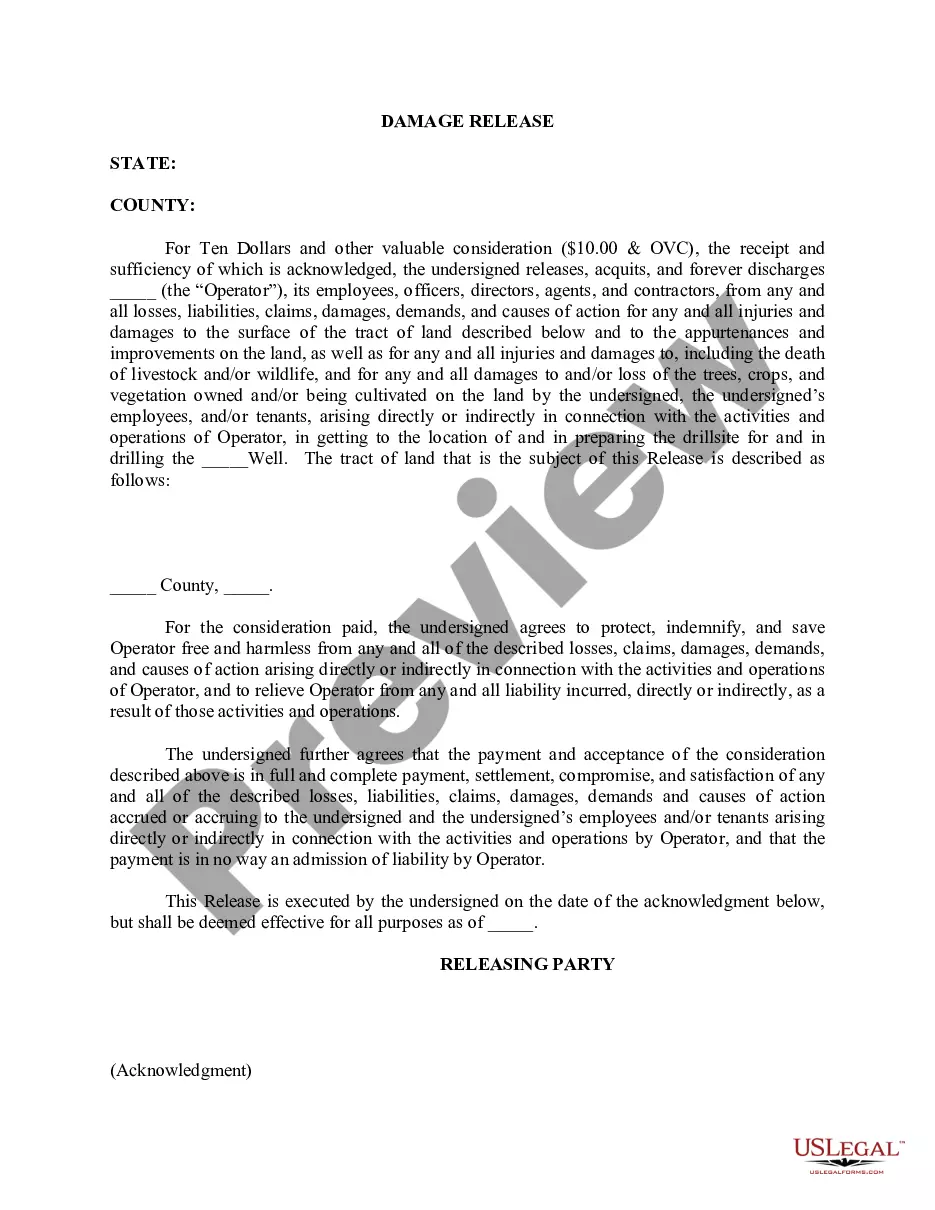

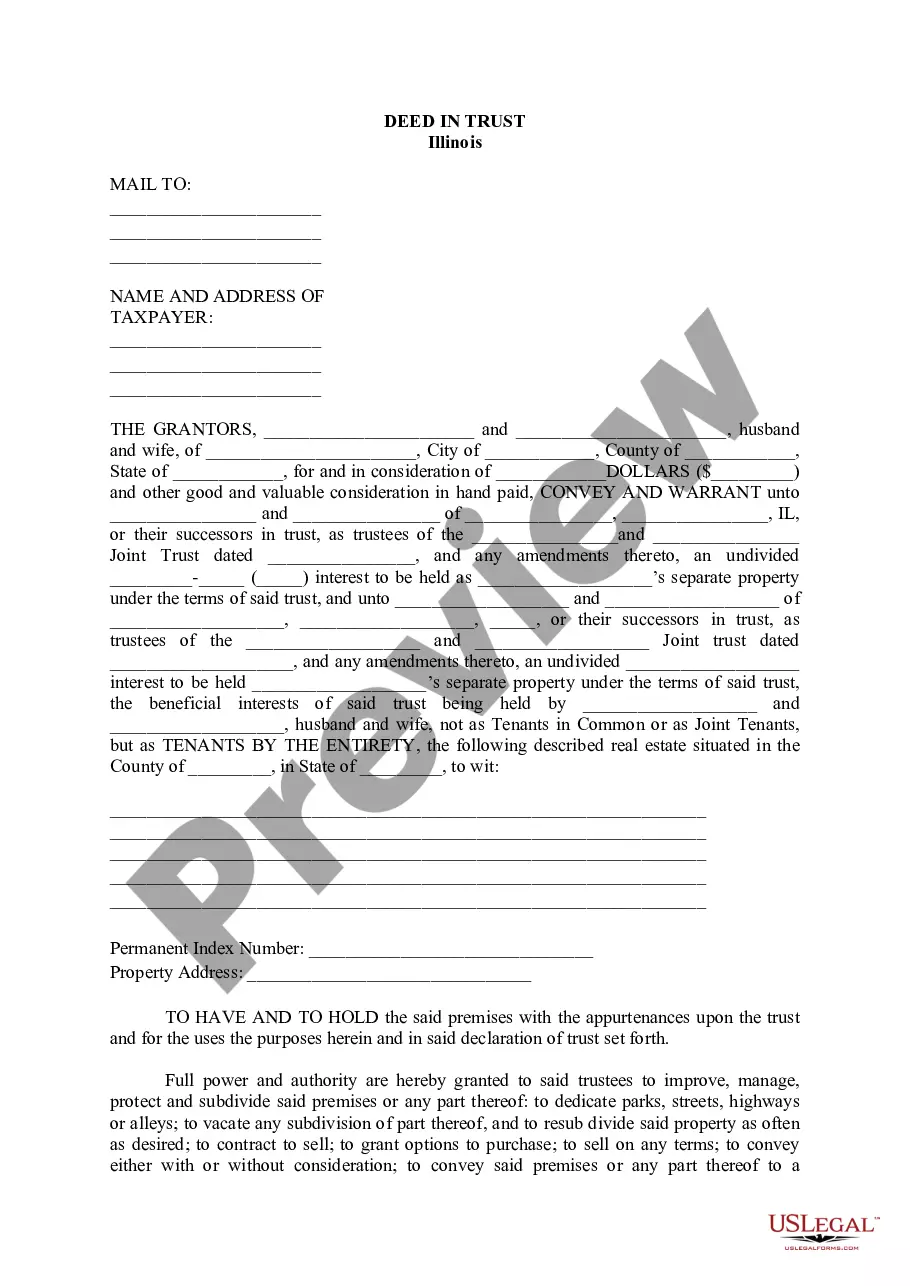

A property damage release form is a legal document that serves as a resolution of a claim or settlement between an individual or business entity and an insurance company. It is typically used when an insured person or business has experienced damage to their property and is seeking compensation from their insurance provider. This form acts as a release of the insurance company's liability in exchange for the agreed-upon settlement amount. The property damage release form is designed to ensure that the insured person or business fully understands the terms of the settlement, including the amount of compensation they will receive and the specific damages that are covered. It is crucial to carefully review and understand all aspects of the form before signing it, as it signifies the insured party's acceptance of the settlement and waives any right to further claim or legal action related to the property damage. Keywords: Property damage release form, insurance company, settlement, compensation, damages, liability, claim, insured, settlement amount, legal document, resolution, waiver, legal action. Different types of property damage release forms with insurance companies can vary based on the particular situation or type of property involved. Some common types include: 1. Automobile Property Damage Release Form: This type of form is used when a person's vehicle has suffered damage due to an accident, theft, or other covered events, and they are seeking compensation from their auto insurance company. 2. Homeowner's Property Damage Release Form: Homeowners who have experienced damage to their property, such as from fire, severe weather, or vandalism, may need to fill out this form with their homeowner's insurance company to initiate the claims process and receive compensation. 3. Commercial Property Damage Release Form: Businesses and commercial property owners often have separate forms specific to their insurance policies, as they may have different coverage and claims processes compared to personal property insurance. 