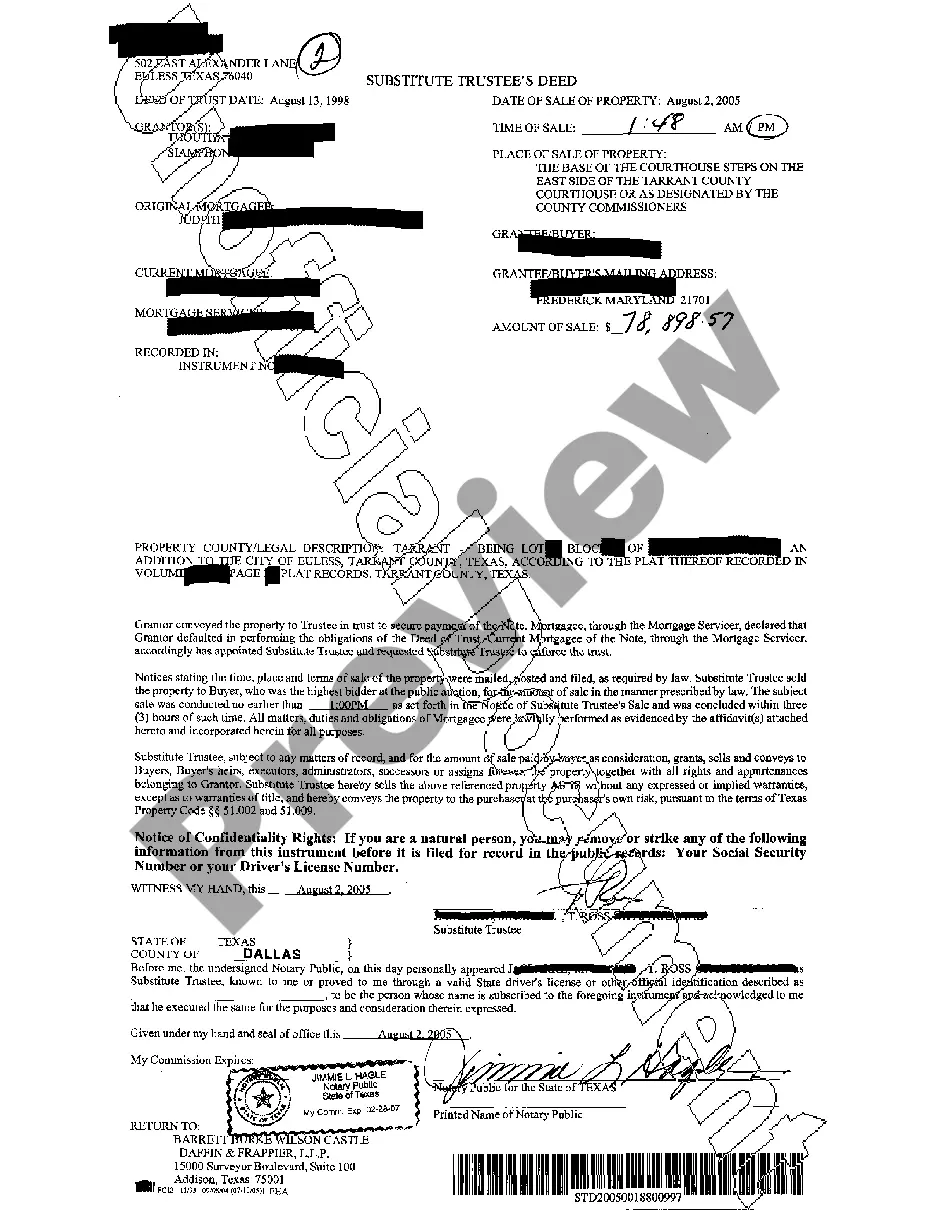

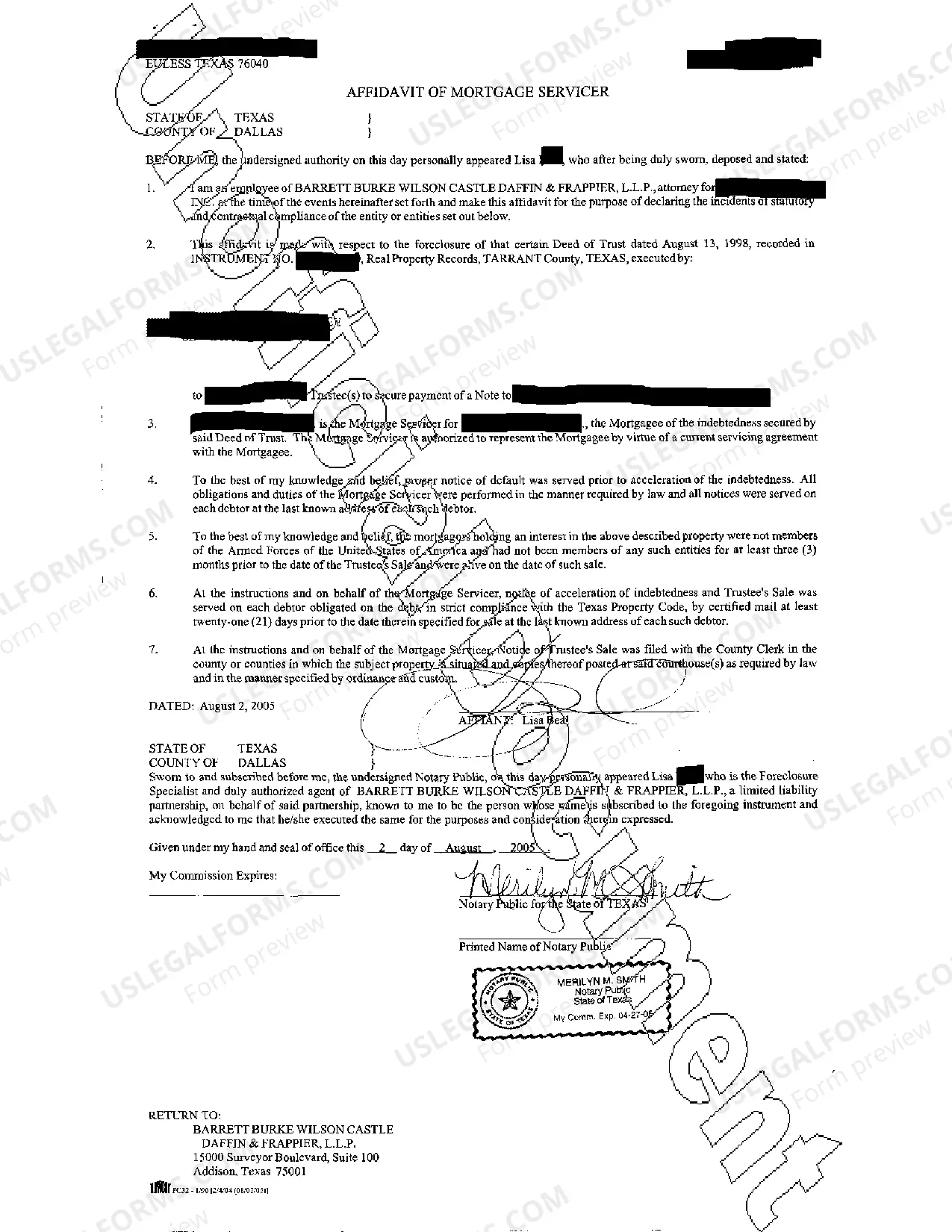

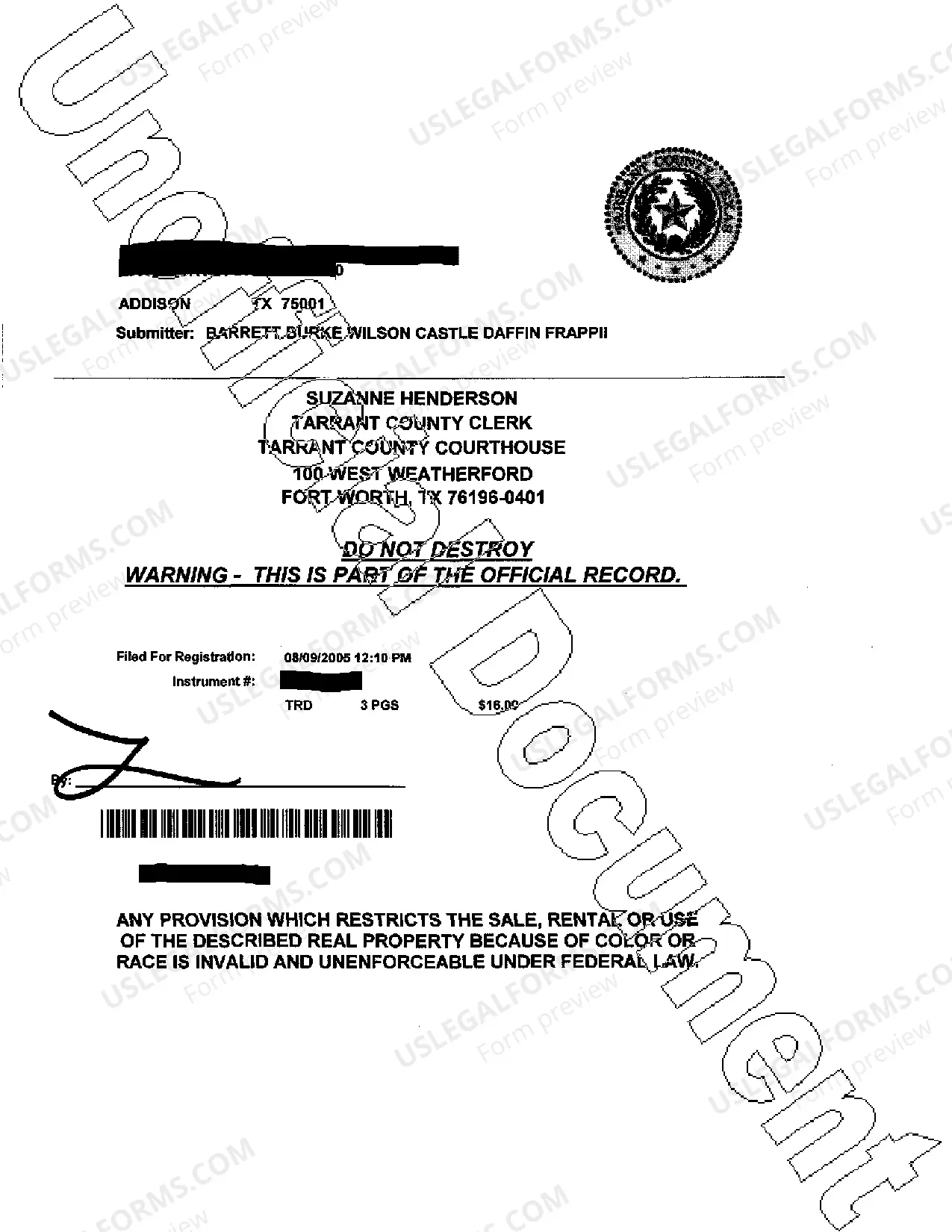

A Substitute Trustee Deed Foreclosure is a legal process through which a property is transferred to a new owner to satisfy a debt owed by the current owner. This type of foreclosure occurs when a borrower defaults on their mortgage or fails to fulfill the terms and conditions outlined in the underlying loan agreement. Keywords: Substitute Trustee Deed, Foreclosure, Legal Process, Property, Transferred, Debt, Borrower, Mortgage, Loan Agreement. Types of Substitute Trustee Deed Foreclosure: 1. Non-Judicial Foreclosure: This type of foreclosure does not require court involvement. It is conducted through a power of sale clause included in the mortgage or deed of trust. The lender initiates foreclosure by appointing a substitute trustee, who then proceeds to sell the property at a public auction. Non-judicial foreclosure is typically faster and less expensive than the judicial process. 2. Judicial Foreclosure: In contrast to non-judicial foreclosure, this type requires court action. The lender files a lawsuit against the borrower, seeking permission from the court to foreclose on the property. A judicial sale is then conducted, usually overseen by a sheriff or court-appointed officer. This method is typically used when the mortgage agreement lacks a power of sale clause or if the lender prefers judicial oversight. 