One Page Grazing Agreement Form For Texas Withholding Tax

Description

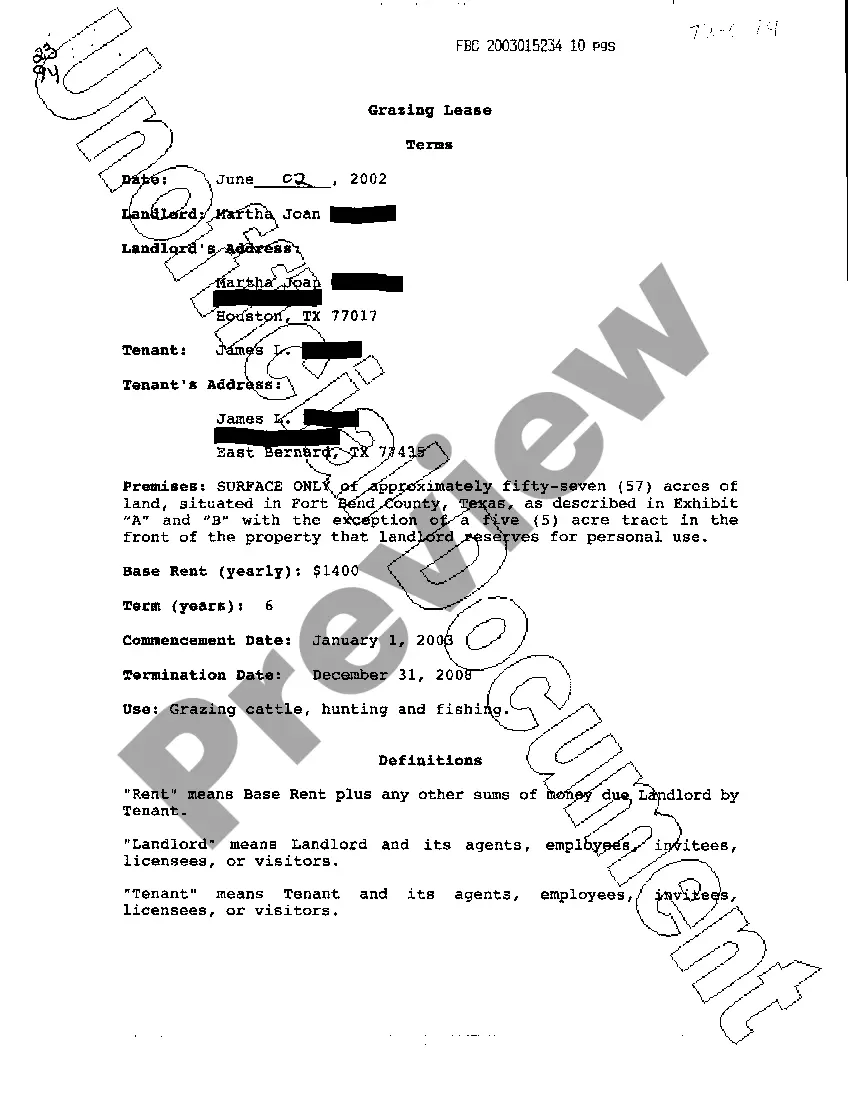

How to fill out Texas Grazing Lease?

