General Denial Example For Credit Card

Description

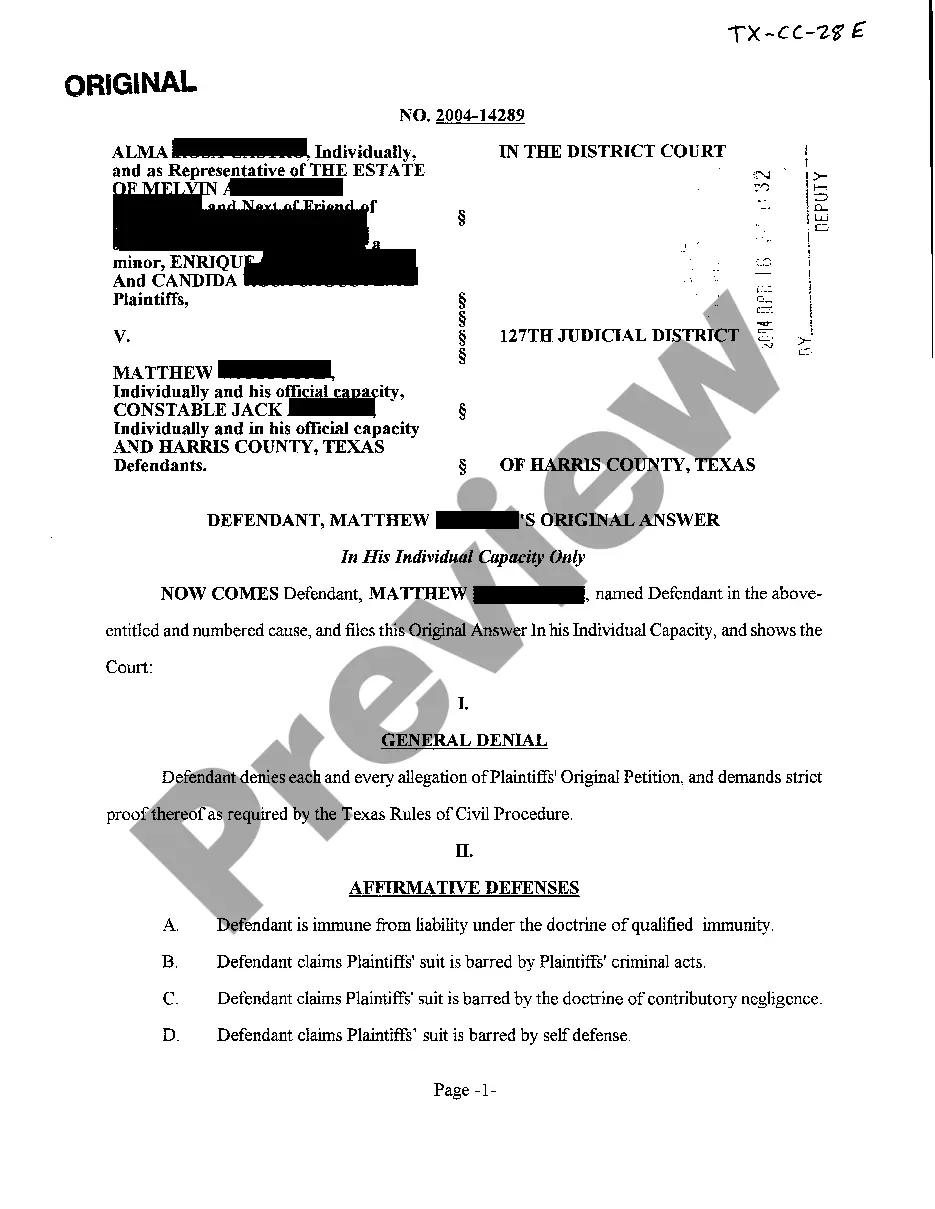

How to fill out Texas General Denial And Affirmative Defenses?

What is the most reliable service to obtain the General Denial Example For Credit Card and other updated versions of legal documents? US Legal Forms is the solution!

It's the largest collection of legal templates for any application. Each form is expertly crafted and validated for adherence to federal and local standards. They are organized by region and state of application, making it easy to find what you require.

US Legal Forms is a fantastic option for anyone needing to handle legal documents. Premium users have additional benefits as they can fill out and sign previously saved files electronically at any time using the integrated PDF editing tool. Give it a try today!

- Experienced users of the platform only need to Log In to the site, confirm if their subscription is active, and click the Download button next to the General Denial Example For Credit Card to acquire it.

- Once saved, the template remains accessible for future use in the My documents section of your account.

- If you do not yet have an account with our library, here are the steps you must follow to create one.

- Form compliance review. Before purchasing any template, you must verify if it meets your usage criteria and complies with your state or county laws. Read the form description and utilize the Preview if available.

Form popularity

FAQ

Reversing a credit card denial involves understanding the reason for the denial. Use the general denial example for credit card as a guide to ensure you provide the correct information and documentation. If the issue was due to insufficient credit history or outstanding debts, consider paying down balances or improving your credit score before reapplying. Additionally, you can use platforms like uslegalforms to access resources that help you navigate the appeal process smoothly.

To challenge a credit card denial, start by reviewing the denial notice carefully. Identify the reason provided for the general denial example for credit card, as this will help you address the issue directly. Collect any necessary documentation, such as payment history or income verification, that supports your case. Once you have your information ready, contact the credit card company to discuss your denial and present your evidence.

