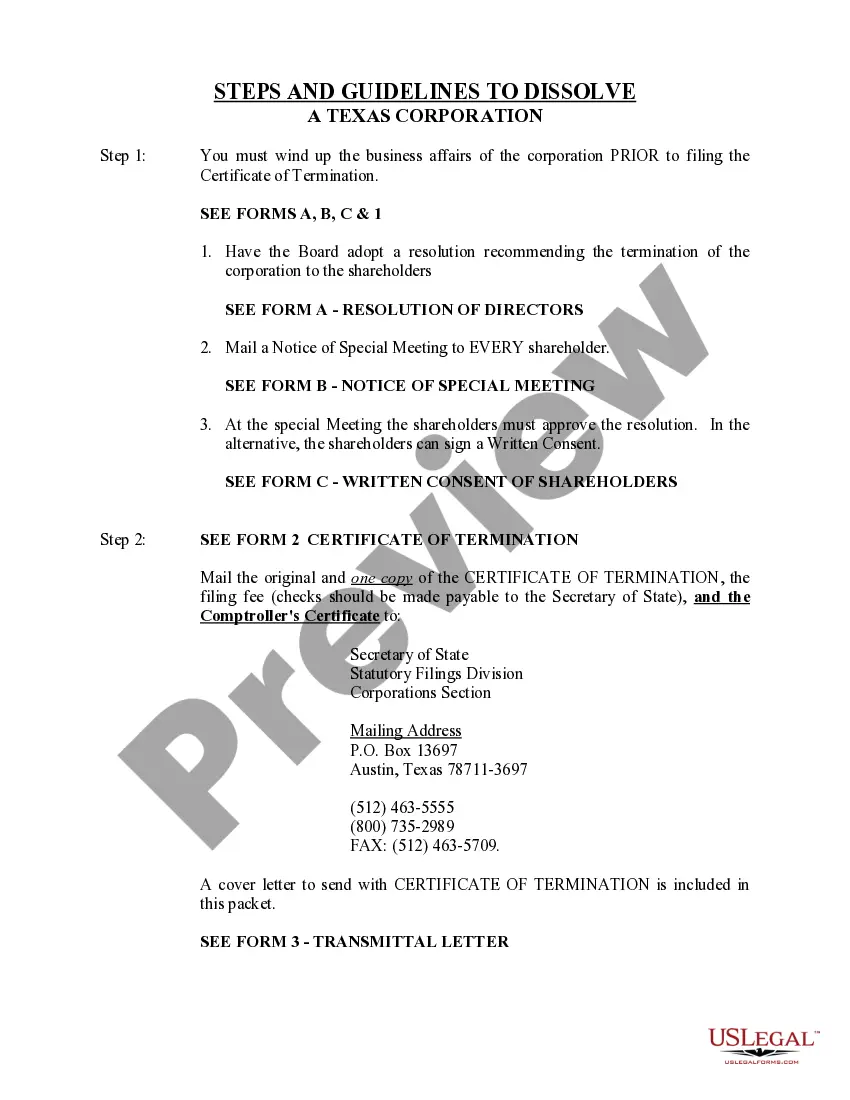

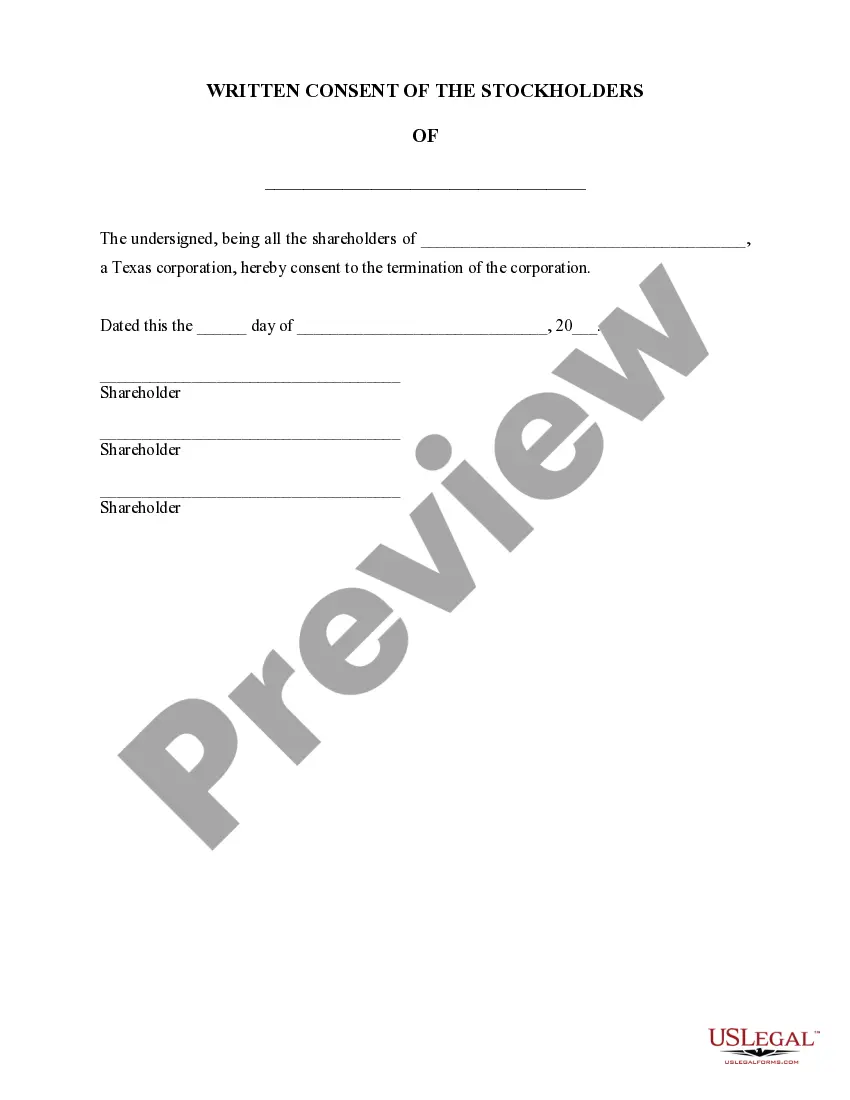

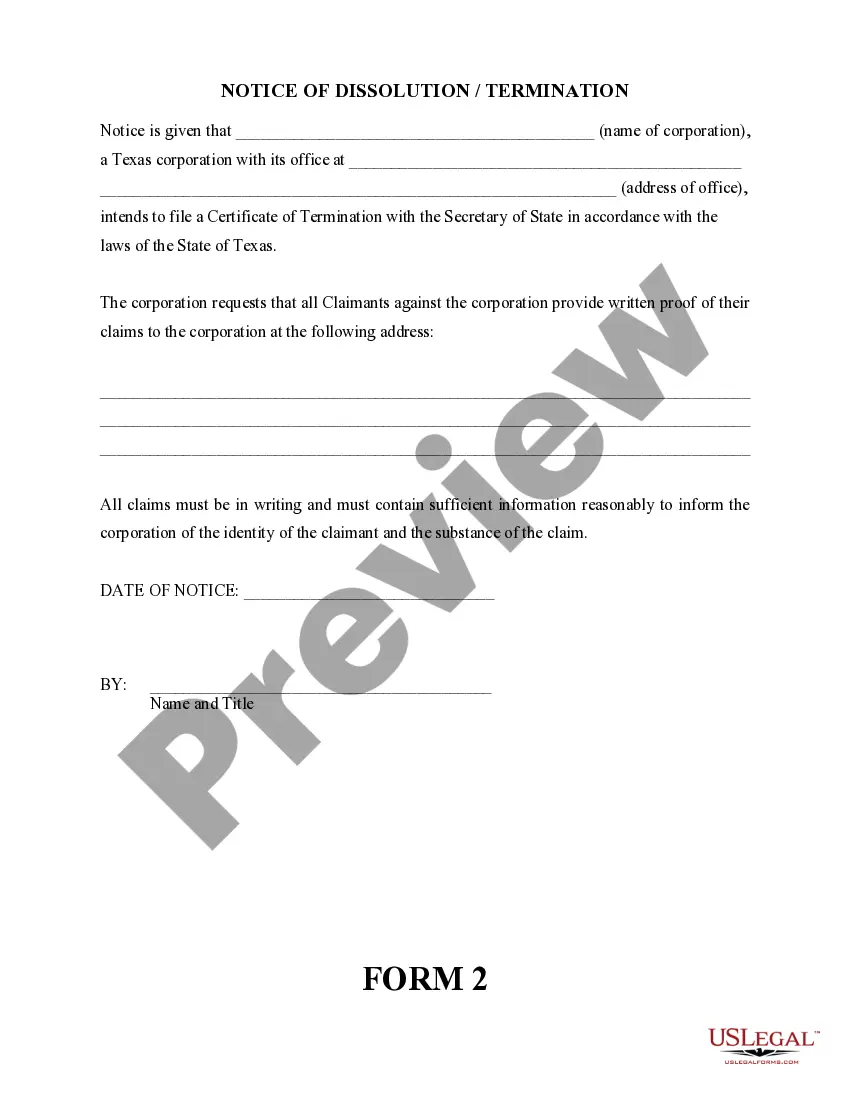

The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

Texas Dissolution Of Corporation

Description

How to fill out Texas Dissolution Package To Dissolve Corporation?

It’s no secret that you can’t become a law professional immediately, nor can you learn how to quickly prepare Texas Dissolution Of Corporation without the need of a specialized set of skills. Putting together legal documents is a time-consuming venture requiring a specific education and skills. So why not leave the creation of the Texas Dissolution Of Corporation to the specialists?

With US Legal Forms, one of the most comprehensive legal document libraries, you can access anything from court documents to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and local laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our platform and get the form you need in mere minutes:

- Find the document you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Texas Dissolution Of Corporation is what you’re looking for.

- Start your search over if you need any other form.

- Register for a free account and select a subscription option to purchase the template.

- Choose Buy now. As soon as the transaction is through, you can download the Texas Dissolution Of Corporation, fill it out, print it, and send or mail it to the designated individuals or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your documents-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

First, you need to be sure to include the legal name of your company. Second, your articles of dissolution should state the date when your company will be dissolved. Finally, there should be a statement that your corporation's board of directors or your LLC's members approved the dissolution.

You can notify the Comptroller's office that you are closing your account by entering the information on the Close Business Location webpage and selecting ?Close all outlets for this taxpayer number.?

