Land Trust Example For House

Description

How to fill out Texas Land Trust Agreement?

It’s well-known that you can't transform into a legal specialist right away, nor can you quickly learn how to expertly formulate a Land Trust Example For House without a distinctive set of expertise.

Crafting legal documents is an extensive journey that demands a particular education and abilities.

So why not assign the creation of the Land Trust Example For House to the experts.

You can revisit your documents from the My documents section at any time.

If you’re a current customer, you can simply Log In, and locate and download the template from the same section.

- Locate the document you need by utilizing the search feature located at the top of the webpage.

- Preview it (if this option is accessible) and review the accompanying description to determine if the Land Trust Example For House fits your requirements.

- Restart your search if you require any additional form.

- Establish a complimentary account and choose a subscription plan to purchase the template.

- Select Buy now. After the payment is processed, you can obtain the Land Trust Example For House, complete it, print it, and deliver it or send it via mail to the required recipients or organizations.

Form popularity

FAQ

The two-year rule for trusts generally refers to the time frame for certain tax implications or benefits regarding trust properties. For a land trust example for house ownership, this rule may impact how long assets need to be held within the trust to avoid capital gains tax on sale. Adhering to this guideline can influence your financial planning, making it vital to understand your obligations. Consulting with a financial advisor or utilizing resources from US Legal Forms can provide clarity on this matter.

Placing your house in a land trust can provide several benefits, such as privacy and asset protection. A land trust example for house ownership simplifies management and ensures continuity even after death. Additionally, it may help avoid probate, allowing your heirs to inherit the property more smoothly. However, it is essential to consider your individual circumstances and consult with a legal expert for personalized advice.

Yes, placing your property in a land trust can provide several benefits. For instance, it helps with privacy, as your name does not appear in public records connected to the property. Additionally, a land trust example for house can simplify estate planning by making it easier to transfer property upon your death. It's often a strategic move for asset protection and can enhance the management of your real estate investment.

