Land Trust Documents With A Mortgage

Description

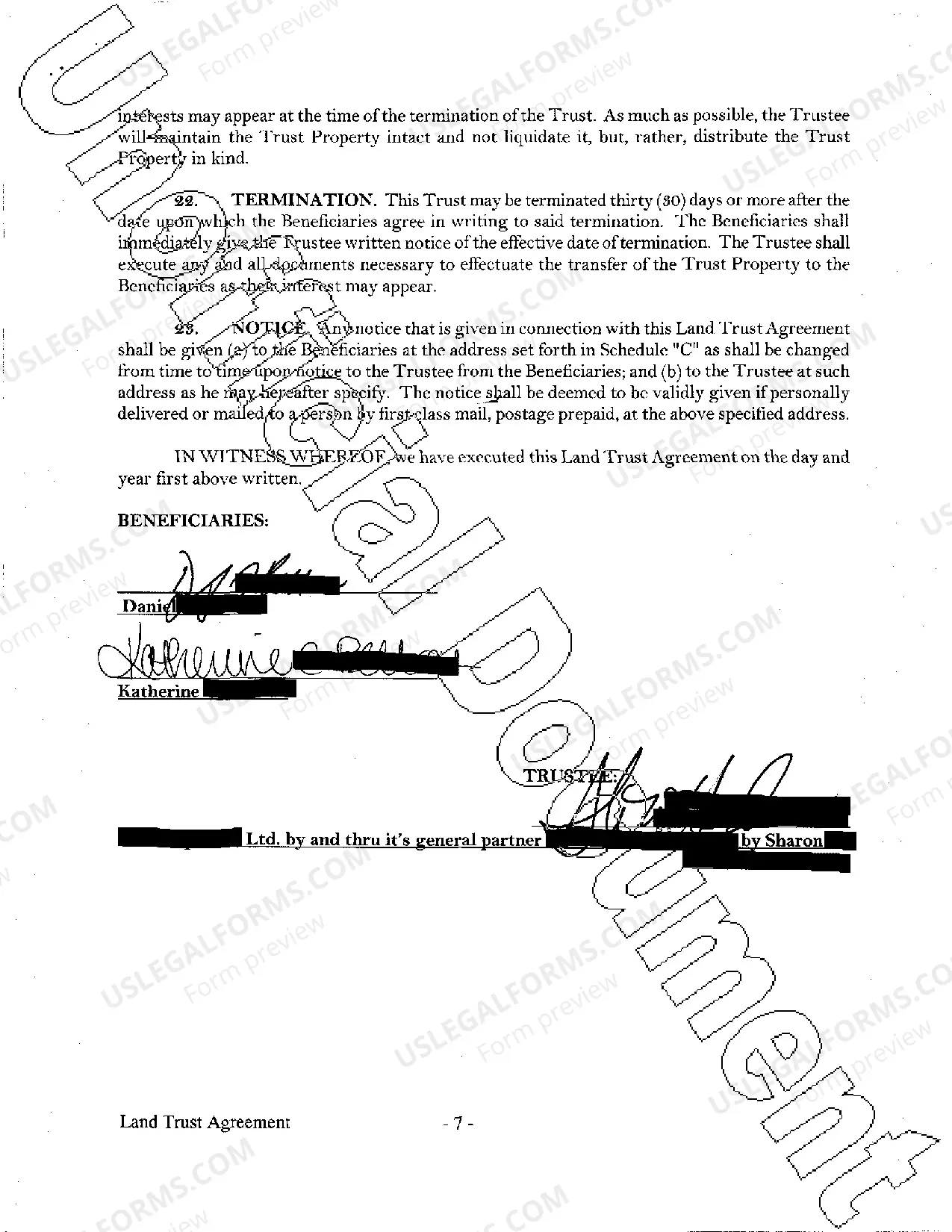

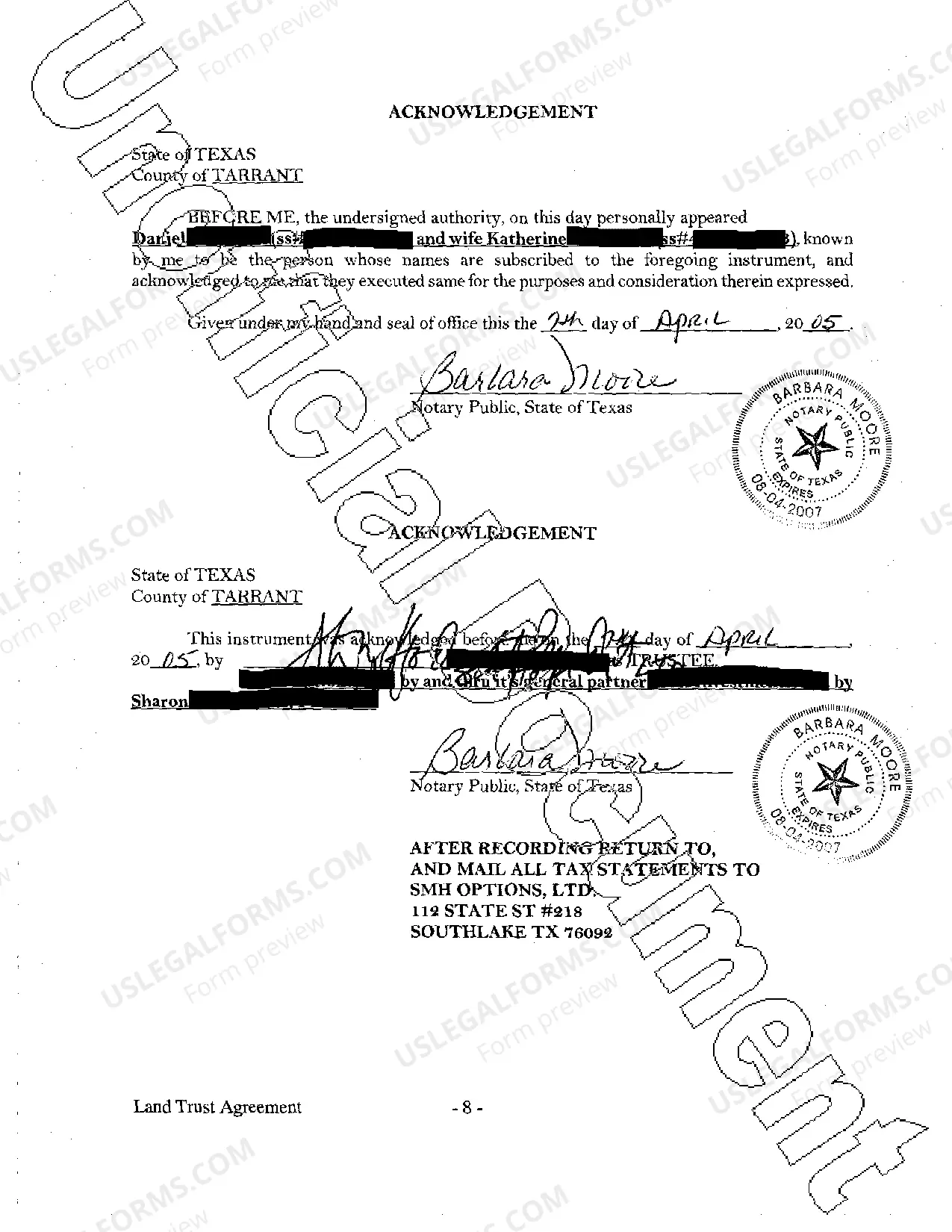

How to fill out Texas Land Trust Agreement?

Accessing legal document examples that align with federal and state statutes is essential, and the internet provides a multitude of alternatives to choose from.

However, what is the purpose of expending time searching for the suitable Land Trust Documents With A Mortgage example online when the US Legal Forms digital library conveniently houses such templates in one location.

US Legal Forms is the premier online legal repository featuring over 85,000 fillable forms prepared by attorneys for any professional and personal situation. They are simple to navigate, with all documents categorized by state and intended use. Our experts remain updated with legal modifications, so you can always trust that your form is current and compliant when acquiring a Land Trust Documents With A Mortgage from our site.

Click Buy Now once you’ve identified the correct form and select a subscription plan. Register for an account or Log In and complete the payment using PayPal or a credit card. Choose the most suitable format for your Land Trust Documents With A Mortgage and download it. All documents accessed through US Legal Forms are reusable. To re-download and complete forms obtained previously, navigate to the My documents tab in your profile. Experience the most comprehensive and user-friendly legal documentation service!

- Acquiring a Land Trust Documents With A Mortgage is straightforward and swift for both existing and new users.

- If you already possess an account with an active subscription, Log In and retrieve the document example you need in your desired format.

