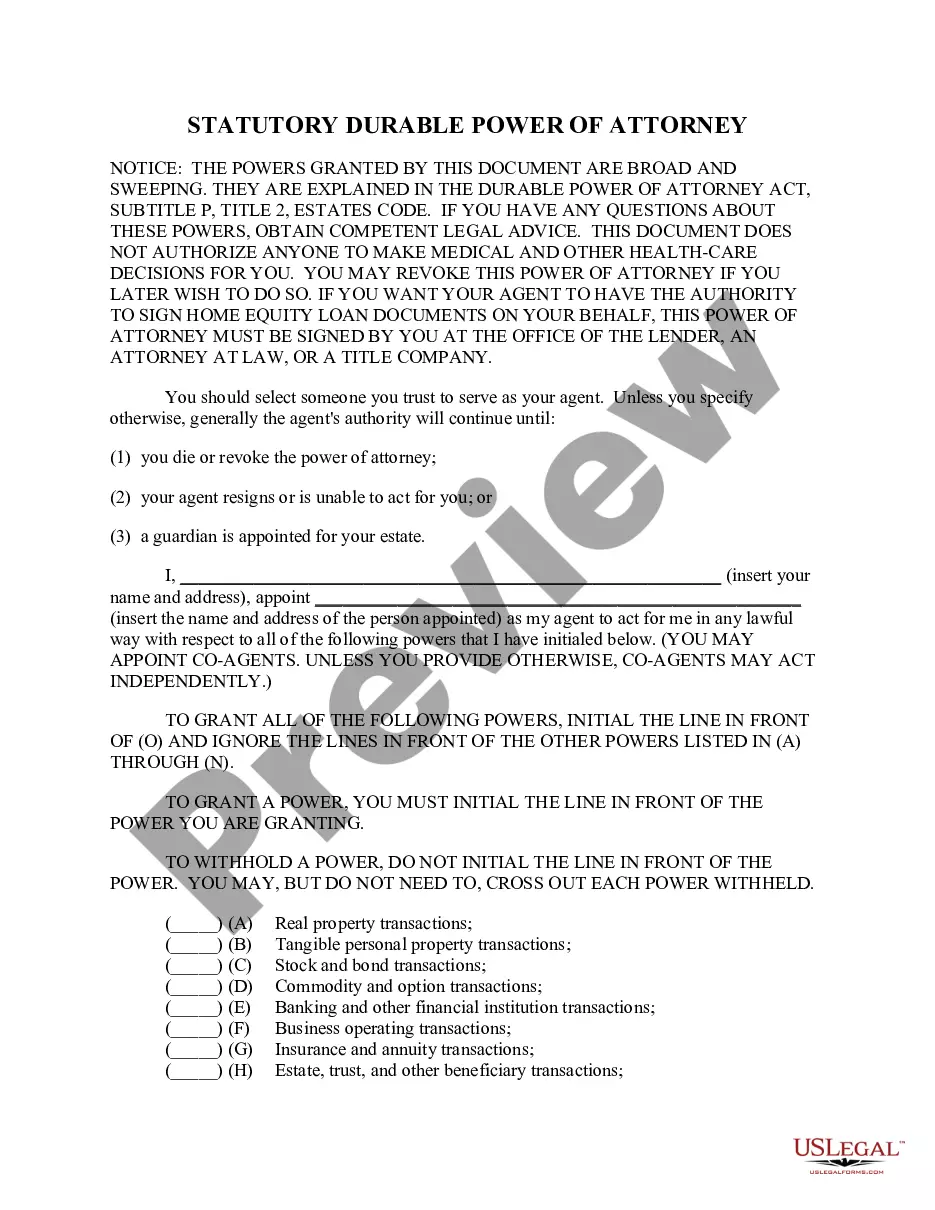

Durable Power Attorney For Finances

Description

How to fill out Texas Statutory General Power Of Attorney With Durable Provisions?

Creating legal papers from the ground up can occasionally be somewhat daunting.

Certain situations may require extensive research and considerable financial investment.

If you’re looking for a more straightforward and cost-effective method of preparing Durable Power Attorney For Finances or any other forms without unnecessary complications, US Legal Forms is always available to you.

Our online repository of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal issues. With just a few clicks, you can quickly access state- and county-specific forms meticulously prepared for you by our legal experts.

But before proceeding directly to downloading Durable Power Attorney For Finances, keep these pointers in mind: Verify the document preview and details to ensure you’re on the form you need.

- Utilize our website whenever you require trustworthy and dependable services to swiftly find and download the Durable Power Attorney For Finances.

- If you’re not unfamiliar with our services and have previously created an account with us, simply Log In to your account, find the template, and download it or re-download it anytime from the My documents section.

- Not yet registered? No worries.

- Setting it up takes minimal time, allowing you to explore the library.

Form popularity

FAQ

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

When your mortgage is paid off you need to clear the title of the property by discharging the mortgage. This done by recording a document at the Registry of Deeds usually called either a ?Discharge of Mortgage? or a Satisfaction of Mortgage?.

In other words, the mortgage discharge is the confirmation that the loan has been repaid in full, while the release is the deed that officially frees the property (building, condominium, house, land) from any mortgage.

When you're at the tail end of your mortgage, you need to discharge your home loan. If it's not done properly, it can impact your ability to sell your property quickly and efficiently. Here's how it's done: Contact your lender ? they'll ask you to complete a mortgage discharge authority form.

A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

If the satisfaction isn't recorded within a minimum of 60 days, they may incur penalties and be held liable for damages and attorney's fees.

A New Mexico deed of trust assigns a real estate title to a trustee to keep until a loan has been repaid from the owner of the property (the ?borrower?) to the provider of the loan (the ?lender?).