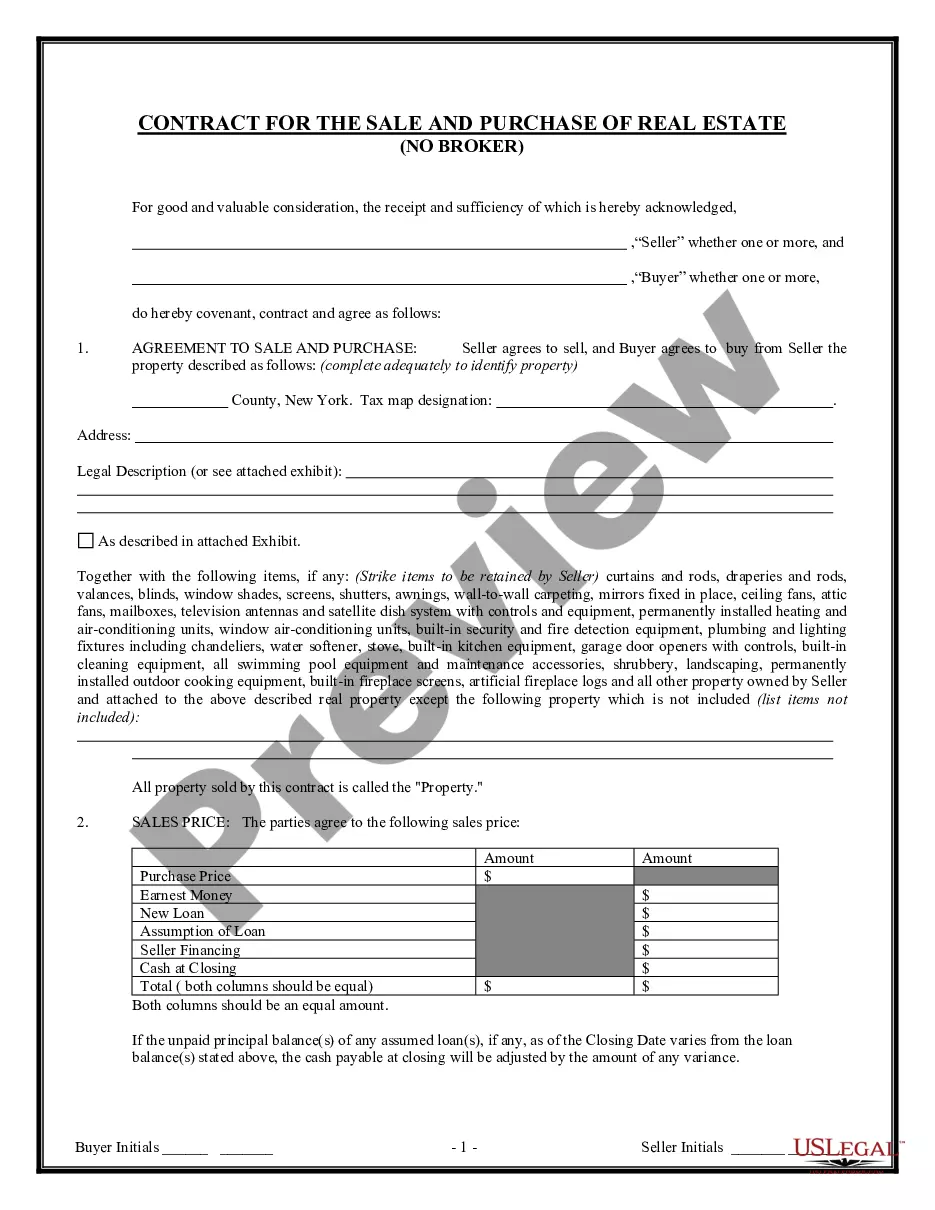

When you are required to fill out the One Page Grazing Agreement Form For Texas Withholding Tax that adheres to your regional state's laws and guidelines, there are several alternatives to consider.

There is no necessity to review every document to ensure it meets all the legal prerequisites if you are a subscriber of US Legal Forms.

It is a reliable source that can assist you in obtaining a reusable and current template on any subject.

Acquiring expertly designed formal documents is made effortless with US Legal Forms. Furthermore, Premium users can also utilize the comprehensive integrated solutions for online document editing and signing. Give it a try today!

