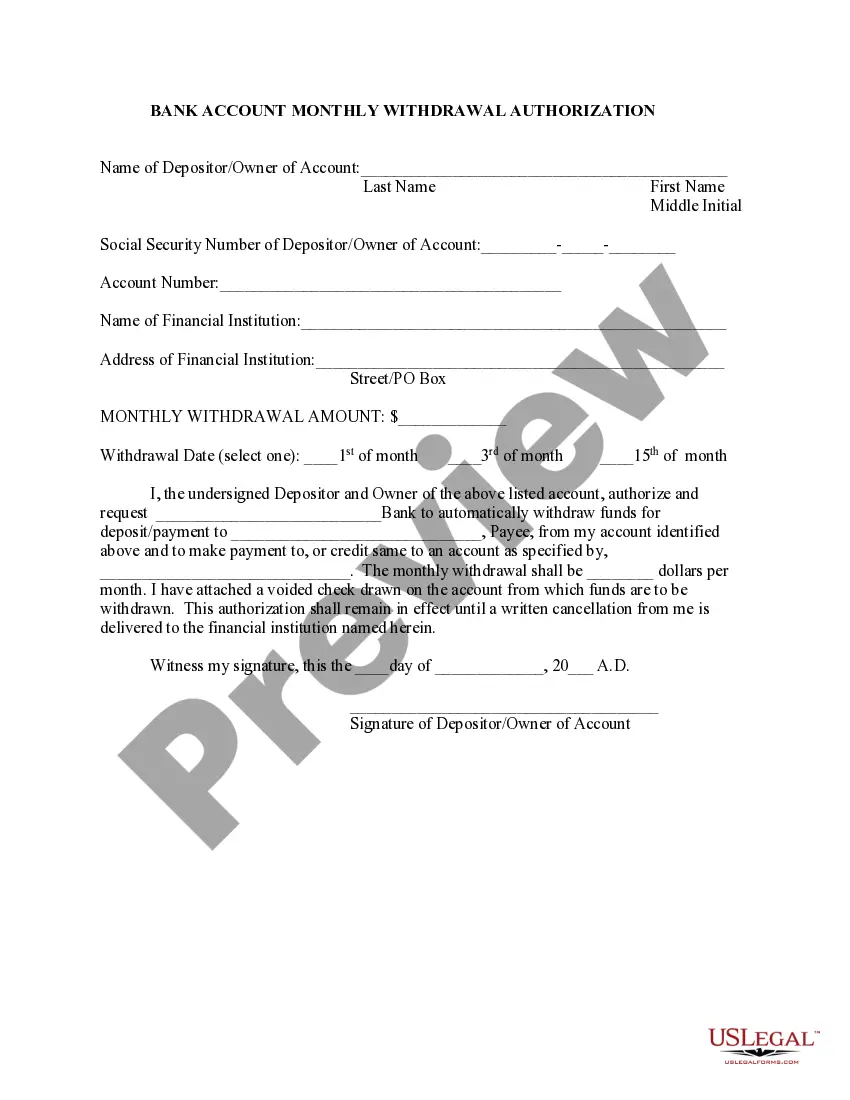

If the check must be payable to the custodial parent, please include the SDU as the co-payee. For example, please make the check payable to “custodial parent and/or the state SDU.” Sending payments electronically to state SDUs is another way to ensure payments arrive quickly and safely.

How to fill out the Child Support Guidelines Worksheet? Collect your gross weekly income and related expenses. Enter all deductions applicable to your income. Calculate your available income by subtracting expenses from income. Determine the combined available income with the second parent.