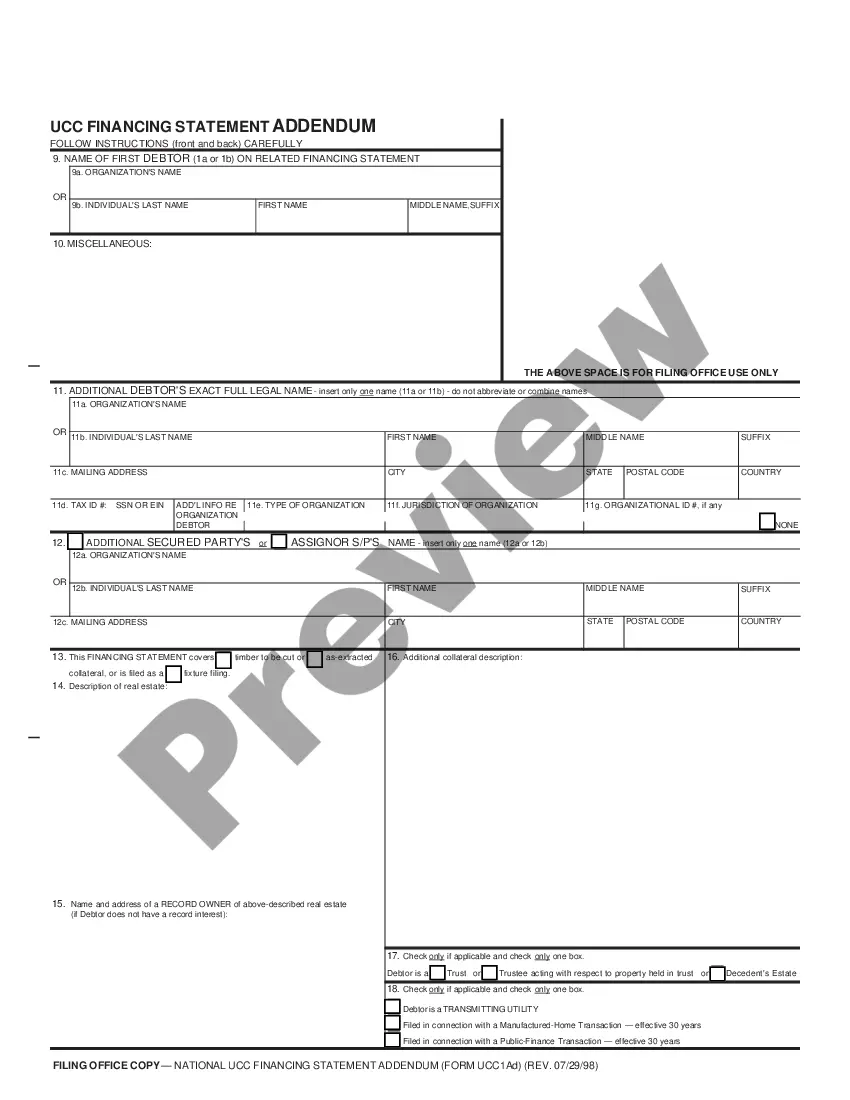

UCC1 - Financing Statement - Texas - For use until August 1, 2013. This form is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will all applicable state laws.

Filing Ucc Financing Statement In Texas

Description

How to fill out Texas UCC1 Financing Statement?

Whether for business purposes or for individual affairs, everyone has to manage legal situations sooner or later in their life. Completing legal paperwork needs careful attention, beginning from picking the right form template. For instance, if you select a wrong version of the Filing Ucc Financing Statement In Texas, it will be turned down once you submit it. It is therefore important to have a reliable source of legal papers like US Legal Forms.

If you have to get a Filing Ucc Financing Statement In Texas template, stick to these easy steps:

- Find the sample you need by utilizing the search field or catalog navigation.

- Look through the form’s description to ensure it matches your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search function to locate the Filing Ucc Financing Statement In Texas sample you need.

- Download the template if it meets your requirements.

- If you already have a US Legal Forms profile, just click Log in to access previously saved templates in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Select the correct pricing option.

- Complete the profile registration form.

- Choose your transaction method: you can use a credit card or PayPal account.

- Select the file format you want and download the Filing Ucc Financing Statement In Texas.

- Once it is saved, you are able to fill out the form with the help of editing software or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you don’t need to spend time searching for the appropriate sample across the web. Use the library’s straightforward navigation to find the correct form for any occasion.

Form popularity

FAQ

DO: Always use the Debtor's exact Legal Name and Address. The debtor's name should match what is listed on their legal license along with the correct address, or on the most recently filed corporate documents. Include the Lender's Name and Address. Provide a description of the collateral.

The Uniform Commercial Code is a comprehensive set of statutes created to provide consistency among the states. It is called a uniform law because the same law exists in many states.

Essentially, a UCC-1 can be described as a financing statement. In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property.

Typical collateral For example, if you take out a loan to buy new machinery, the lender might file a UCC-1 lien and claim that new machinery as collateral on the loan. You would, of course, work with your lender to designate what the collateral will be before you sign any documentation committing to the loan.