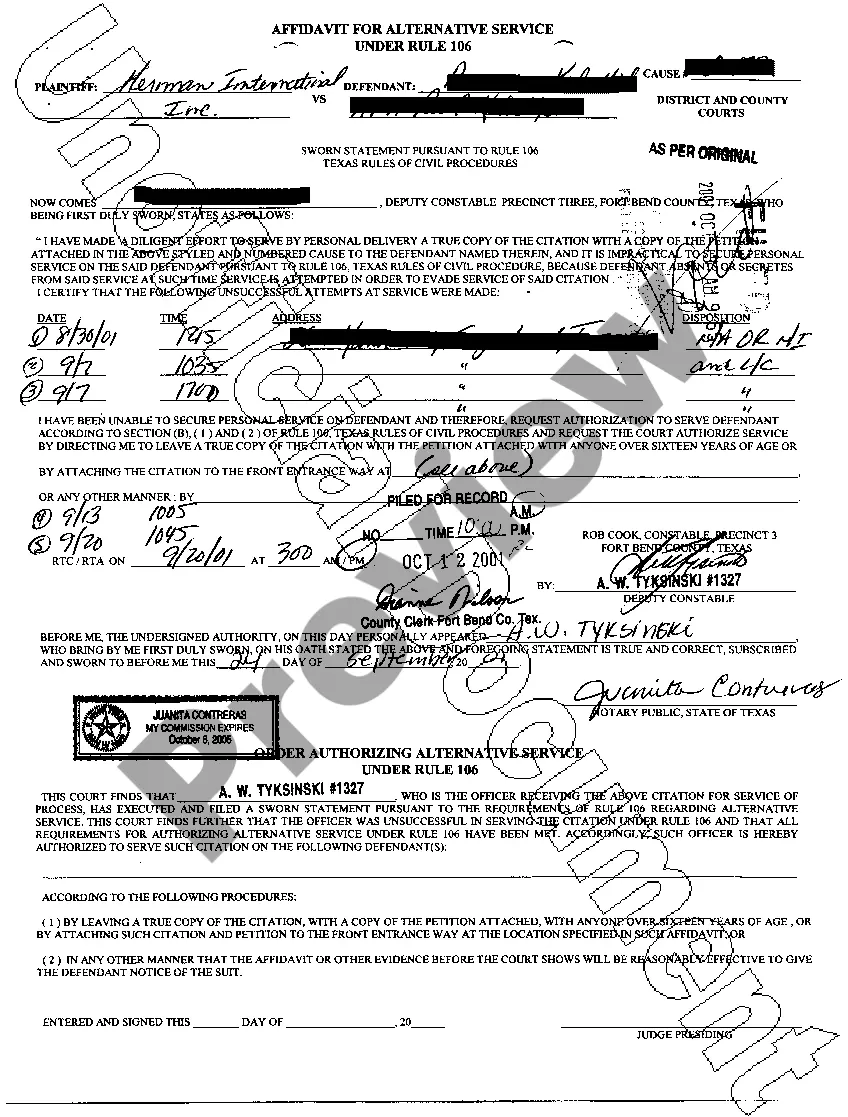

Motion For Rule 106 Texas

Description

How to fill out Motion For Rule 106 Texas?

Getting a go-to place to take the most current and appropriate legal templates is half the struggle of handling bureaucracy. Discovering the right legal files calls for accuracy and attention to detail, which is the reason it is vital to take samples of Motion For Rule 106 Texas only from reputable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You can access and see all the details concerning the document’s use and relevance for the circumstances and in your state or region.

Consider the listed steps to finish your Motion For Rule 106 Texas:

- Use the library navigation or search field to find your template.

- View the form’s information to ascertain if it matches the requirements of your state and county.

- View the form preview, if there is one, to make sure the template is definitely the one you are searching for.

- Resume the search and find the proper template if the Motion For Rule 106 Texas does not match your needs.

- If you are positive regarding the form’s relevance, download it.

- When you are an authorized user, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Select the pricing plan that fits your needs.

- Go on to the registration to finalize your purchase.

- Complete your purchase by picking a transaction method (bank card or PayPal).

- Select the document format for downloading Motion For Rule 106 Texas.

- Once you have the form on your device, you may change it using the editor or print it and complete it manually.

Get rid of the inconvenience that comes with your legal paperwork. Explore the extensive US Legal Forms collection where you can find legal templates, check their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Kentucky Franchise Tax The tax is calculated using the lesser of $0.095/$100 of Kentucky gross receipts or $0.75/$100 of Kentucky gross profits. Regardless of which calculation method is used, business owners are required to pay a minimum Kentucky LLET of $175.

Kentucky Form 20A100 "Declaration of Representative" is used for this purpose. IRS Form 2848, "Power of Attorney and Declaration of Representative", is also acceptable for income tax purposes. under the authority of the Finance and Administration Cabinet.

To make payments, the FEIN is required along with the Kentucky Corporate/LLET 6-digit account number.

KY Withholding Account Number Register online with the KY Dept of Revenue to receive a Withholding Account Number. Registration may also be completed via the Kentucky Registration Application (10A100).

Purpose of Form 20A100. Use the Declaration of Representative (Form 20A100) to authorize the individual(s) to represent you before the Kentucky Department of Revenue. You may grant the individual(s) authorization to act on your behalf with regard to any tax administered by the Kentucky Department of Revenue.

A Limited Liability Entity Tax (LLET) applies to both C corporations and Limited Liability Pass-Through Entities (LLPTEs) and is not an alternative to another tax. However, corporations paying the LLET are allowed to apply that amount as a credit towards its regular corporate income tax.

The State Records Center stores court records 15-35 years old. Submit this records request form to state.records@ky.gov or call 502-564-3617. The case and locator numbers must be provided as these records cannot be searched only by name and/or Social Security number.

To obtain your valid Kentucky Corporation/LLET account number, please contact the Department of Revenue at (502) 564-3306. To submit payment online, visit .