3. Strict Foreclosure: This type of foreclosure is less common and occurs when the lender legally obtains the property without a public auction. Instead, the lender files a lawsuit against the borrower, stating that the borrower has defaulted on the loan. If the court rules in favor of the lender, ownership of the property is transferred directly to the lender. 4. Deed-in-Lieu of Foreclosure: Although not technically a type of substitute trustee deed foreclosure, it is worth mentioning. This option occurs when a borrower, facing imminent foreclosure, voluntarily transfers the property title to the lender. Unlike other foreclosures, this method allows the borrower to avoid public auction, potentially minimizing credit damage. Substitute Trustee Deed Foreclosure is an important legal process that ensures the lender's rights are protected in cases of borrower default. The type of foreclosure method used depends on state laws, the terms outlined in the loan agreement, and the preferences of the lender.

Substitute Trustee Deed Foreclosure

Description

How to fill out Substitute Trustee Deed Foreclosure?

Handling legal papers and operations can be a time-consuming addition to your day. Substitute Trustee Deed Foreclosure and forms like it usually require you to search for them and navigate the best way to complete them effectively. Consequently, whether you are taking care of economic, legal, or individual matters, having a comprehensive and practical online library of forms close at hand will go a long way.

US Legal Forms is the top online platform of legal templates, offering more than 85,000 state-specific forms and a variety of resources that will help you complete your papers easily. Discover the library of appropriate papers open to you with just one click.

US Legal Forms offers you state- and county-specific forms offered at any time for downloading. Protect your document managing operations using a high quality service that allows you to prepare any form within a few minutes without additional or hidden charges. Just log in in your account, find Substitute Trustee Deed Foreclosure and acquire it right away in the My Forms tab. You can also access formerly downloaded forms.

Would it be the first time utilizing US Legal Forms? Sign up and set up your account in a few minutes and you’ll have access to the form library and Substitute Trustee Deed Foreclosure. Then, adhere to the steps listed below to complete your form:

- Make sure you have discovered the right form using the Preview feature and reading the form description.

- Pick Buy Now when all set, and select the monthly subscription plan that is right for you.

- Press Download then complete, sign, and print out the form.

US Legal Forms has 25 years of experience assisting users control their legal papers. Obtain the form you require today and improve any process without having to break a sweat.

Form popularity

FAQ

Substitute Trustee. The person or persons appointed by the current mortgagee or mortgage servicer to exercise the power of sale in lieu of the original trustee designated in the deed of trust.

In non-judicial foreclosures, the trustee or a substitute trustee will be the one to conduct the sale. These auctions can sometimes be referred to as a "trustee sale" or "substitute trustee" sale.

In a nutshell, the Substitution of Trustee and Deed of Reconveyance is a legal document that evidences security interest is being release by a lender. In most cases, the document shows that a loan has been paid off. Property owners may even receive this document if they have refinanced a loan.

A trust deed is a legal agreement between you and your creditors to pay back part of what you owe over a set period. This is usually four years, but may vary.

In a nutshell, the Substitution of Trustee and Deed of Reconveyance is a legal document that evidences security interest is being release by a lender. In most cases, the document shows that a loan has been paid off. Property owners may even receive this document if they have refinanced a loan.