Land Trust Form With Llc As Beneficiary

Description

Form popularity

FAQ

To pass your LLC to heirs, you can utilize a land trust form with LLC as beneficiary. This approach allows you to outline specific instructions for asset distribution upon your passing. By designating your LLC as a beneficiary within a land trust, you ensure a smooth transfer to your heirs, minimizing probate complications. US Legal Forms provides accessible templates and resources to create an effective plan that meets your needs.

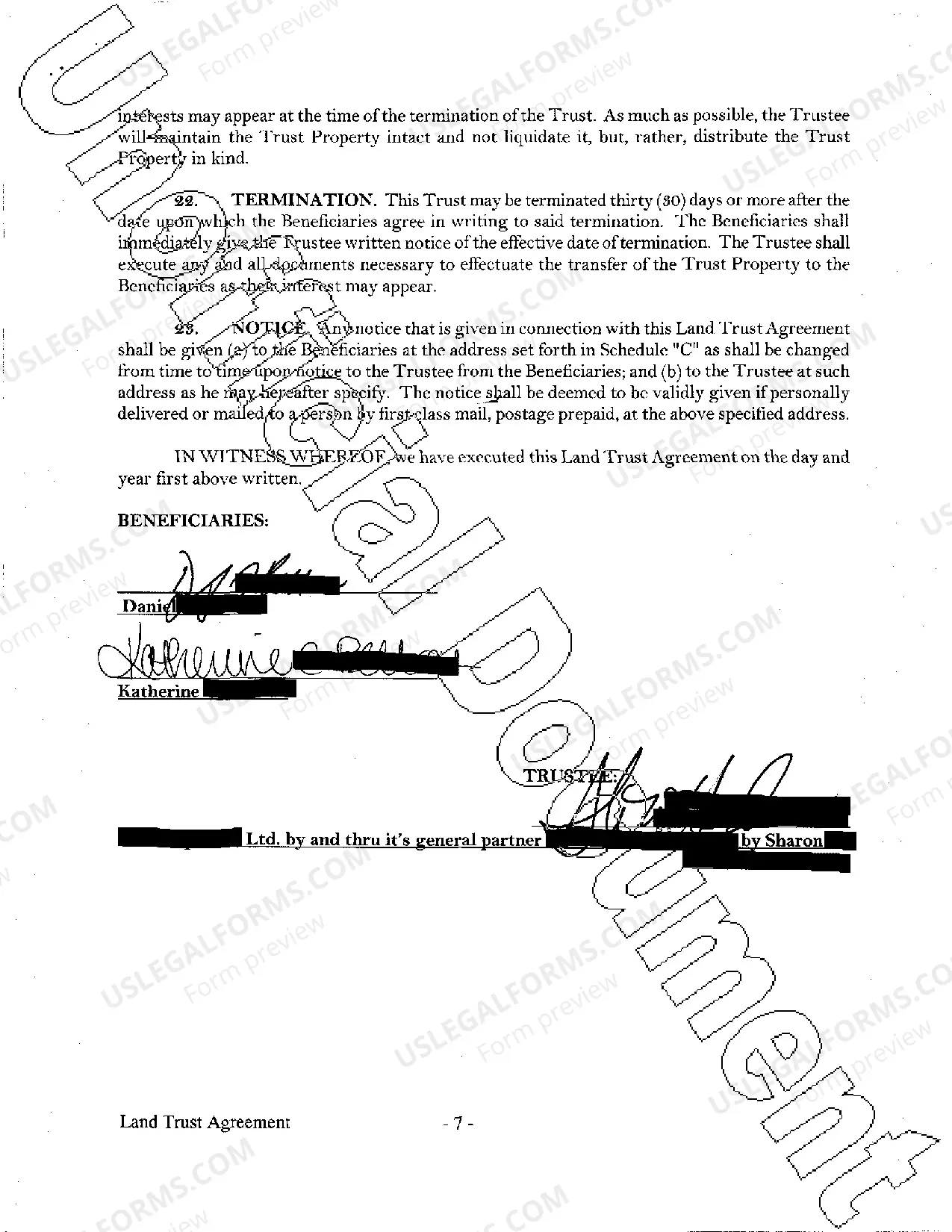

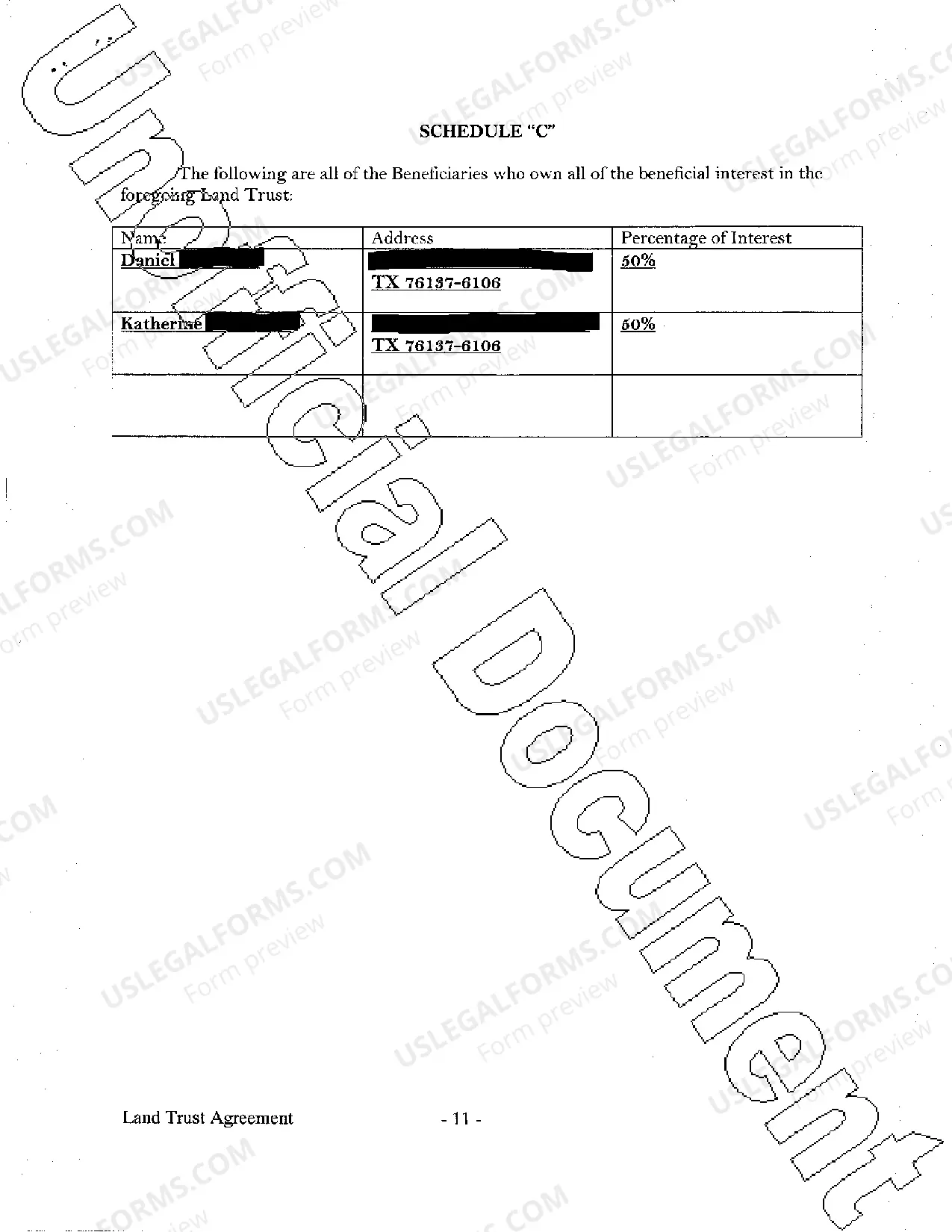

To assign a beneficiary to your LLC, you first need to establish a land trust. This involves drafting a land trust form with LLC as beneficiary, which clearly designates the LLC as the holder of the property rights. Once established, you must complete the necessary documentation to transfer the property into the land trust. Utilizing the USLegalForms platform can simplify this process, providing you with the tools to create compliant forms easily and ensuring your LLC benefits are protected.

While there are advantages, a few disadvantages exist in putting an LLC in a trust. These include potential complexity in management and possible additional tax implications. However, using a land trust form with LLC as beneficiary clarifies ownership and management arrangements, which can mitigate some of these concerns.

Yes, an LLC can be designated as a beneficiary of a trust. This setup can provide specific benefits, such as asset protection and clear directions for managing business interests. It's essential to use a land trust form with LLC as beneficiary properly, making sure that your intentions are clearly outlined for future management.

