Alimony Calculator In Virginia

Description

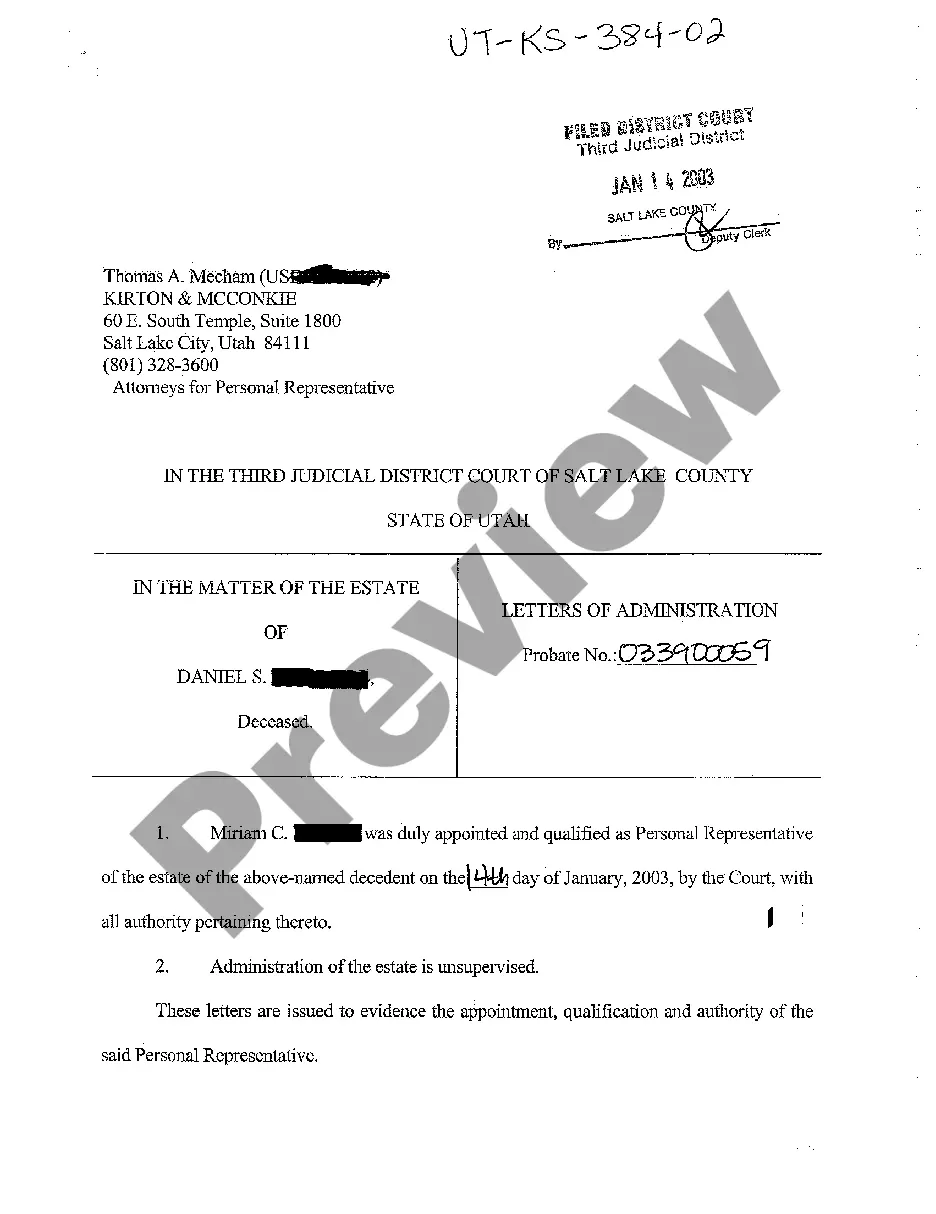

How to fill out Affidavit Of Defendant Spouse In Support Of Motion To Amend Or Strike Alimony Provisions Of Divorce Decree Because Of Obligor Spouse's Changed Financial Condition?

The Alimony Calculator In Virginia you see on this page is a multi-usable legal template drafted by professional lawyers in accordance with federal and local laws. For more than 25 years, US Legal Forms has provided people, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, simplest and most reliable way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Alimony Calculator In Virginia will take you only a few simple steps:

- Search for the document you need and check it. Look through the sample you searched and preview it or review the form description to verify it suits your needs. If it does not, make use of the search option to get the right one. Click Buy Now when you have located the template you need.

- Sign up and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Choose the format you want for your Alimony Calculator In Virginia (PDF, DOCX, RTF) and download the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your papers one more time. Make use of the same document again whenever needed. Open the My Forms tab in your profile to redownload any previously downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

The formula stated in § 16.1-278. is: (a) 30% of the gross income of the payor less 50% of the gross income of the payee in cases with no minor children and (b) 28% of the gross income of the payor less 58% of the gross income of the payee in cases where the parties have minor children in common.

Alimony (Spousal Support) Is Not Tax-deductible in Virginia For any divorce after December 31, 2018, payor spouses can no longer claim alimony as a tax deduction, and recipient spouses don't have to claim spousal support as taxable income.

A spouse is more likely to receive an award of spousal support with no defined duration, where spousal support will continue until death of either party or remarriage, if there was a long-term marriage and the spouse seeking support is nearing or at retirement age, or unable to become sufficiently employed to provide ...

Alimony, which is also referred to as spousal support, is the payment of financial support by one spouse to the other and can be awarded in a divorce, annulment, or separate maintenance action. However, alimony is not granted in all divorces in Virginia.

Alimony, which is also referred to as spousal support, is the payment of financial support by one spouse to the other and can be awarded in a divorce, annulment, or separate maintenance action. However, alimony is not granted in all divorces in Virginia.