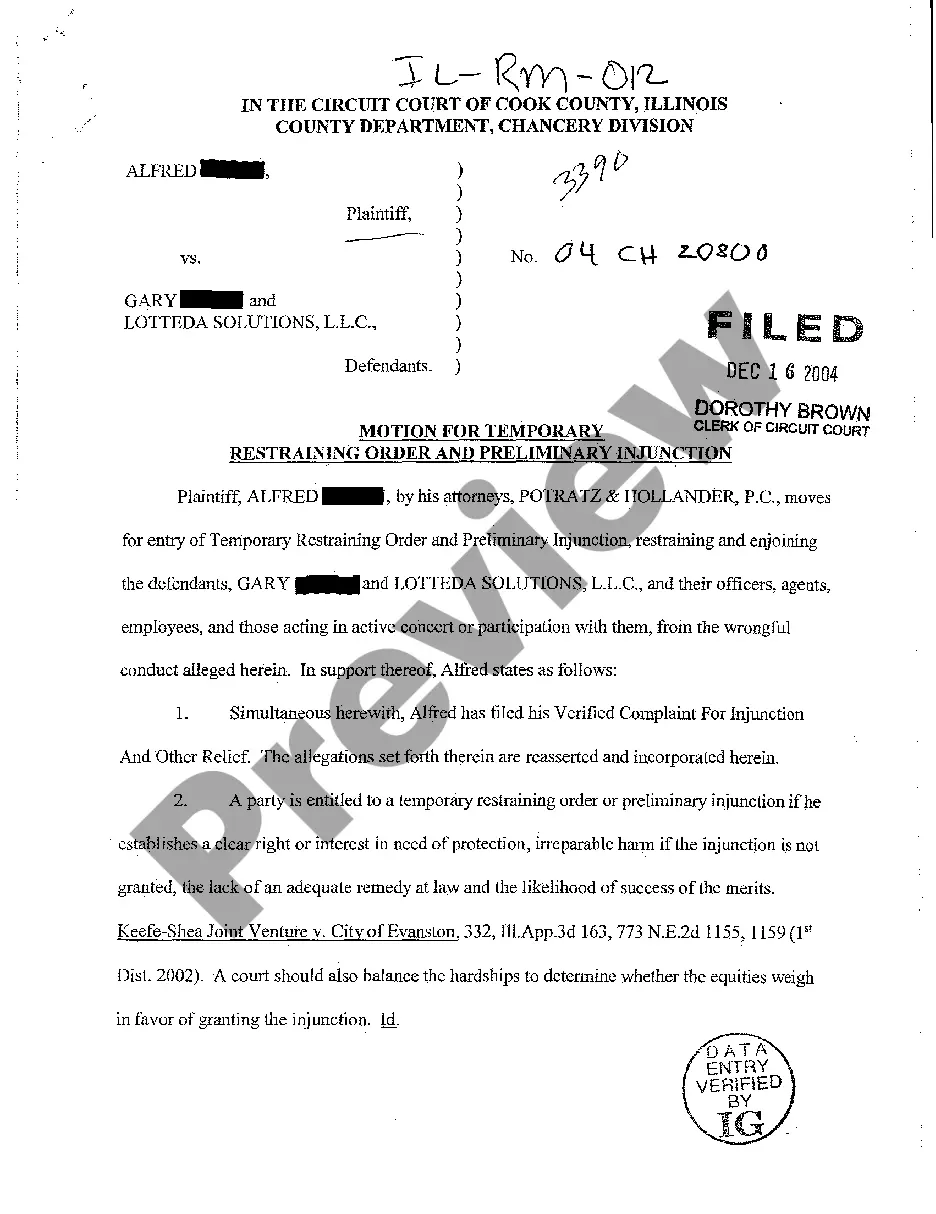

Placing your house in a land trust provides privacy and protection from potential lawsuits. A land trust example for house ensures that your name is not publicly associated with your property, which reduces the risk of targeted legal actions. Additionally, this arrangement can simplify estate planning, allowing for smoother transfer of asset ownership upon passing. Engaging with platforms like US Legal Forms can help you set up your land trust efficiently.

One disadvantage of a land trust is the limited control you may have over the property once it is placed in the trust. The trustee has the responsibility to manage the property according to the trust's terms, which might not align with your preferences. Additionally, setting up a land trust can involve legal fees and administrative costs. Before proceeding, it’s helpful to evaluate a land trust example for house ownership to weigh the advantages against potential drawbacks.

