Child Support Lien Priority In Texas

Description

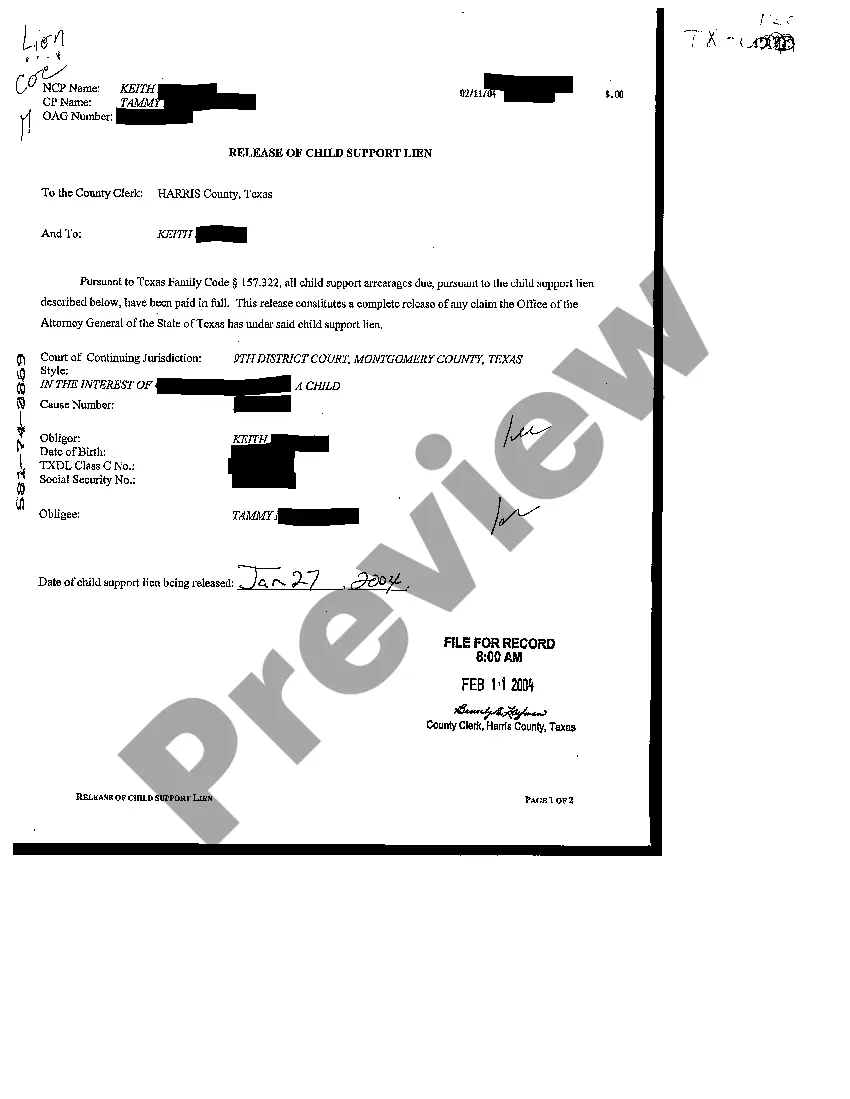

How to fill out Texas Release Of Child Support Lien?

The Child Support Lien Priority in Texas showcased on this webpage is a reusable official template created by experienced attorneys in adherence to federal and state laws and guidelines.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal professionals with more than 85,000 validated, state-specific documents for any business or personal event. It is the fastest, simplest, and most dependable method to acquire the forms you require, as the service assures bank-grade data protection and anti-malware safeguards.

Consider subscribing to US Legal Forms to have authentic legal templates for every situation in life at your fingertips.

- Search for the document you require and verify it.

- Browse through the template you looked for and preview it or read the form description to confirm it meets your requirements. If it doesn’t, utilize the search bar to find the suitable one. Press Buy Now once you discover the template you need.

- Register and Log In.

- Select the pricing plan that fits you and set up an account. Utilize PayPal or a credit card for a quick transaction. If you already possess an account, Log In and review your subscription to proceed.

- Receive the editable template.

- Pick the format you desire for your Child Support Lien Priority in Texas (PDF, DOCX, RTF) and download the sample to your device.

- Complete and sign the documents.

- Print the template to fill it out by hand. Alternatively, use an online versatile PDF editor to swiftly and accurately fill and sign your form with an eSignature.

- Redownload your documents.

- Use the same document again whenever needed. Access the My documents tab in your profile to redownload any previously saved forms.

Form popularity

FAQ

To put a lien for child support in Texas, start by obtaining a court order that specifies the amount owed. Once you have the order, file the lien notice with the county clerk where the non-custodial parent resides or owns property. This action formally establishes the lien and helps secure payment. Using platforms like US Legal Forms can guide you through the necessary steps efficiently.

To file a lien notice in Texas, you must prepare the necessary documents and submit them to the appropriate county clerk's office. Ensure that the lien notice includes essential details, such as the debtor's name and the amount owed. Following the correct filing procedures is crucial for establishing child support lien priority in Texas. Utilizing resources from US Legal Forms can simplify this process.

In Texas, a child support lien is a legal claim against a non-custodial parent's assets due to unpaid child support. This lien allows the custodial parent to secure payment by attaching the non-custodial parent's property or income. It is essential to follow the correct procedures for filing to ensure that the lien is enforceable. This process is where platforms like US Legal Forms can provide valuable assistance.

The priority of a lien is generally determined by the time it is filed and the type of lien it is. In Texas, a properly recorded child support lien usually takes precedence over other unsecured claims. Other factors, like statutory liens or judicial liens, can influence this priority. Understanding these elements can significantly affect your financial rights.

Lien priority in Texas is decided based on statutory provisions and the chronological order of filing. When multiple liens exist, the law typically favors the earliest recorded lien. Therefore, if you are dealing with child support lien priority in Texas, timely filing is crucial to ensure your lien is recognized first. Legal advice can help clarify these nuances.

In Texas, lien priority is determined by the order in which liens are filed. The first lien filed generally takes precedence over others. This means that if a child support lien is filed before other liens, it holds a higher priority. However, specific rules can apply based on the type of lien, so it's essential to understand the details.

To obtain a lien for child support in Texas, you should first file a request with the court that issued the child support order. This request must include details about the amount owed and any necessary documentation. Once the court approves the lien, it becomes a legal claim against the non-paying parent’s property. It’s essential to understand the child support lien priority in Texas, as it can affect how the lien is enforced and collected.

Yes, child support can put a lien on your property in Texas if you fall behind on payments. This lien serves to secure the amount owed to the custodial parent. It is crucial to understand that such a measure impacts your credit and property rights. By staying informed about child support lien priority in Texas, you can take proactive steps to avoid these legal complications.

To remove a child support lien in Texas, you must first ensure that all overdue payments are made. Once you have settled your obligations, you can file a motion with the court to release the lien. Additionally, you may need to notify the Texas Child Support Division of your compliance. By addressing these steps, you can effectively manage your child support lien priority in Texas.