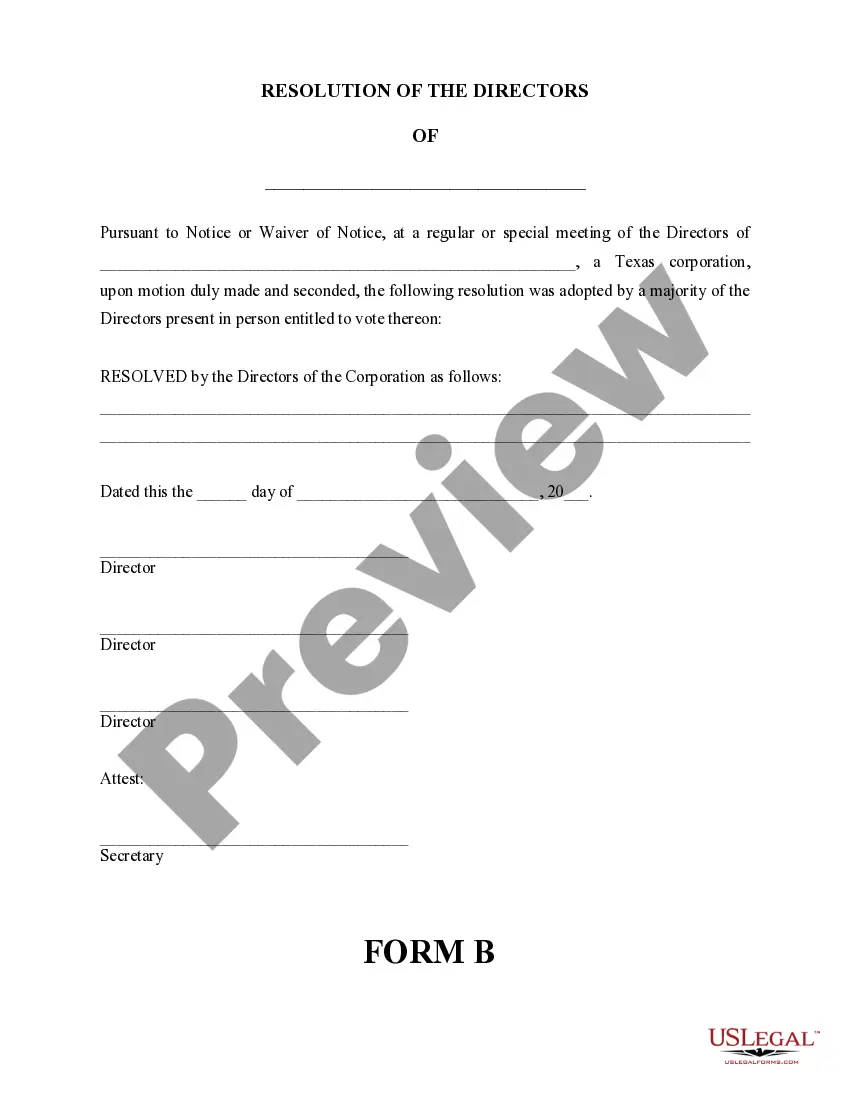

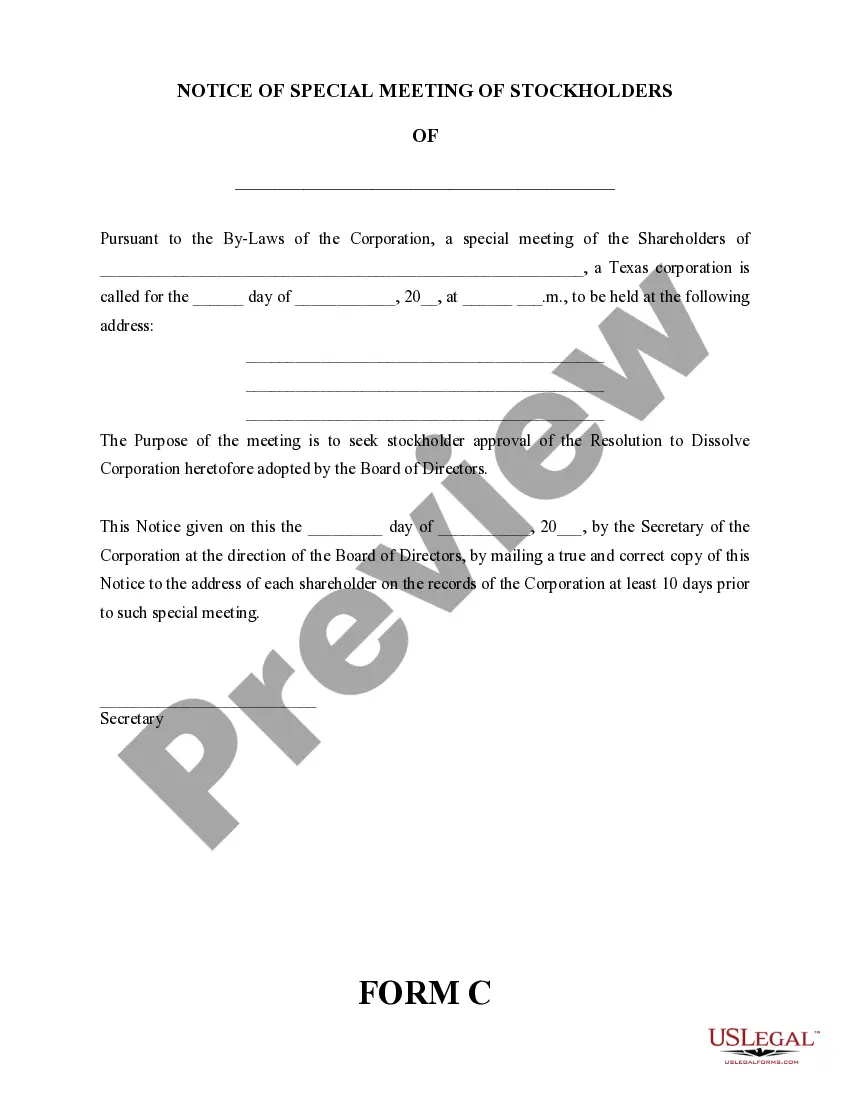

Usually this involves a vote by the board of directors and another by the shareholders, but more or less may be required depending on the local laws and the articles of incorporation. Second, one must satisfy the required filings and fees for the federal and state governments in which the business is registered.

You can notify the Comptroller's office that you are closing your account by entering the information on the Close Business Location webpage and selecting ?Close all outlets for this taxpayer number.?

If you're shutting your business down completely, you must file Articles of Dissolution to terminate your company's existence. If you discontinue business in a state where you had foreign qualified, you must file Articles of Withdrawal to avoid fines, penalties, and a potential loss of liability protection.