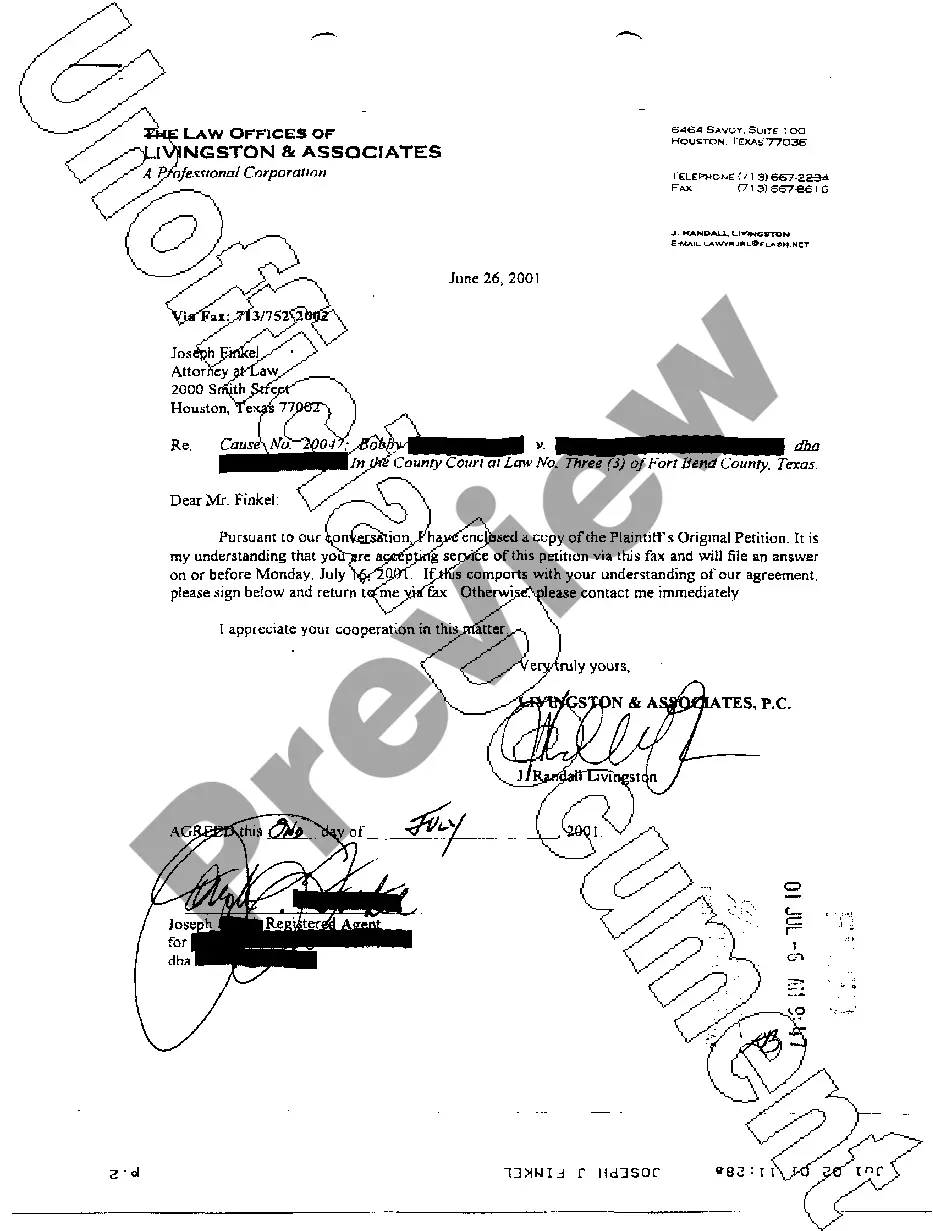

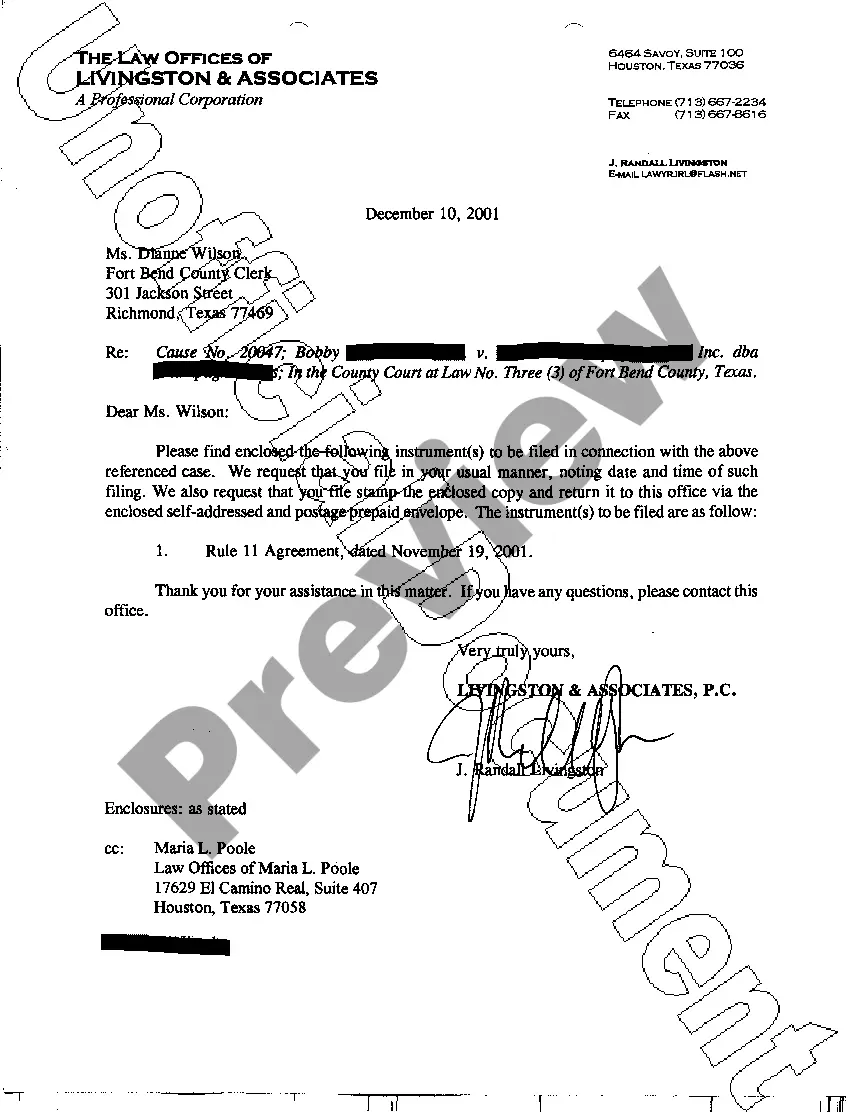

306a Letter Divorce For Husband

Description

How to fill out Texas Rule 11 Letter?

Acquiring legal document samples that adhere to federal and state directives is essential, and the internet presents countless choices available.

However, what is the benefit of spending time searching for the suitable 306a Letter Divorce For Husband example online when the US Legal Forms online repository already has such templates gathered in one location.

US Legal Forms is the largest online legal directory with over 85,000 editable templates created by attorneys for various professional and personal situations. They are straightforward to navigate with all documents categorized by state and intended use. Our experts stay updated with legislative modifications, ensuring that your paperwork is consistently current and compliant when obtaining a 306a Letter Divorce For Husband from our site.

Click Buy Now once you have identified the correct form and choose a subscription plan. Register for an account or Log In and process the payment using PayPal or a credit card. Choose the most suitable format for your 306a Letter Divorce For Husband and download it. All templates you discover through US Legal Forms are reusable. To re-download and complete previously acquired forms, access the My documents tab in your account. Enjoy the most comprehensive and user-friendly legal document service!

- Acquiring a 306a Letter Divorce For Husband is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you require in the appropriate format.

- If you are new to our platform, follow the steps outlined below.

- Examine the template using the Preview feature or through the text description to confirm it aligns with your requirements.

- Find another sample using the search tool at the top of the page if necessary.

Form popularity

FAQ

You can get an EIN immediately by applying online. International applicants must call 267-941-1099 (Not a toll-free number). If you prefer, you can fax a completed Form SS-4 to the service center for your state, and they will respond with a return fax in about one week.

Applying for an EIN for your California LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.

How much does it cost to get an EIN? Applying for an EIN for your California LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day.

Once payment processing for an EIN is completed, you will not need to pay for it again. An EIN will remain with the business entity in perpetuity unless the business changes entity types, or the business declares bankruptcy.

You can get your EIN by: visiting the IRS at Apply for an Employer Identification Number (EIN) Online, or. calling the IRS at 1 800 829-4933, or. sending the IRS federal form SS-4, Application for Employer Identification Number.

Applying for an EIN is a free service offered by the Internal Revenue Service. Businesses can apply for an EIN by phone, fax, mail, or online.

Applying for an Employer Identification Number (EIN) is a free service offered by the Internal Revenue Service. Beware of websites on the Internet that charge for this free service.