This is one of the official workers' compensation forms for the state of Texas.

Employee Advance Online With Bad Credit

Description

How to fill out Texas Employees Request For Advance Of Benefits?

Bureaucracy necessitates exactness and precision.

If you do not routinely manage filling out documents such as Employee Advance Online With Bad Credit, it may lead to some confusion.

Choosing the right template from the onset will guarantee that your document submission proceeds smoothly and avert the issues of resending a file or repeating the same task from the start.

Obtaining the correct and latest templates for your documentation can be done within minutes with an account at US Legal Forms. Eliminate the uncertainties of bureaucracy and enhance your efficiency in handling documents.

- Find the template using the search bar.

- Ensure the Employee Advance Online With Bad Credit you have found is suited for your state or region.

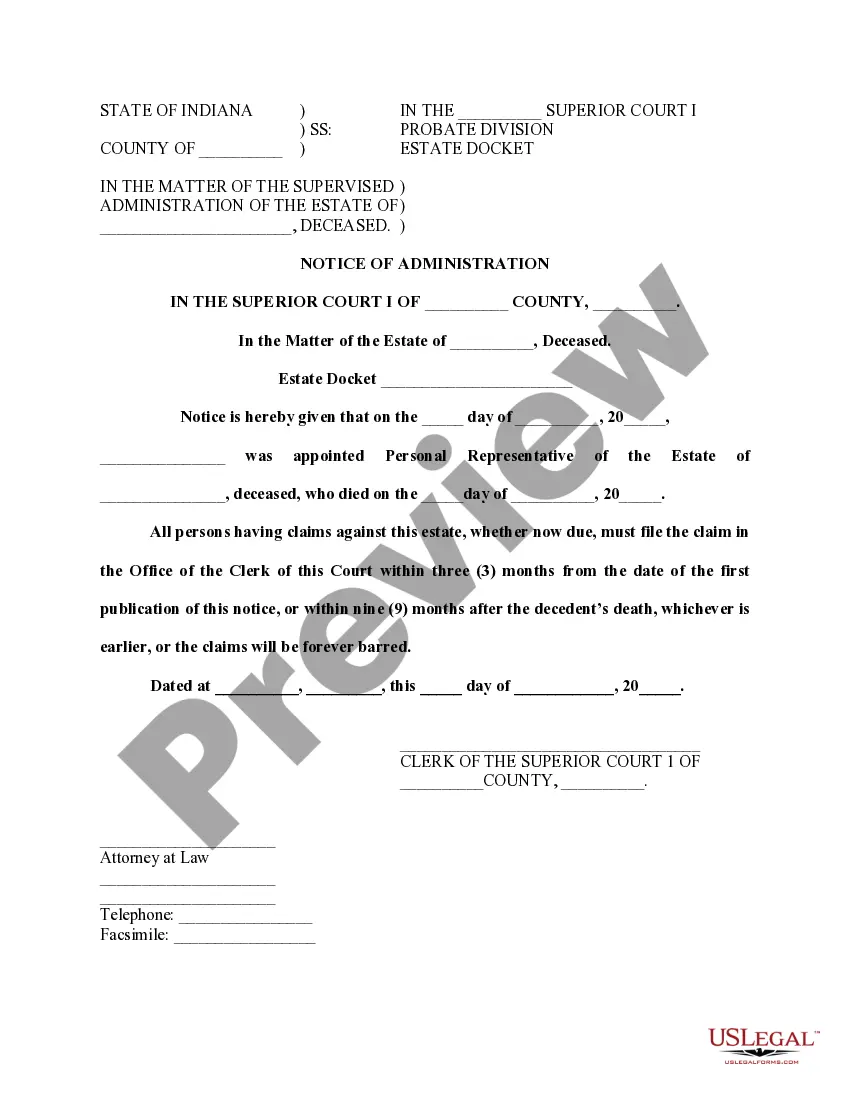

- View the preview or examine the description that includes the details on how to utilize the template.

- When the result aligns with your search, click the Buy Now button.

- Select the suitable option among the available subscription plans.

- Sign in to your account or create a new one.

- Finalize the purchase using a credit card or PayPal account.

- Download the form in the file format you prefer.

Form popularity

FAQ

To get $2000 quickly with bad credit, consider using the employee advance online with bad credit option. This service allows you to access funds promptly, even if your credit score is less than ideal. You simply need to apply through a reliable platform, like UsLegalForms, which specializes in providing these financial solutions. By submitting your application, you can receive the funds you need without the complications that traditional lenders often impose.

Advances to employees are usually recorded as a debit on the employer's financial statements. When you take an employee advance online with bad credit, the transaction affects the organization's assets and liabilities. It reflects a receivable until the employee repays the advance. Understanding the accounting treatment of these advances can help you navigate future financial decisions.

Yes, payroll advances are generally considered taxable income in Canada. When you take an employee advance online with bad credit, the amount may be subject to income tax deductions. This means that any advances provided will be reported as part of your earnings for that tax year. For clarity on your specific situation, it's best to consult a tax professional or refer to Canada Revenue Agency guidelines.

The salary advance limit typically depends on your employer's policies and the service provided. If you are seeking an employee advance online with bad credit, this option may vary. Generally, employers may offer advances ranging from a few hundred to a few thousand dollars. It's essential to check with your employer for specific limits regarding salary advances.

When writing a letter for a salary advance, start with a polite greeting and state your request directly. Explain your financial situation and how an employee advance online with bad credit can ease your burden. Include specifics like the amount needed and propose a repayment timeline. A well-structured letter can improve your chances of receiving the advance.

Recording an advance to an employee typically involves documenting the amount and purpose of the advance in your payroll system. Ensure you keep a record that outlines the repayment terms to maintain clarity. For those using the uslegalforms platform, you can find templates that simplify this process. Accurate records help both you and your employee track the advance and its repayment.

To ask for an advance payment politely, start by expressing gratitude for your employer's support. Clearly explain your situation and how the advance will help you. When you request an employee advance online with bad credit, emphasize your commitment to repaying the amount promptly. Respectful communication can foster understanding and increase your chances of approval.

To borrow $100 right now, consider using an employee advance online with bad credit from various financial service apps. These services can provide fast access to funds based on your current income, making them accessible even if your credit isn't perfect. Many platforms allow you to apply directly through their app, streamlining the process. Make sure to check the repayment terms to manage your budget effectively.