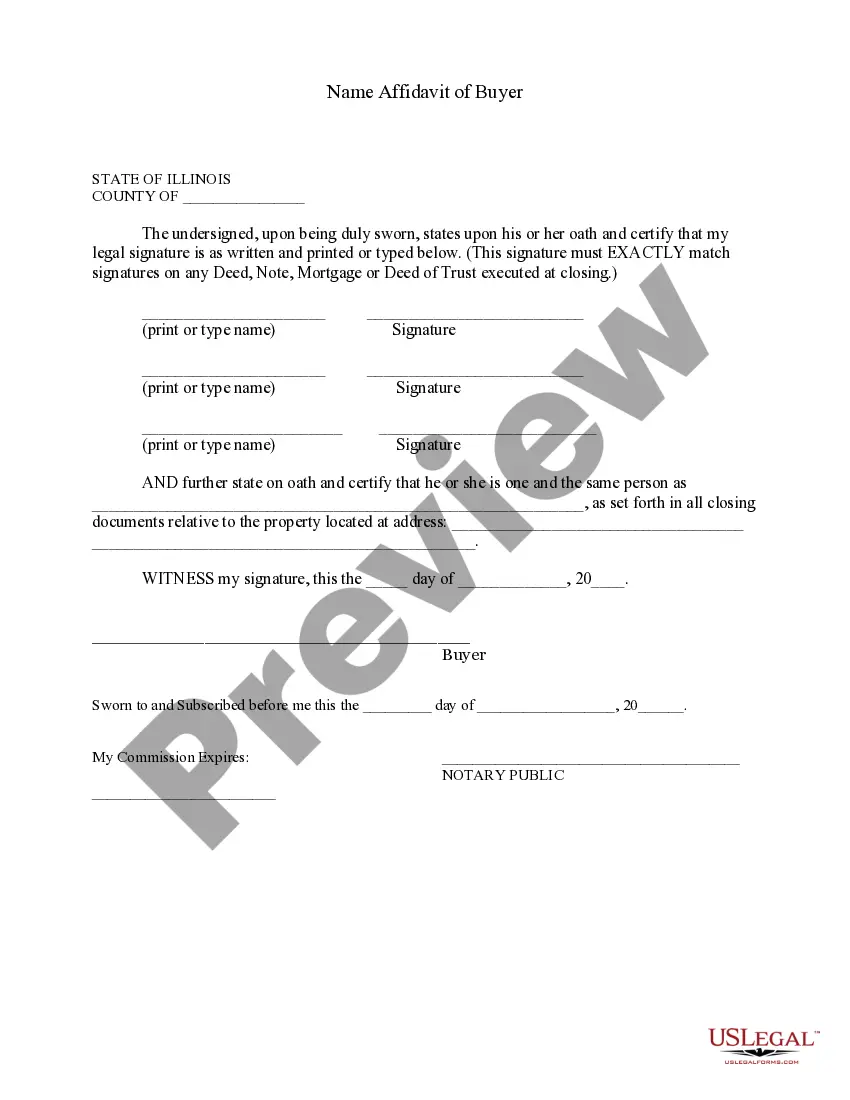

This is a generic Affidavit to accompany a Motion to amend or strike alimony provisions of a divorce decree because of cohabitation by dependent spouse. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Affidavit Motion Amend Form 1065 In Hillsborough

Description

Form popularity

FAQ

California law requires business entities that prepare an original or amended return using tax preparation software to electronically file (e-file) their return with us.

Use Form 1065-X, if you are not filing electronically, to: Correct items on a previously filed Form 1065, Form 1065-B, or Form 1066. Make an Administrative Adjustment Request (AAR) for a previously filed Form 1065, Form 1065-B, or Form 1066.

Administrative adjustment request (AAR) filings have become more common since the IRS clarified it would increase enforcement efforts involving entities taxed as partnerships.

What makes an AAR different from an amended return? In an AAR, the default treatment of a change is assessment of tax on the partnership itself. This tax is assessed at the highest individual or corporate rate, and it can apply to any item changed on the return, including non-income items.

To correct errors to partnership-related items, partnerships under the Bipartisan Budget Act (BBA) of 2015 must file an administrative adjustment request (AAR) instead of an amended return.

The IRS may correct certain errors on a return and may accept returns without certain required forms or schedules. In these instances, there's no need to amend your return. However, file an amended return if there's a change in your filing status, income, deductions, credits, or tax liability.

Because it must be filed before the applicable deadline, a superseding return can only be filed within that limited window of time. In contrast, an amended return changes items reported on an original return but is filed after the original filing deadline, including extensions.

Preparing and e-filing an amended 1065: On the Partnership Information Worksheet scroll down to Part VI - Electronic Filing Information. Uncheck the electronic filing boxes for the return. Check the Amended Return checkbox for the federal and any state that you need to e-file an amended return for. Open the 1065 p1-3.

Once the Form 1040X opens, at the top of the form, select the year for which the amendment must be made. By checking the box for the year to be amended, ProSeries will track all changes that you make as you work to correct the original return.

Use Form 1065-X, if you are not filing electronically, to: Correct items on a previously filed Form 1065, Form 1065-B, or Form 1066. Make an Administrative Adjustment Request (AAR) for a previously filed Form 1065, Form 1065-B, or Form 1066.