- If you are unfamiliar with our site, follow the steps outlined below.

- Review the template using the Preview feature or via the text outline to confirm it satisfies your needs.

- If required, find another sample using the search functionality located at the top of the page.

Form popularity

FAQ

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

Second, most land trusts are automatically disqualified from secondary market loans. The other issue with land trusts is that they give the illusion that there is no liability. Land trusts still have liability, even in Illinois. The real property owner, and not just the trust or trustee, can be found liable for things.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

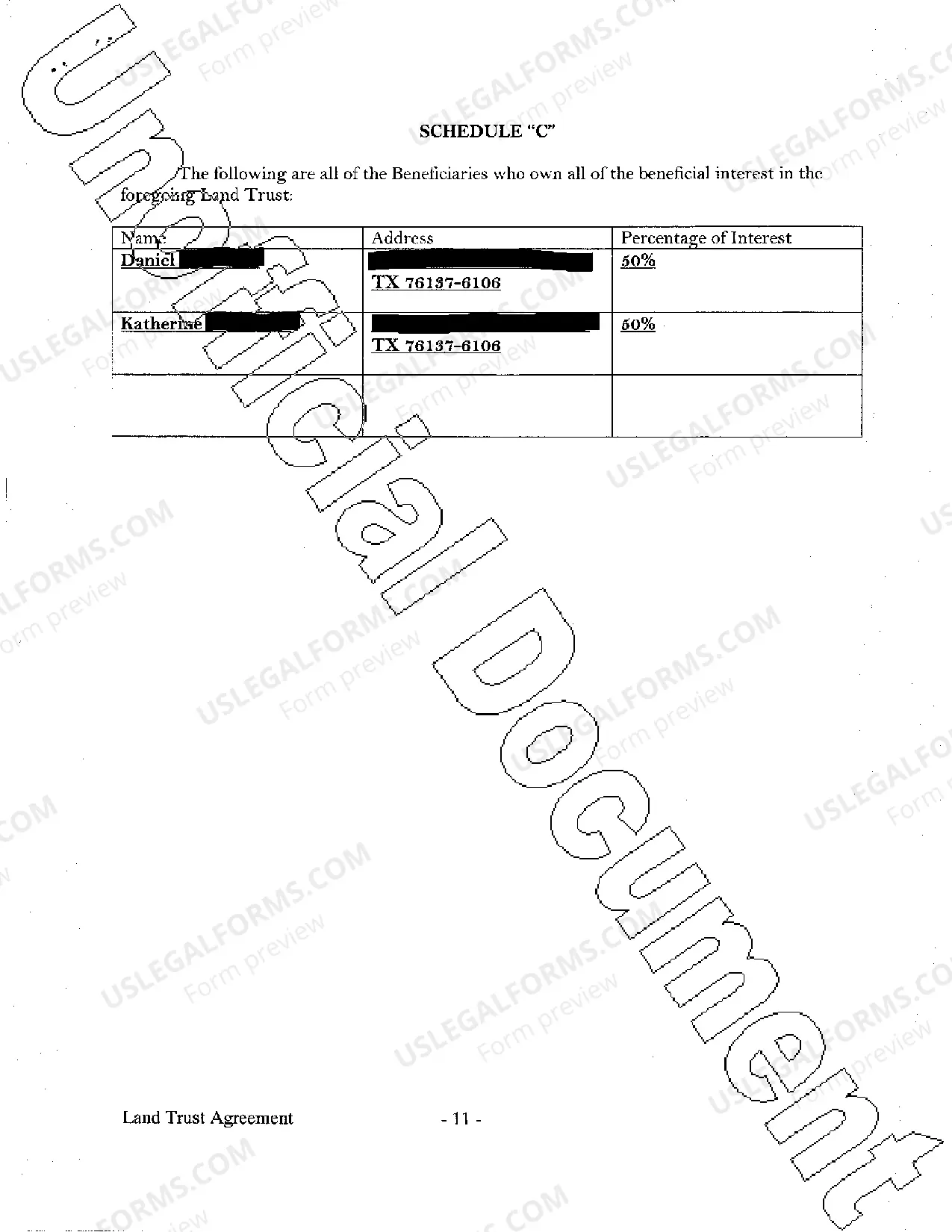

Collateral Assignment of Beneficial Interest: This is the agreement that secures the lenders interest in the beneficial interest of the trust and puts a lien on the beneficial interest in the trust. It is the land trust equivalent of the mortgage.