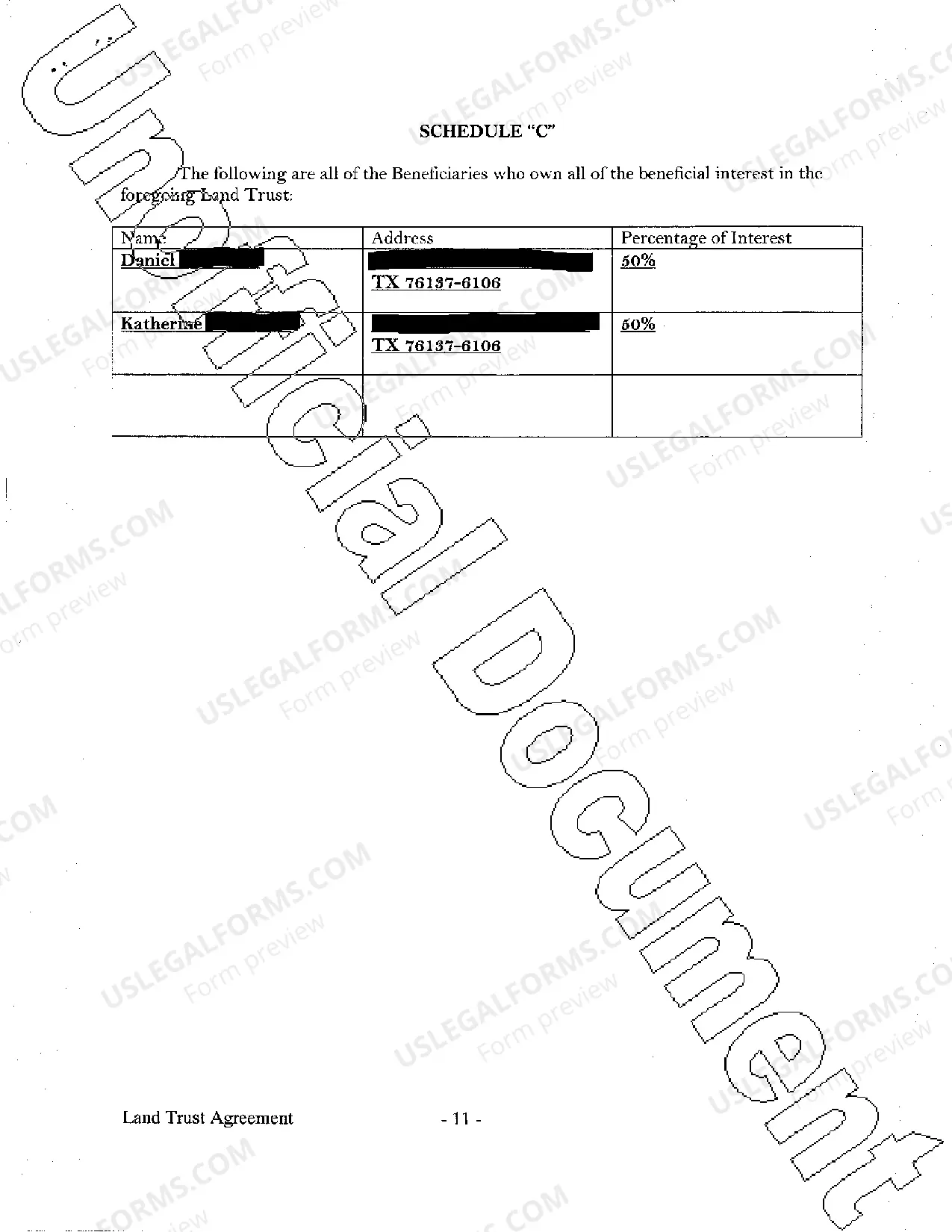

An example of a land trust might involve a family property where the parents establish a trust for their home. In this instance, the parents transfer ownership to a trustee, who manages the property for their children. This setup preserves ownership without public exposure and ensures a smooth transition of the property upon the parents' passing. Understanding a land trust example for house ownership can highlight its advantages in wealth preservation.

The key point of putting your house in a trust is to simplify the transfer of assets and protect your estate. This method helps bypass probate and ensures your property goes directly to your chosen beneficiaries. Additionally, a trust can protect your home from potential creditors and give you peace of mind. By looking at a land trust example for house ownership, you can better understand the benefits this process provides.

The best way to put your house in a trust is to work with a legal professional specializing in estate planning. They will guide you through the paperwork necessary for transferring your property into a trust. It is essential to ensure that the trust is properly established to avoid complications later. Platforms like US Legal Forms offer resources and documents to streamline this process and help you create a solid land trust example for house ownership.

A land trust example involves designating a trustee to hold the title of the property on behalf of the beneficiary. For instance, you might transfer your home into a trust, which is then managed by a trusted individual or entity. This protection means your personal information remains private, while you still enjoy the benefits of ownership. By exploring this method, you can see how a land trust example for house ownership operates in real life.

The point of a land trust is to provide privacy and control over your property. When you place your house in a land trust, it allows you to keep the property owner's name confidential. This arrangement can protect your estate from probate, offer asset protection, and provide ease of transferring the property to beneficiaries. A land trust example for house use showcases how this strategy can offer both security and flexibility.