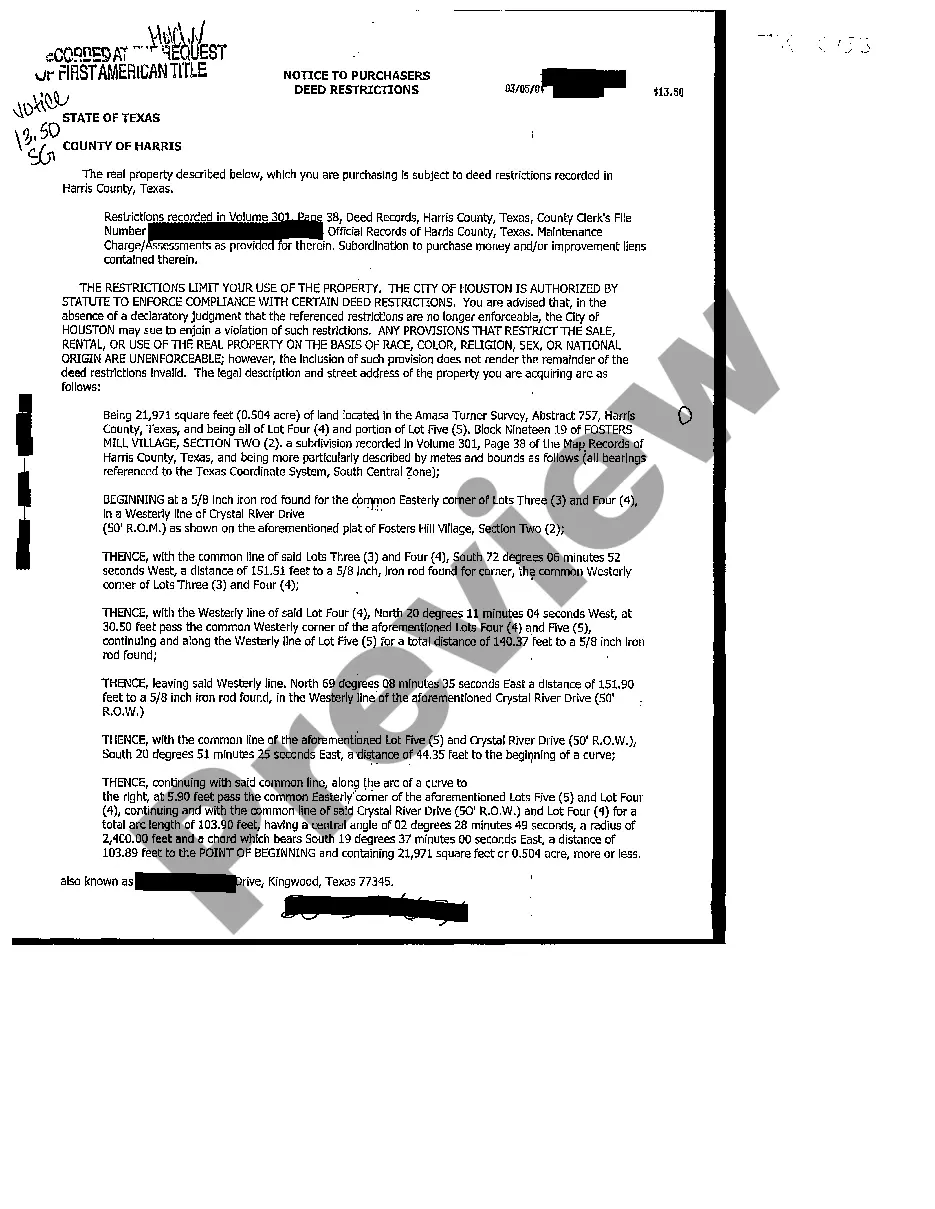

Mud Disclosure Notice For

Description

How to fill out Texas Notice To Purchasers?

It’s clear that you cannot transform into a legal authority instantly, nor can you acquire the ability to swiftly prepare a Mud Disclosure Notice For without possessing a specialized skill set. Assembling legal documents is a lengthy procedure that necessitates specific training and expertise. So why not entrust the development of the Mud Disclosure Notice For to the professionals.

With US Legal Forms, one of the most comprehensive legal document repositories, you can access everything from court documents to templates for in-office correspondence. We understand how vital compliance and adherence to federal and state statutes and regulations are. That’s why, on our platform, all templates are location-specific and updated.

Here’s how to get started with our platform and obtain the document you require in just a few minutes.

You can access your forms again from the My documents tab at any time. If you are an existing client, you can simply Log In, and locate and download the template from the same tab.

Regardless of the purpose of your documentation—whether it’s financial and legal, or personal—our platform is here to assist you. Try US Legal Forms today!

- Locate the document you need using the search bar at the top of the page.

- Preview it (if this option is available) and review the accompanying description to ascertain whether Mud Disclosure Notice For is what you seek.

