Trustee Deed Of Cross Guarantee

Description

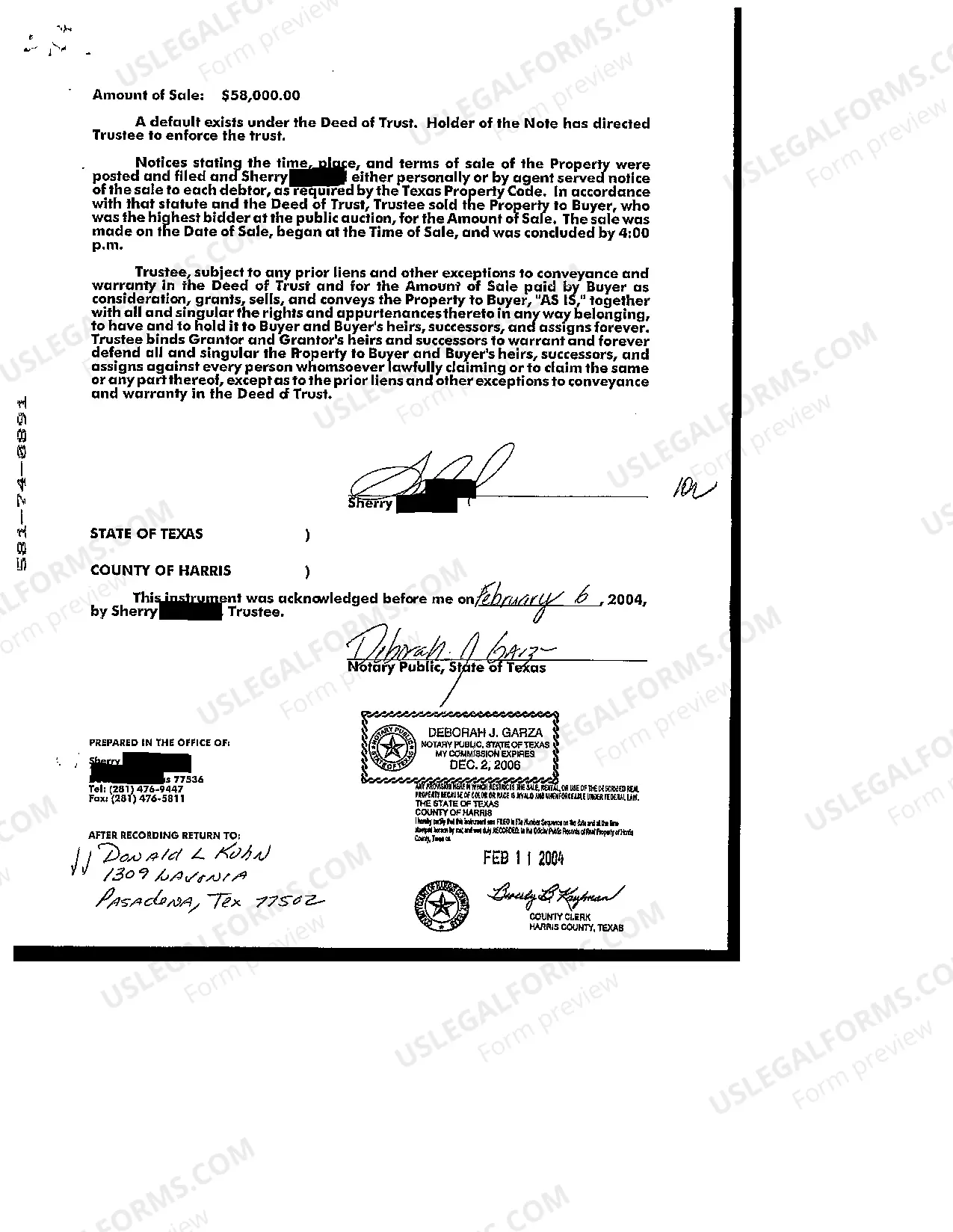

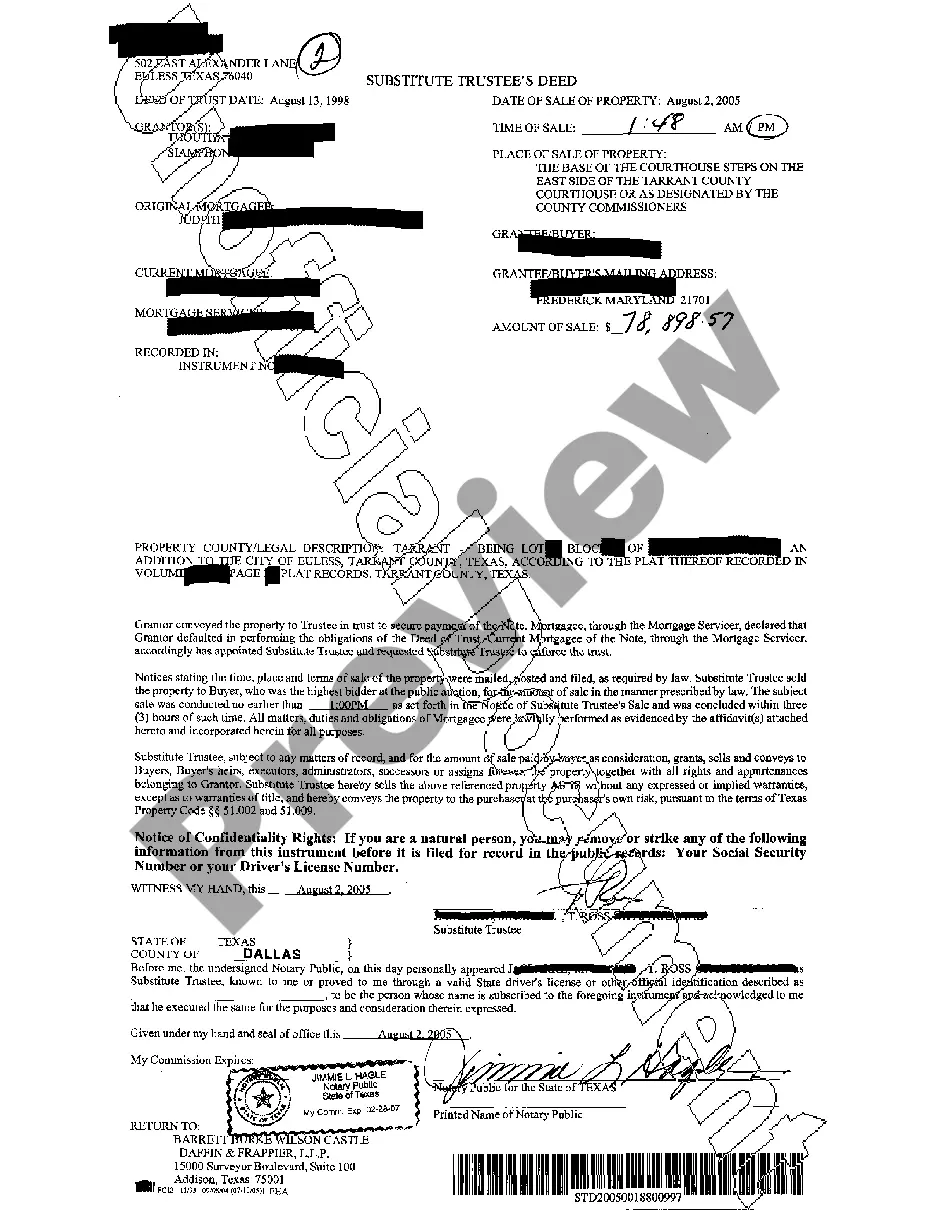

How to fill out Texas Trustee's Deed?

It’s clear that you cannot become a legal authority instantly, nor can you determine how to swiftly create a Trustee Deed Of Cross Guarantee without the necessity of a specialized skill set.