4. Renter's Property Damage Release Form: Tenants who have renter's insurance and have experienced damage to their rented property, such as from a flood or burglary, may have their own release form to complete and submit to the insurance company. It is important to note that the specific name or format of property damage release forms can vary between insurance companies, states, or countries. Additionally, different insurance companies may have their own customized versions of these forms, tailored to their specific policies and requirements.

Property Damage Release Form With Insurance Company

Description

How to fill out Property Damage Release Form With Insurance Company?

Handling legal documents and procedures might be a time-consuming addition to the day. Property Damage Release Form With Insurance Company and forms like it usually require that you search for them and understand the way to complete them effectively. As a result, regardless if you are taking care of financial, legal, or personal matters, having a thorough and convenient online catalogue of forms on hand will go a long way.

US Legal Forms is the top online platform of legal templates, boasting more than 85,000 state-specific forms and a number of tools to help you complete your documents quickly. Check out the catalogue of relevant documents available to you with just one click.

US Legal Forms gives you state- and county-specific forms offered by any time for downloading. Safeguard your papers managing procedures having a high quality service that allows you to put together any form in minutes with no extra or hidden charges. Simply log in to your profile, find Property Damage Release Form With Insurance Company and acquire it immediately from the My Forms tab. You can also access previously downloaded forms.

Could it be the first time making use of US Legal Forms? Register and set up up an account in a few minutes and you’ll gain access to the form catalogue and Property Damage Release Form With Insurance Company. Then, adhere to the steps listed below to complete your form:

