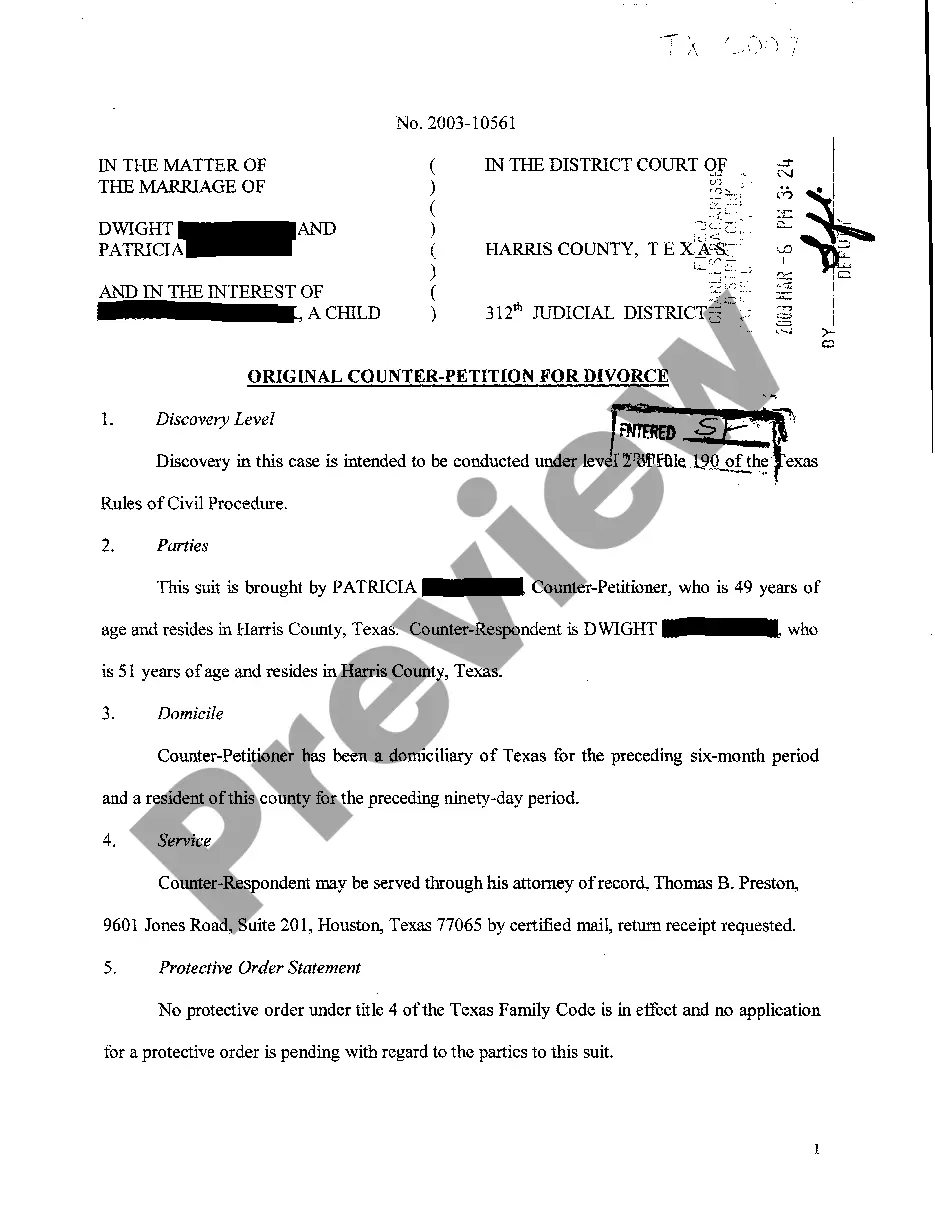

Counter Petition Sapcr Texas Without Modification

Description

How to fill out Texas Counter Petition?

It’s widely known that you cannot instantly become a legal expert, nor can you readily understand how to swiftly prepare a Counter Petition Sapcr Texas Without Modification without possessing a specialized background.

Drafting legal documents is a lengthy process that necessitates specific education and expertise. So, why not entrust the drafting of the Counter Petition Sapcr Texas Without Modification to the professionals.

With US Legal Forms, one of the most extensive legal document repositories, you can access everything from courtroom documents to templates for internal business communication.

Commence your search again if you require a different form.

Register for a free account and select a subscription plan to purchase the template.

- We recognize how essential compliance and adherence to federal and state laws and regulations are.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how to get started with our service and acquire the form you need in just minutes.

- Locate the form you need using the search bar at the top of the page.

- Preview it (if this option is provided) and review the accompanying description to determine if Counter Petition Sapcr Texas Without Modification is what you need.

Form popularity

FAQ

Do you need to notarize a Loan Agreement? First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

A loan agreement is a written agreement between a lender that lends money to a borrower in exchange for repayment plus interest. The borrower will be required to pay back the loan in ance with a payment schedule (unless there is a balloon payment).

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

The IRS mandates that any loan between family members be made with a signed written agreement, a fixed repayment schedule, and a minimum interest rate.

How to Draft a Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

Do you need to notarize a Loan Agreement? First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

Depending on the loan, a promissory note, deed of trust, security agreement, agreement to provide insurance, and UCC financing statement may be generated during the loan process. Many banks and credit unions utilize document preparation software to generate these types of documents.