- Restart your search if you require a different template.

- Create a free account and choose a subscription option to acquire the form.

- Select Buy now. Once the transaction is complete, you can obtain the Mud Disclosure Notice For, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

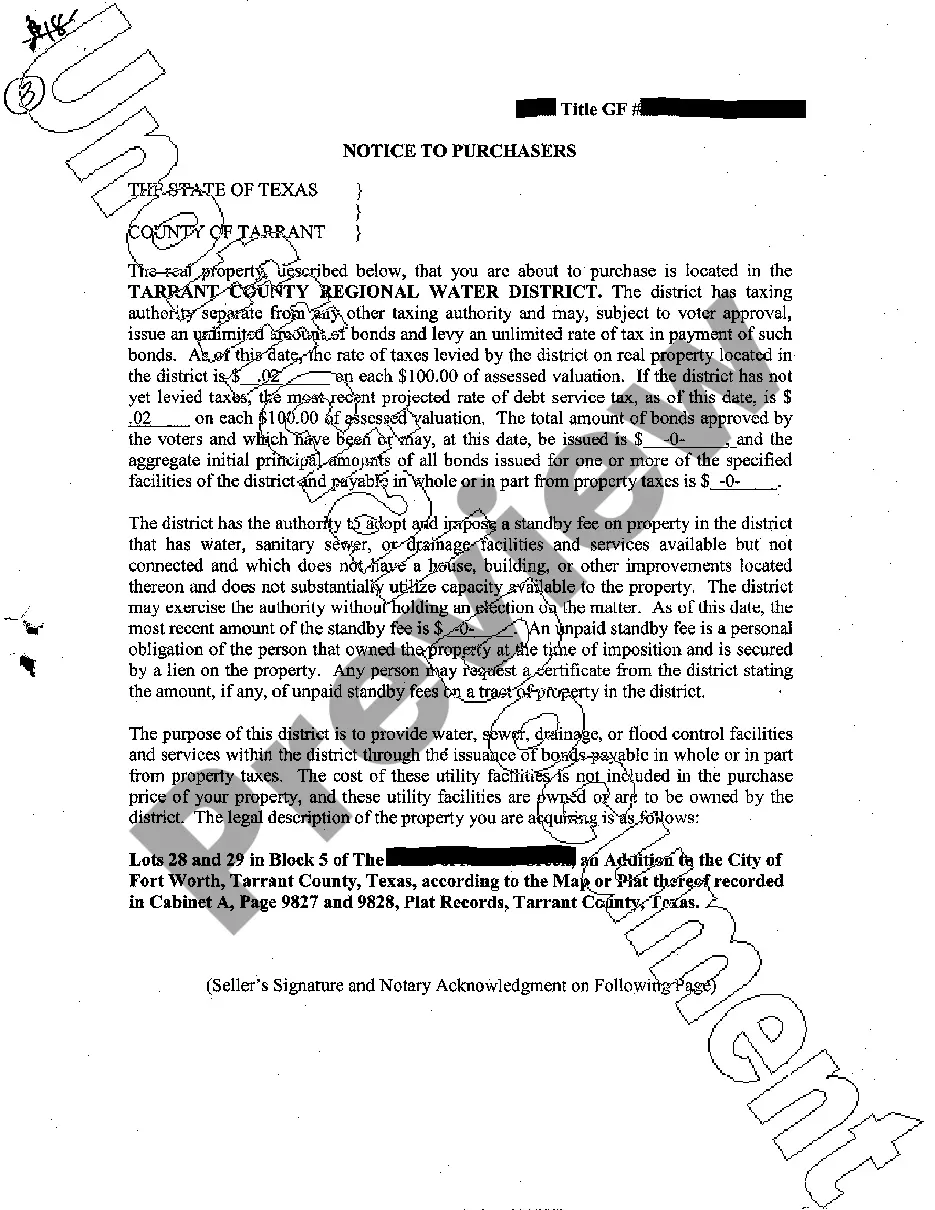

The seller is required by the Texas Water Code to provide a buyer a notice to purchasers indicating that property is located within a MUD prior to the buyer entering into a sales contract. The notice must provide information regarding the tax rate, bonded indebtedness, and fees, if any, of the MUD.

The seller is required by the Texas Water Code to provide a buyer a notice to purchasers indicating that property is located within a MUD prior to the buyer entering into a sales contract.

Ing to Texas House Bill 2815 which became effective on June 18, 2023, the law covering notice required to a purchaser of property in a MUD changed. This change to the law made form 400 obsolete and no longer useable under the new law and its notice provision.

A Municipal Utility District (MUD) is one of several types of special districts that function as independent, limited governments. The purpose of a MUD is to provide a developer an alternate way to finance infrastructure, such as water, sewer, drainage, and road facilities.

What are MUD taxes? Municipal Utility Districts are funded through bonds. Homeowners then pay off those bonds through MUD tax. As the debt decreases, MUD taxes may also decrease over time.