People often put their business in a trust to ensure smooth management and protection of their assets. Trusts can help avoid probate, reduce estate taxes, and offer liability protection. By using a land trust form with LLC as beneficiary, individuals can also maintain control of their business while ensuring it remains within the family or designated beneficiaries.

Transferring ownership of an LLC to a trust involves a few straightforward steps. First, you need to create a land trust form with LLC as beneficiary, outlining the trust terms. Then, you must fill out an assignment of membership interest to formally transfer ownership. This process secures the LLC's assets under the trust, allowing for seamless management.

One significant mistake parents often make is failing to thoroughly communicate their intentions and set clear rules for the trust. Without a clear understanding of how the trust operates, beneficiaries may struggle with decision-making or mismanage assets. Utilizing a land trust form with LLC as beneficiary can help clarify roles and responsibilities, promoting better management of the family assets.

Yes, a trust can own 100% of an LLC. This arrangement allows for greater control over the LLC's assets and operations, especially when the trust is structured correctly. By using a land trust form with LLC as beneficiary, you ensure that the business is managed according to your wishes, even after you are no longer able to do so.

It can be a shrewd strategy to place your LLC in a trust. This setup simplifies asset management and supports your estate planning goals. With a land trust form with LLC as beneficiary, you protect your business assets and ensure smoother transitions for your beneficiaries, allowing them to inherit without hassle.

Yes, you can place an LLC into a land trust. This combination provides both privacy and legal protection, creating an effective asset management tool. By utilizing a land trust form with LLC as beneficiary, you can enjoy peace of mind knowing that your assets are secured while keeping ownership details confidential.