Notice Beneficiary Form For Chase Bank

Description

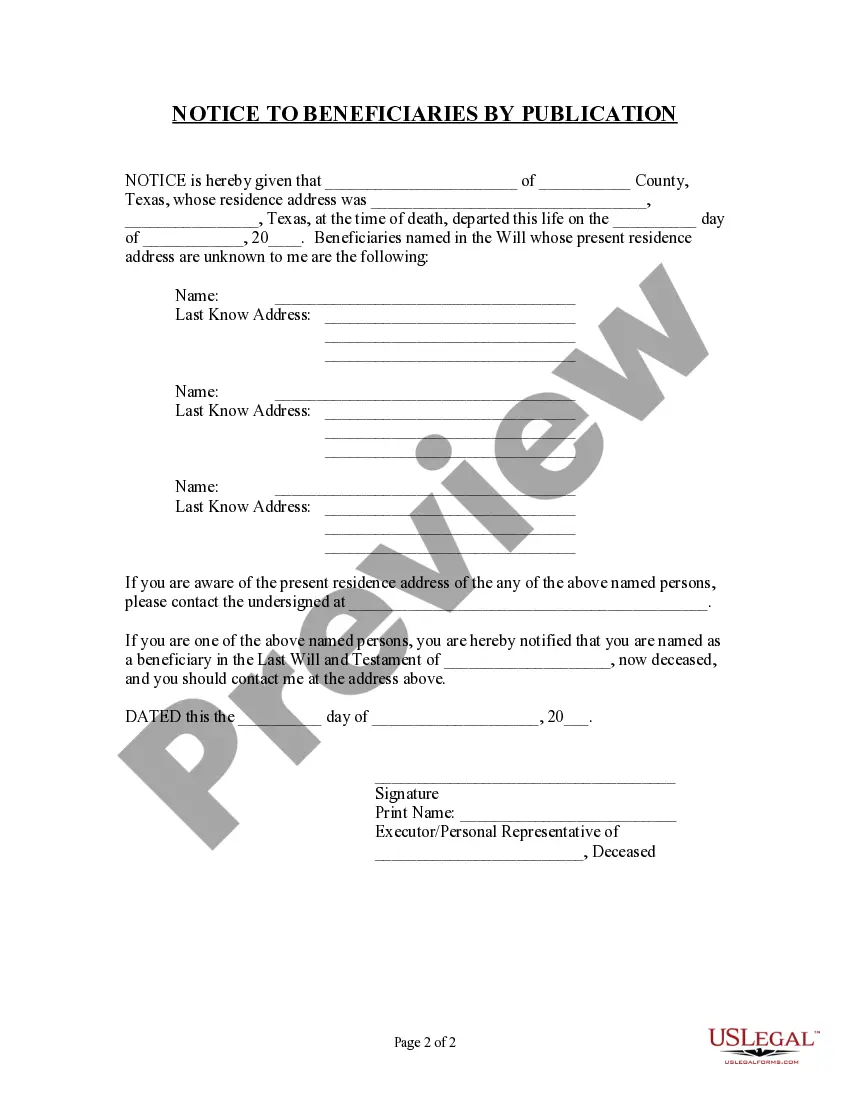

How to fill out Texas Notice To Beneficiaries Of Being Named In Will?

Legal paperwork administration can be daunting, even for the most seasoned professionals.

When you're looking for a Notice Beneficiary Form For Chase Bank and lack the opportunity to spend time searching for the appropriate and current version, the process can be challenging.

US Legal Forms meets any requirements you may have, from personal to corporate documentation, all in one location.

Utilize advanced tools to complete and manage your Notice Beneficiary Form For Chase Bank.

Here are the steps to follow after accessing the form you need: Verify that this is the correct form by previewing it and checking its description. Ensure that the template is acceptable in your state or county. Select Buy Now when you are ready. Choose a subscription plan. Select the format you need, and Download, fill out, eSign, print, and send your documents. Take advantage of the US Legal Forms online library, backed by 25 years of expertise and reliability. Streamline your everyday document management into a smooth and user-friendly experience today.

- Access a resource library of articles, guides, manuals, and materials pertinent to your situation and needs.

- Save time and energy searching for the documents you require, and use US Legal Forms’ advanced search and Preview feature to locate Notice Beneficiary Form For Chase Bank and download it.

- If you're a subscriber, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to review the documents you have previously downloaded and manage your files as you wish.

- If it's your first experience with US Legal Forms, create an account and gain unlimited access to all the benefits of the library.

- An extensive online form library could revolutionize the way anyone manages these scenarios effectively.

- US Legal Forms is a frontrunner in digital legal documents, offering over 85,000 state-specific legal templates available to you at any time.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

In general, you can choose a beneficiary with an online or paper form you mail in. You can elect one or multiple beneficiaries depending on your bank or credit union. If you name multiple beneficiaries, the amounts will generally be shared equally among those you name.

You can edit, delete or add beneficiaries and Transfer on Death designations (for non-retirement accounts) at chase.com: On your Accounts page, open the Main Menu (at top left). Under ?Investments," choose ?Beneficiaries? and make your changes.

To add a beneficiary, you can simply contact your bank and ask if you can designate a beneficiary on your accounts. The bank will likely provide you with a beneficiary designation form (called a "Totten trust") to fill out.

An account with a named beneficiary is a payable-on-death (POD) account. Your financial institution can give you a form for each account. The person you choose to inherit your account is a beneficiary. After your death, the account beneficiary can immediately claim ownership.

Here's how to navigate the loss of a loved one Call 1-800-392-5749 option 1 or visit a local branch. Required decedent information: The decedent's full legal name. Their Social Security Number.