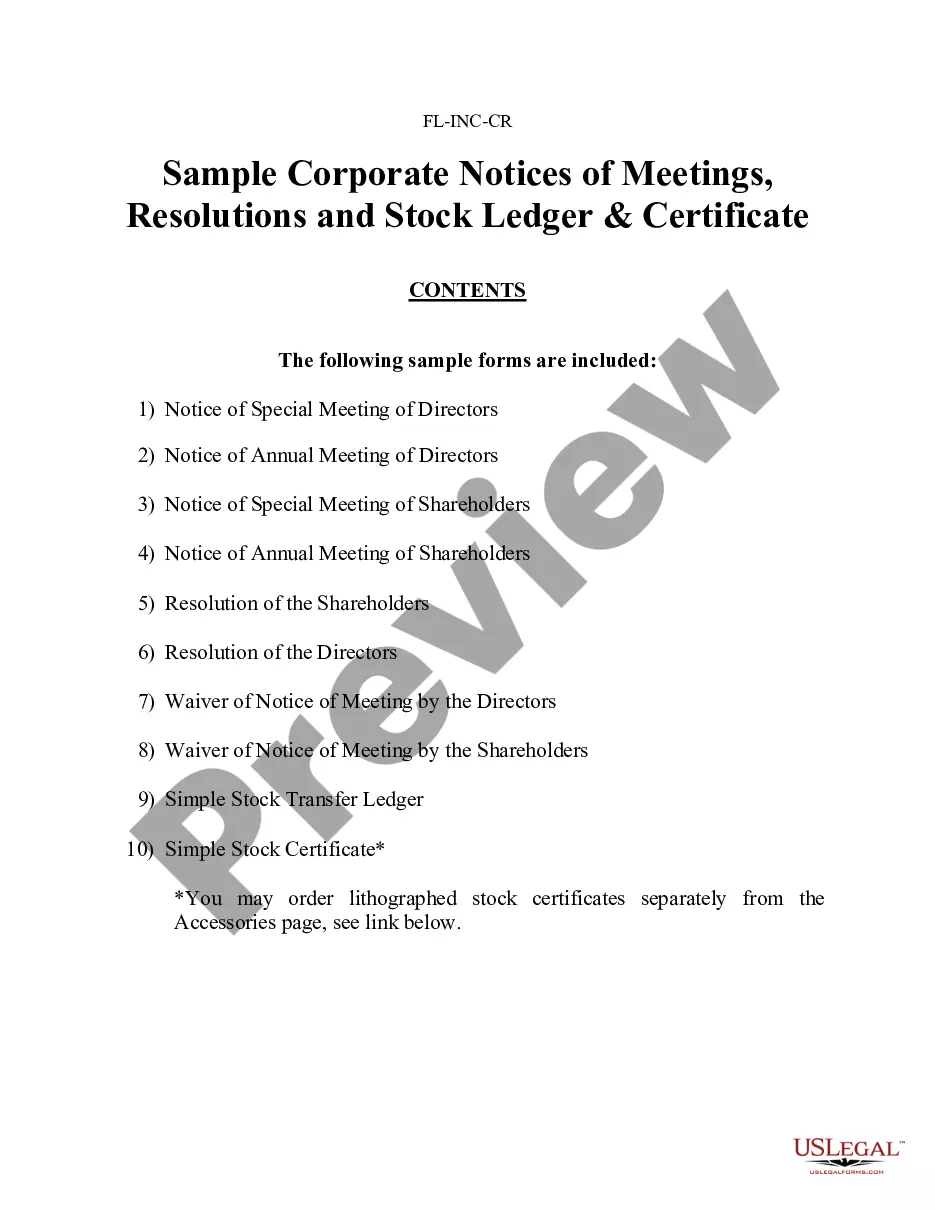

- US Legal Forms boasts the most extensive online database with a compilation of over 85k ready-to-use documents for both business and personal legal situations.

- All templates are verified to conform to each state's regulations.

- Thus, when acquiring the One Page Grazing Agreement Form For Texas Withholding Tax from our platform, you can be confident that you possess a legitimate and current document.

- Accessing the necessary sample from our site is remarkably straightforward.

- If you have an existing account, simply Log In to the system, confirm your subscription is active, and save the chosen file.

- Subsequently, you can navigate to the My documents tab in your profile and access the One Page Grazing Agreement Form For Texas Withholding Tax at any time.

- If this is your first encounter with our library, please follow the guide below.

- Browse the suggested page and assess it for alignment with your needs.