Assembling legal documents is a lengthy process requiring specific education and expertise.

So why not entrust the drafting of the Trustee Deed Of Cross Guarantee to the experts.

Preview it (if this option is available) and review the accompanying description to determine whether the Trustee Deed Of Cross Guarantee is what you need.

If you require a different template, begin your search anew. Create a free account and select a subscription plan to purchase the form. Click Buy now. Once the purchase is complete, you can access the Trustee Deed Of Cross Guarantee, fill it out, print it, and send or mail it to the designated individuals or organizations. You can revisit your forms from the My documents tab at any time. If you’re a returning customer, you can simply Log In and locate and download the template from the same tab. Regardless of the purpose of your documents—whether they are financial, legal, or personal—our website has you covered. Try US Legal Forms today!

- With US Legal Forms, one of the largest legal template repositories, you can discover everything from court documents to templates for internal communication.

- We understand how vital compliance with federal and local laws and regulations is.

- That’s why, on our platform, all templates are region-specific and current.

- Here’s how to start with our website and obtain the form you need in just minutes.

- Locate the form you require by utilizing the search feature at the top of the page.

Form popularity

FAQ

A deed of cross guarantee is a legal document that outlines how multiple parties guarantee each other's debts. It is often used in corporate finance and real estate transactions. By executing a trustee deed of cross guarantee, the parties involved agree to back each other's financial commitments, creating a unified front. This document plays a crucial role in facilitating smoother financial transactions and can help optimize business operations.

The purpose of a trustee deed of cross guarantee is to provide additional security for lenders. By linking the obligations of multiple entities, the deed ensures that if one party fails, others will fulfill the outstanding debts. This enhances the financial viability of businesses and projects, making it easier to secure funding. In essence, it creates a supportive network among the parties involved.

A trustee deed of cross guarantee involves multiple parties agreeing to secure each other's obligations. When one party defaults, the other parties can step in and cover the obligations. This arrangement reduces the risk for lenders, as they have a safety net. Essentially, through a deed of cross guarantee, all signatories share the responsibility, which strengthens financial security.

Yes, in many cases, a guarantee is legally required to be documented by a deed, particularly when it involves significant obligations. The trustee deed of cross guarantee serves as a formal agreement that outlines these obligations clearly. By using this deed, you create a binding commitment that enhances the enforceability of the guarantee. To ensure compliance and to effectively manage your legal risks, consider utilizing platforms like US Legal Forms to access templates for a trustee deed of cross guarantee.

The purpose of a deed of cross guarantee is to protect the financial interests of stakeholders by ensuring that obligations across multiple businesses are covered. This minimizes financial risk and fosters a cooperative relationship between the entities involved. By implementing a trustee deed of cross guarantee, organizations can enhance their borrowing power and offer greater security to investors.

A deed of cross guarantee allows one entity to guarantee the liabilities of another, creating a network of mutual support. This arrangement strengthens creditworthiness and increases trust among lenders. It serves as a vital tool in reducing risks associated with lending, making the trustee deed of cross guarantee an essential element for companies seeking financial stability.

The three main types of guarantees include personal guarantees, bank guarantees, and corporate guarantees. Personal guarantees are made by individuals, while bank guarantees involve a lender ensuring payment. Corporate guarantees are issued by businesses to back the obligations of their subsidiaries. Each of these can be enhanced by a trustee deed of cross guarantee, providing additional assurance to creditors.

The deed of guarantee serves as a formal promise made by one party to take responsibility for another's debt. This legal document ensures that if the primary borrower defaults, the guarantor will step in to fulfill the obligation. A well-structured trustee deed of cross guarantee can enhance the credibility of the involved parties, making financial transactions more secure.

A cross guarantee provides security for lenders across multiple entities. By ensuring that one entity guarantees the debts of another, it creates a safety net that reduces risk for creditors. This can facilitate smoother financing options for businesses navigating complex transactions. Thus, understanding the trustee deed of cross guarantee is vital for entities looking to strengthen their financial standing.