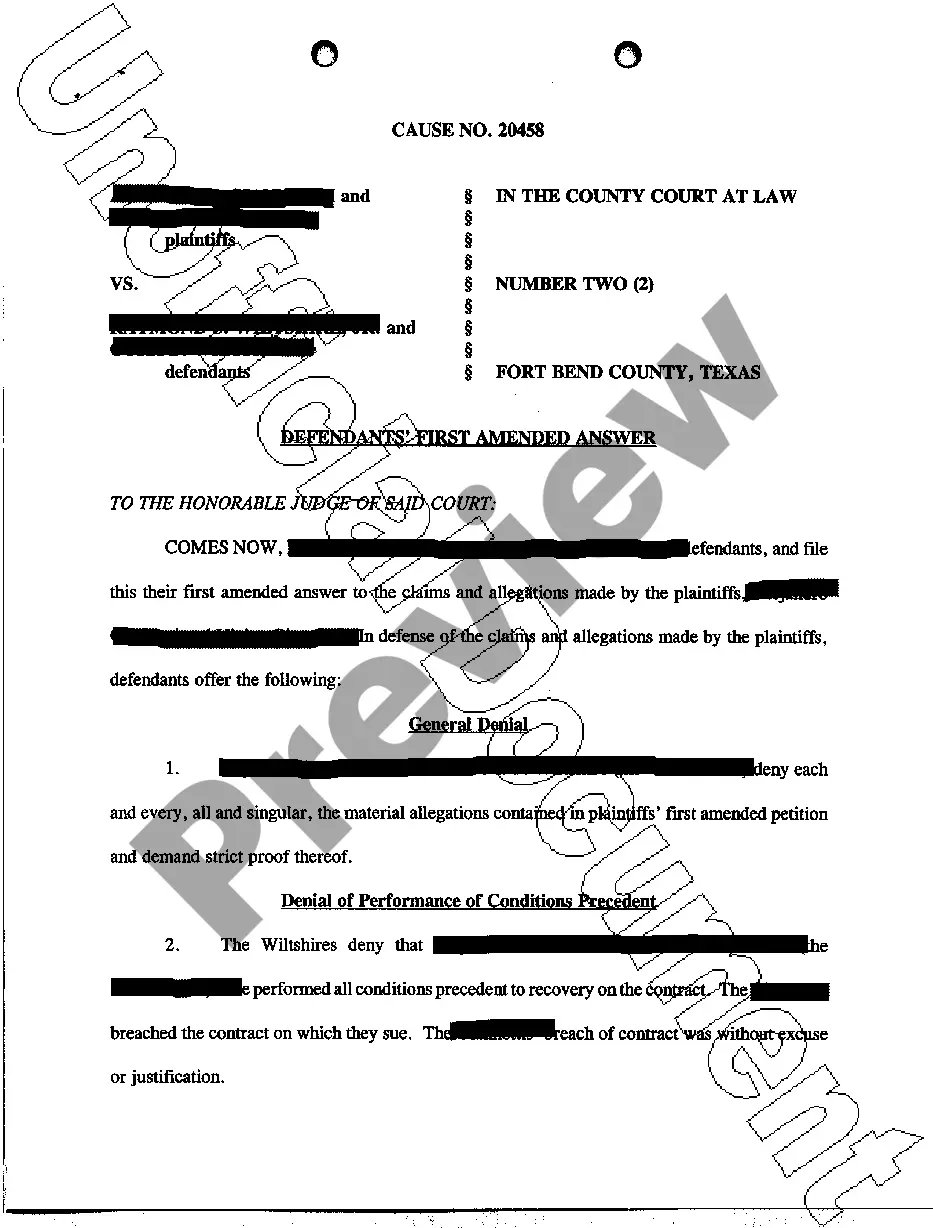

Responding to a lawsuit without an attorney in Texas requires careful attention to detail. You should file a written answer that addresses the allegations, possibly using a general denial example for credit card cases. Be sure to submit your response by the deadline specified in the lawsuit notice to avoid default. Tools available on US Legal Forms can help simplify the process, providing templates and guidance.

To get a debt lawsuit dismissed in Texas, you can file a motion to dismiss with the court. Outline your reasons clearly, which might include lack of evidence by the creditor. You can use a general denial example for credit card claims to support your motion. Utilizing platforms like US Legal Forms can aid you in drafting your motion effectively.

To respond to a debt collection lawsuit in Texas, you need to prepare an official document, such as an answer. Incorporate defenses relevant to your case, including a general denial example for credit card claims if applicable. Filing this document on time is vital to avoid negative consequences. Consider consulting resources like US Legal Forms to ensure your answer is properly formatted.

If a creditor sues you in Texas, they will file a lawsuit in the appropriate court. You will receive a notice about the lawsuit, which you must respond to within a specific timeframe. Ignoring it may result in a default judgment against you. A proactive response, perhaps utilizing a general denial example for credit card debt, is crucial to protect your rights.

To dispute credit collections, start by gathering all related documentation. Ensure you have a clear idea of the debt you are disputing, and identify inaccuracies. You may send a written dispute to the collection agency, referencing a general denial example for credit card charges. Be sure to also check with credit bureaus to challenge any incorrect entries.