Form popularity

FAQ

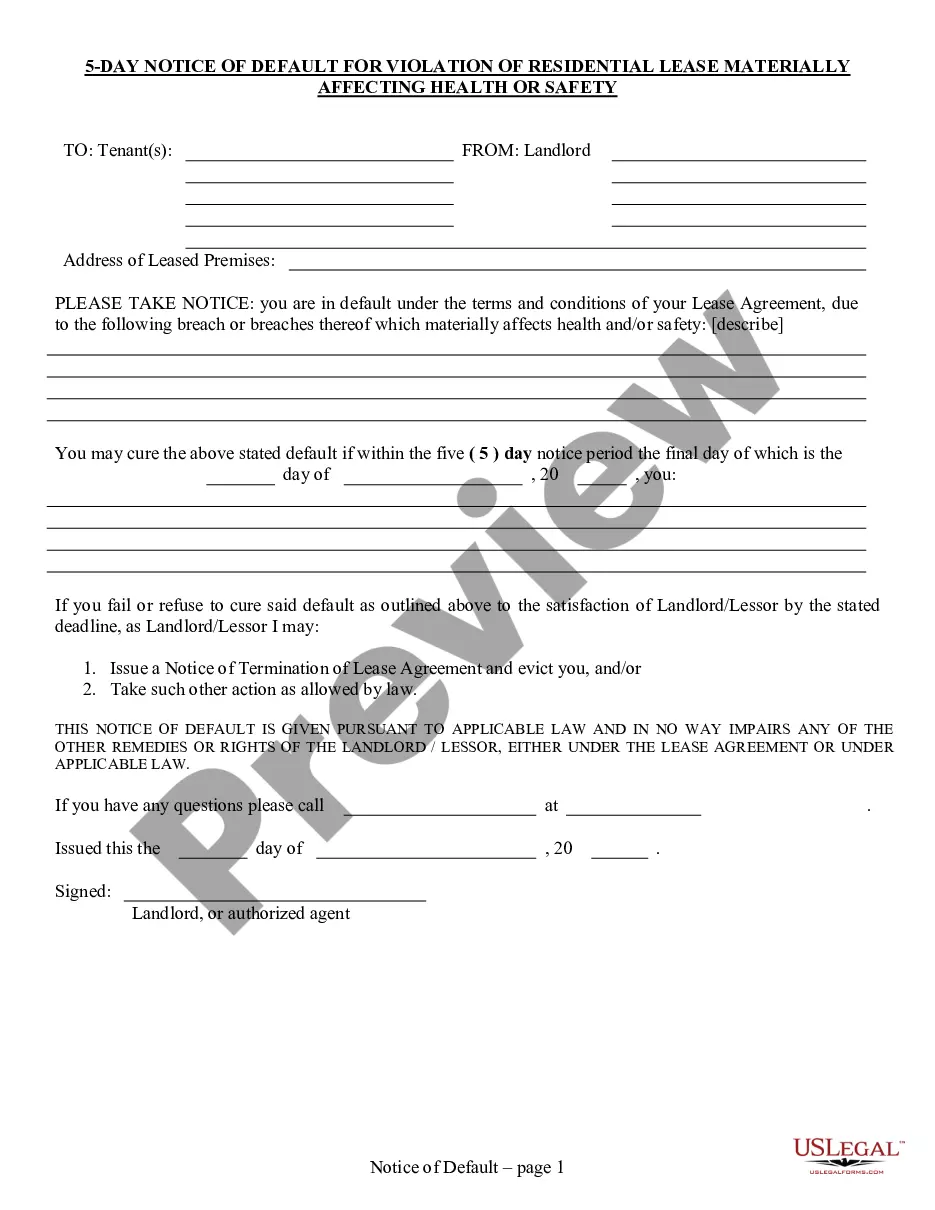

What is a Grazing Licence? A licence is simply a permission for a licensee/grazier to access the licensor's property to graze their animals or to take grass/crop from the property. The primary aim of a licence is to prevent such acts from being construed as trespass.

To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You must include the Ag/Timber Number on the agricultural exemption certificate (PDF) or the timber exemption certificate (PDF) when buying qualifying items.

Now, when you purchase a property that is under an ag valuation, you'll have to maintain that valuation. It doesn't automatically transfer for you. You have to apply for that valuation with the tax appraisal district.

For Texas, the average lease rates for 2020 are: Irrigated cropland: $95.00 (up $3.00 from 2019) Non-irrigated cropland: $30.00 (No change) Pastureland: $7.00 (up $0.20 from 2019)

A grazing agreement is a profit a prendre and gives the grazier the right to take grass from the land by grazing it with animals. A grazing licence will often be granted for the summer season (April to October), but can be granted for any period and at any time of year.