Alimony Calculator For Sc

Description

How to fill out Affidavit Of Defendant Spouse In Support Of Motion To Amend Or Strike Alimony Provisions Of Divorce Decree Because Of Obligor Spouse's Changed Financial Condition?

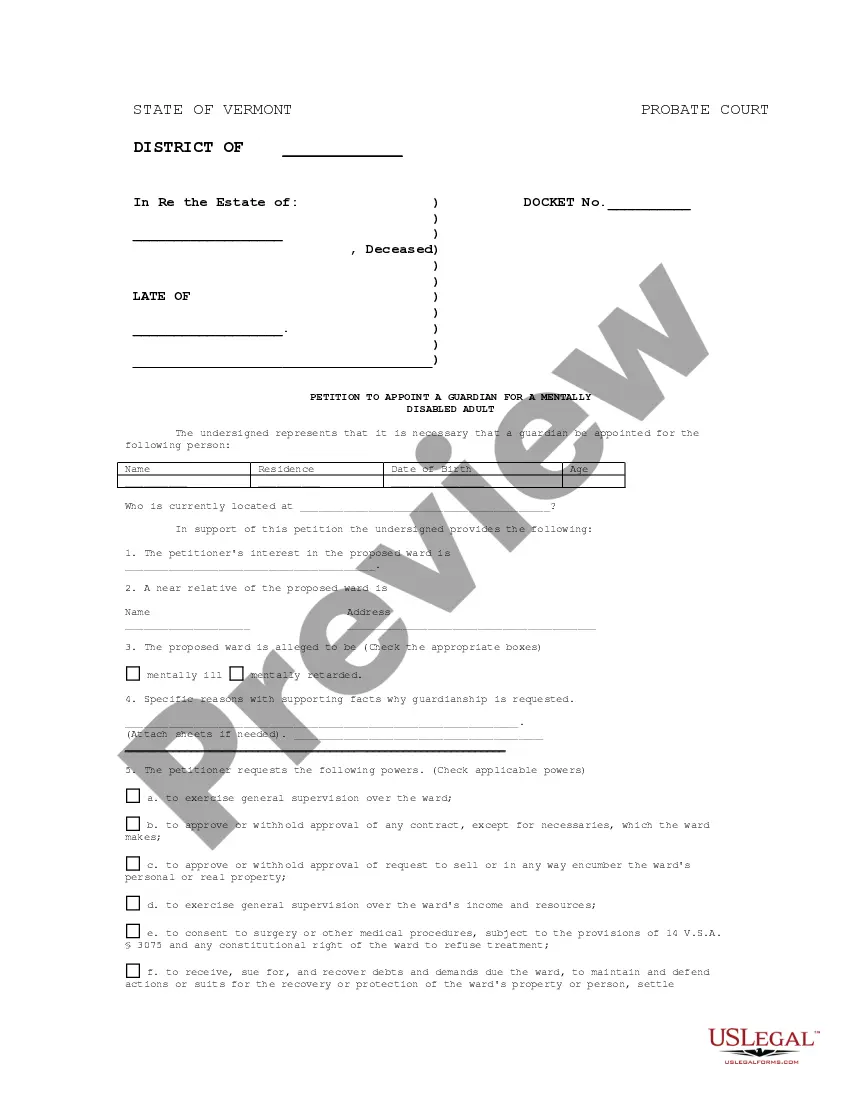

Whether for business purposes or for personal affairs, everybody has to handle legal situations at some point in their life. Filling out legal paperwork demands careful attention, beginning from choosing the appropriate form sample. For instance, if you pick a wrong edition of a Alimony Calculator For Sc, it will be turned down once you submit it. It is therefore crucial to get a trustworthy source of legal documents like US Legal Forms.

If you need to get a Alimony Calculator For Sc sample, follow these easy steps:

- Get the sample you need using the search field or catalog navigation.

- Examine the form’s description to make sure it fits your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search function to locate the Alimony Calculator For Sc sample you need.

- Download the template when it matches your requirements.

- If you already have a US Legal Forms profile, click Log in to access previously saved templates in My Forms.

- In the event you don’t have an account yet, you can obtain the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the profile registration form.

- Select your payment method: use a bank card or PayPal account.

- Choose the file format you want and download the Alimony Calculator For Sc.

- Once it is saved, you are able to complete the form by using editing software or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you never have to spend time searching for the right sample across the web. Use the library’s straightforward navigation to get the proper template for any occasion.

Form popularity

FAQ

Is Alimony Taxed? Those who receive alimony must pay tax on it, and include it in their income when filing their taxes. Alimony is tax deductible for providers. However, this is due to change for divorces finalized after December 31, 2018.

In South Carolina, some alimony payments can last for a lifetime because the most common form of alimony awarded by the court is permanent alimony called ?periodic alimony.? Although this type of alimony is permanent, there are four situations why such alimony may stop or may be reduced in South Carolina: (1) death of ...

Reimbursement Alimony in South Carolina Reimbursement alimony is typically awarded when the court finds it necessary to reimburse the supported spouse from the future earnings of the payor spouse based upon circumstances or events that occurred throughout the marriage.

The answer is that South Carolina does not have a formula or specific mathematical guidelines to determine the amount of alimony that must be paid.

Reimbursement Alimony in South Carolina Reimbursement alimony is typically awarded when the court finds it necessary to reimburse the supported spouse from the future earnings of the payor spouse based upon circumstances or events that occurred throughout the marriage.