Affidavit Of Trust Texas Withdrawal Limit

Description

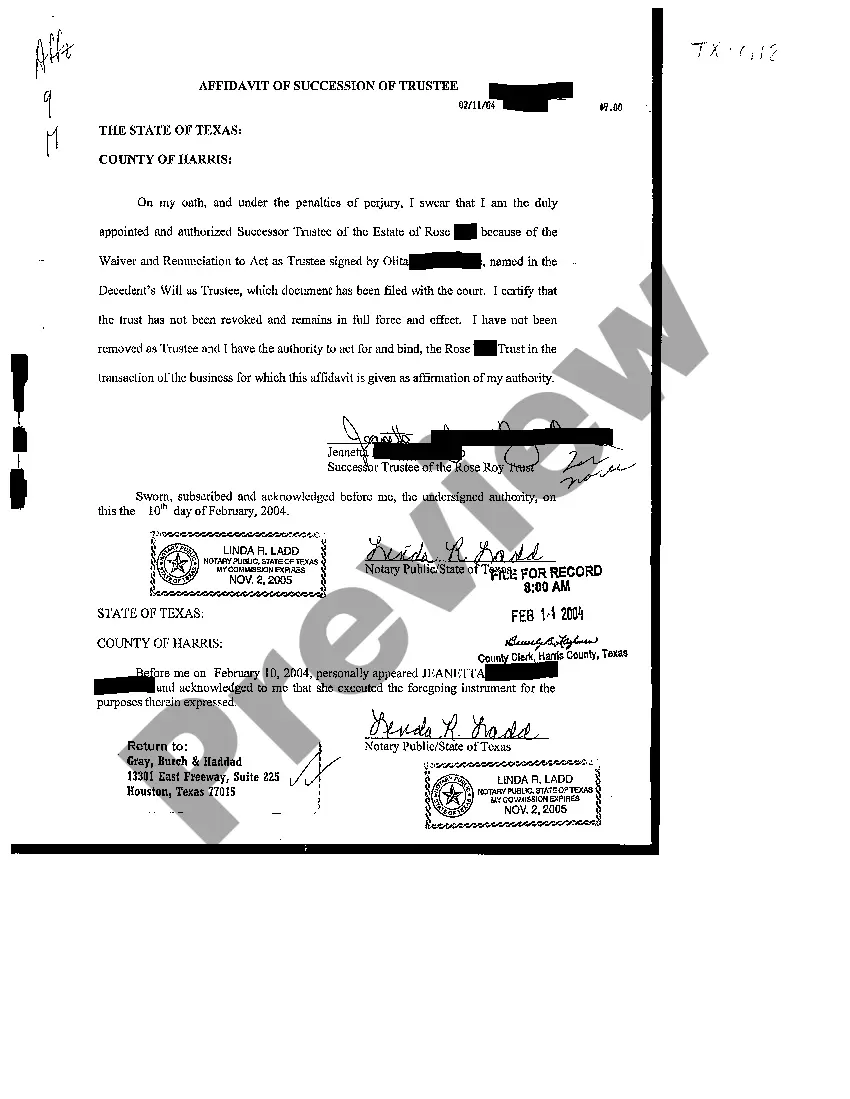

How to fill out Texas Affidavit Of Succession Of Trustee?

What is the most trustworthy service to obtain the Affidavit Of Trust Texas Withdrawal Limit and other current versions of legal documents? US Legal Forms is the answer!

It's the largest repository of legal templates for any purpose. Every document is correctly drafted and verified for adherence to federal and local laws and regulations. They are organized by region and state, making it simple to find the one you require.

US Legal Forms is an excellent resource for anyone needing to handle legal documents. Premium users can benefit even more by filling out and signing previously saved documents electronically at any time using the built-in PDF editing tool. Discover it today!

- Experienced users of the site simply need to Log In to the platform, confirm their subscription status, and click the Download button next to the Affidavit Of Trust Texas Withdrawal Limit to acquire it.

- Once saved, the document is accessible for future use within the My documents section of your account.

- If you do not yet possess an account with our library, here are the steps you must follow to create one.

- Form compliance verification. Prior to obtaining any document, ensure it aligns with your use case requirements and your state or county's regulations. Review the form description and utilize the Preview if available.

Form popularity

FAQ

To summarize, the executor does not automatically have to disclose accounting to beneficiaries. However, if the beneficiaries request this information from the executor, it is the executor's responsibility to provide it. In most cases, the executor will provide informal accounting to the beneficiaries.

The Affidavit of Heirship form you file must contain:The decedent's date of death.The names and addresses of all witnesses.The relationships the witnesses had with the deceased.Details of the decedent's marital history.Family history listing all the heirs and the percentage of the estate they may inherit.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs. What determines how long a Trustee takes will depend on the complexity of the estate where properties and other assets may have to be bought or sold before distribution to the Beneficiaries.

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.

ChecklistThe name and address of the deceased party (called the "Decedent")The name and address of the party providing sworn testimony in this affidavit (called the "Affiant")The date and location of the Decedent's death.Whether or not the Decedent left a will and, if so, the name and address of the Executor.More items...