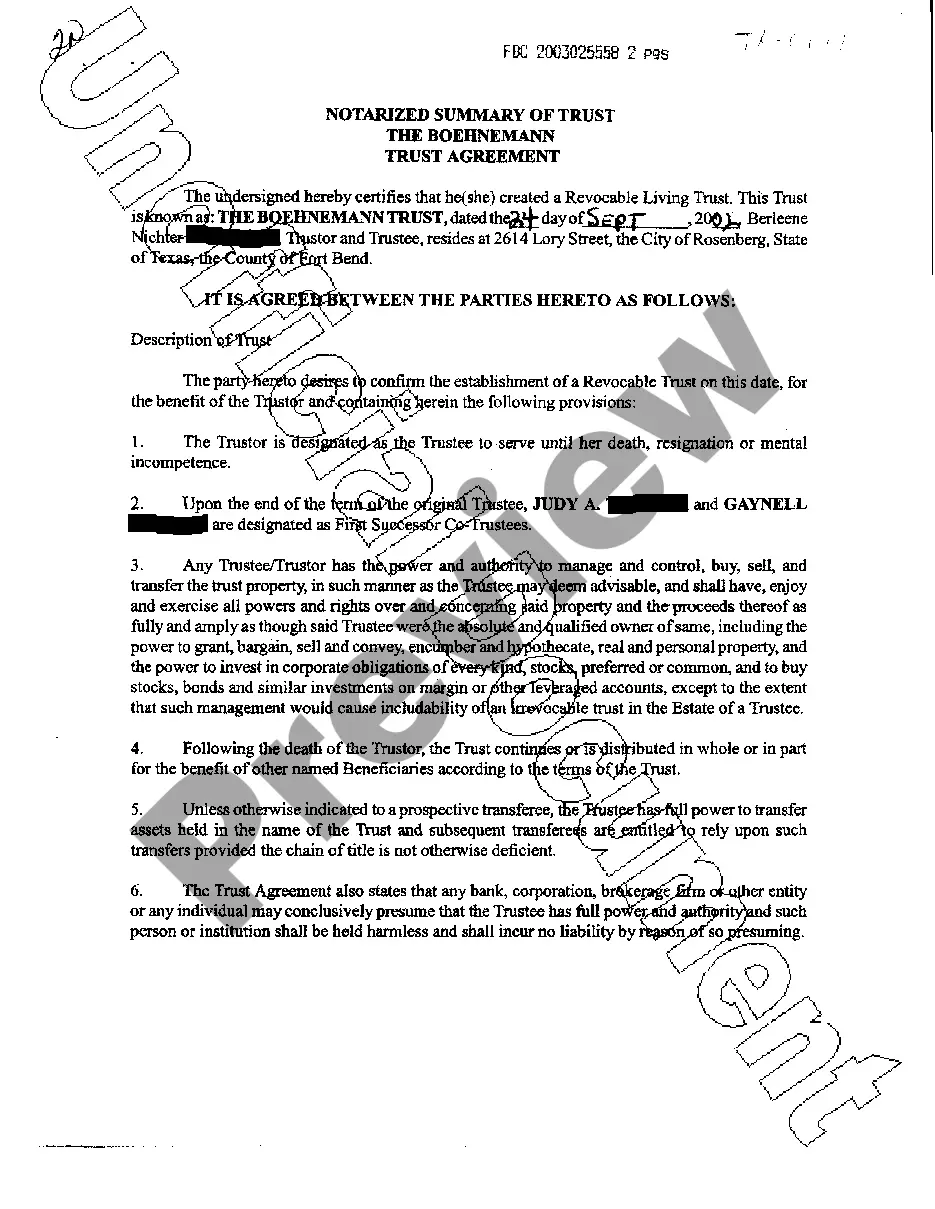

Texas Trust Agreement With Us

Description

How to fill out Texas Trust Agreement?

There's no longer any need to spend countless hours searching for legal documents to fulfill your local state obligations.

US Legal Forms has gathered all of them in one location and simplified their accessibility.

Our website provides over 85,000 templates for various business and individual legal matters categorized by state and area of application.

Use the search field above to find another sample if the current one does not suit your needs.

- All forms are expertly created and verified for accuracy, allowing you to feel confident in obtaining a current Texas Trust Agreement with us.

- If you are acquainted with our platform and already possess an account, you must ensure your subscription remains valid before accessing any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all saved documents whenever necessary by opening the My documents tab in your profile.

- If you have never used our platform before, the procedure will involve a few additional steps to finish.

- Here’s how new users can find the Texas Trust Agreement with us in our library.

- Read the page content thoroughly to ensure it includes the sample you require.

- To do so, utilize the form description and preview options if available.

Form popularity

FAQ

To make a living trust in Texas, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

A trust is not a legal entity in Texas. It is a relationship whereby a trustee acts as the agent for two classes of beneficiaries, income beneficiaries and remainder beneficiaries.

In Texas a trust is not a legal entity. Rather, it is a legal relationship in which a trustee holds legal title for the benefit of another person called the beneficiary. Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust.

Wills and probate proceedings are public, which means anyone can view the details of your assets and beneficiaries. Trusts are not on the public record, which means no one will have access to those personal details.

If you would like to create a living trust in Texas you will need to sign a written trust document before a notary public. The trust is not effective until you transfer ownership of assets to it. A living trust offers options that may be beneficial to you as you plan for the future.