- Be sure you have found the proper form by using the Preview option and looking at the form description.

- Choose Buy Now as soon as ready, and choose the subscription plan that suits you.

- Choose Download then complete, sign, and print out the form.

US Legal Forms has 25 years of experience helping consumers control their legal documents. Get the form you require today and enhance any operation without breaking a sweat.

Form popularity

FAQ

7 steps to file a home or auto claim Step 1: File a police report. Step 2: Document any damage. Step 3: Review your coverage. Step 4: Contact your insurance company. Step 5: Prepare for the insurance adjuster. Step 7: Receive the claim payment and repair the damage.

7 Tips for Writing a Demand Letter To the Insurance Company Organize your expenses. ... Establish the facts. ... Share your perspective. ... Detail your road to recovery. ... Acknowledge and emphasize your pain and suffering. ... Request a reasonable settlement amount. ... Review your letter and send it!

One of the documents the insurance adjuster will attempt to get you to sign is the 'Release of All Claims' Form. This form is often included as part of a settlement agreement and it is a release of liability. Essentially, this form releases the other party from fault.

A property damage release is common after car accidents, especially in crashes where vehicles are totaled. This type of release allows the insurance company to finalize your claim. By signing, you agree that the insurer has satisfied its obligations regarding your claim, and you aren't owed anything more.

When you file a claim, you'll be asked to provide some basic details, such as where and when the accident or incident took place, contact information for everyone involved and a description of what happened. You might also be asked to give an estimated cost of the damage from the accident?if you have that available.