Notice Beneficiaries Whose Withdrawals

Description

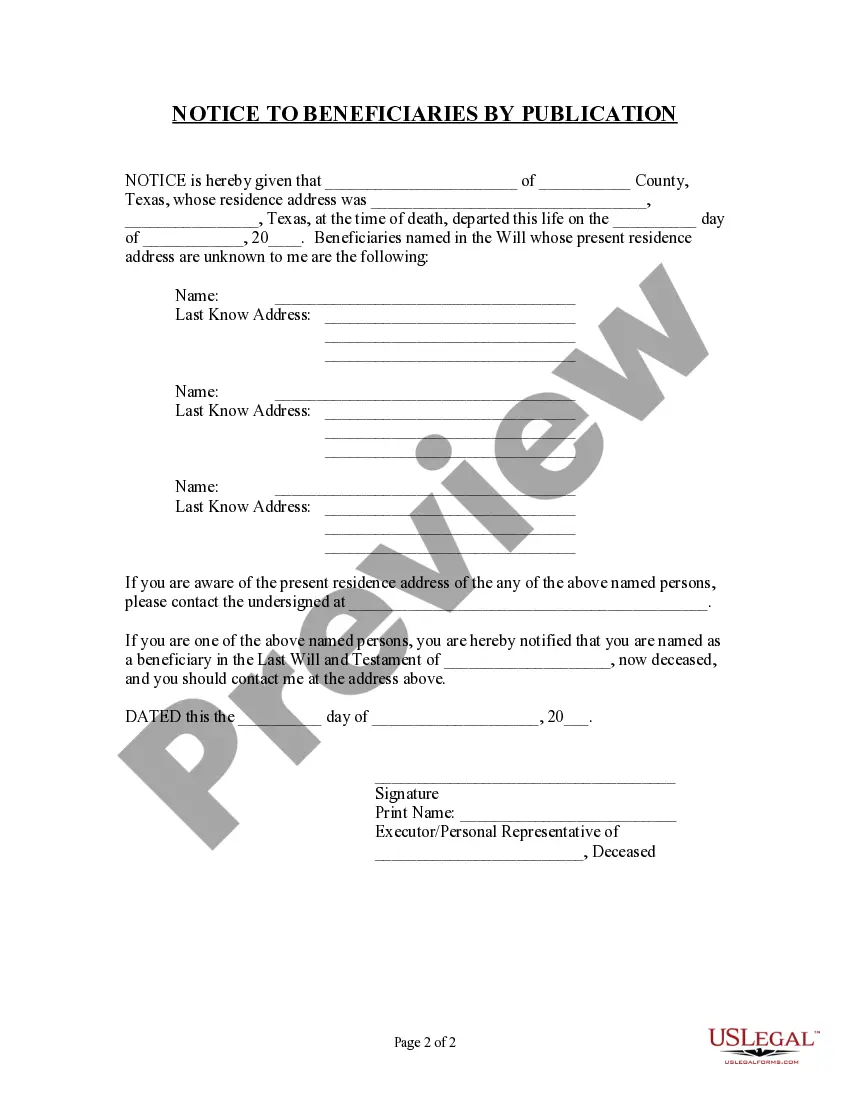

How to fill out Texas Notice To Beneficiaries Of Being Named In Will?

Acquiring legal document examples that comply with federal and local laws is crucial, and the web provides numerous choices to select from.

However, what’s the benefit of spending time searching for the properly prepared Notice Beneficiaries Whose Withdrawals sample online if the US Legal Forms digital library already consolidates such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable templates created by attorneys for any business and personal situation. They are simple to navigate with all documents organized by state and intended use.

Find another sample using the search feature at the top of the page if needed. Click Buy Now once you’ve discovered the correct form and choose a subscription plan. Create an account or Log In and make a payment using PayPal or a credit card. Choose the optimal format for your Notice Beneficiaries Whose Withdrawals and download it. All templates you find through US Legal Forms are reusable. To re-download and complete previously purchased forms, access the My documents section in your profile. Take advantage of the most comprehensive and user-friendly legal document service!

- Our specialists stay updated with legal amendments, ensuring your documents are current and compliant when acquiring a Notice Beneficiaries Whose Withdrawals from our site.

- Acquiring a Notice Beneficiaries Whose Withdrawals is simple and swift for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you require in the preferred format.

- If you are unfamiliar with our website, follow the steps below.

- Review the template using the Preview function or through the text description to verify it fulfills your needs.

Form popularity

FAQ

The decedent can name a payable on death (POD) beneficiary who will receive the funds upon the decedent's death. The decedent does this by signing a beneficiary form with the bank. To transfer the funds, you will need to provide the bank with a copy of the death certificate.

Again, this means you can't just withdraw from a trust fund. Instead, you receive that money or assets through one of the following distribution types that are pre-determined by the grantor: Outright distributions, in which the beneficiaries receive the assets outright, generally in a lump sum, and without restrictions.

A withdrawal right is the right, given to the beneficiary of a trust, to withdraw all or a portion of each gift made to the trust. For example, if a $1,000 gift is made to a trust and a beneficiary of the trust has a withdrawal right over that gift, he or she can withdraw up to $1,000 from the trust.

After a person dies, beneficiaries are usually notified within three months once a probate court receives the person's will, or within 60 days if the person had a trust. Typically, the executor or trustee is responsible for notifying beneficiaries. Notification laws vary by state, however.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.