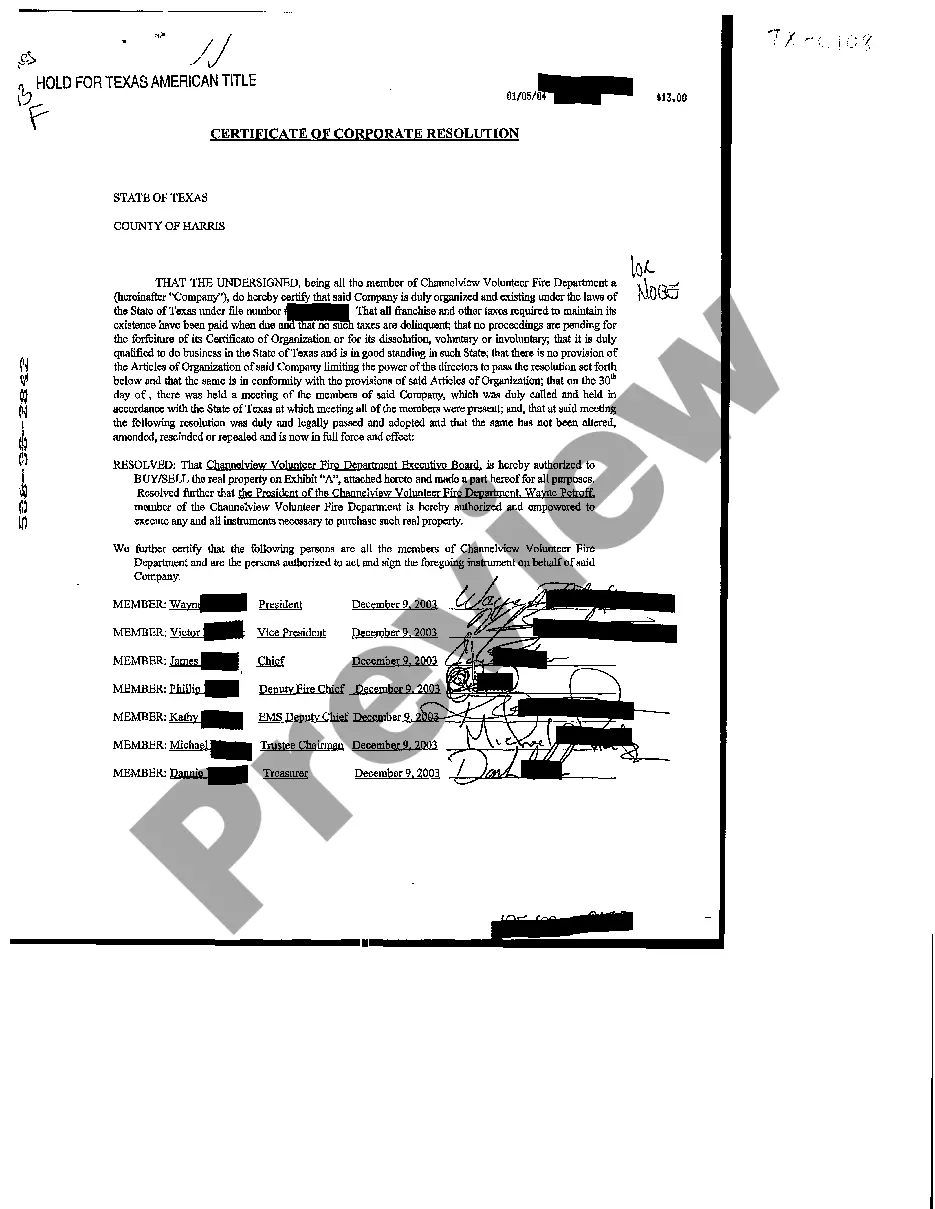

Corporate Resolution Texas Withholding Tax

Description

How to fill out Texas Certificate Of Corporate Resolution?

The Corporate Resolution Texas Withholding Tax displayed on this page is a reusable official template created by qualified attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has offered individuals, organizations, and lawyers more than 85,000 validated, state-specific documents for any business and personal situation. It’s the quickest, easiest, and most reliable method to access the paperwork you require, as the service ensures bank-level data security and anti-malware safeguards.

Reuse the same document whenever necessary. Access the My documents tab in your profile to redownload any previously saved forms. Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your fingertips.

- Search for the document you require and examine it.

- Browse the file you looked for and preview it or check the form description to confirm it meets your needs. If it doesn’t, utilize the search bar to find the correct one. Click Buy Now when you have found the template you require.

- Choose a pricing plan that fits you and create an account. Use PayPal or a credit card to make an immediate payment. If you already possess an account, Log In and verify your subscription to proceed.

- Select the format you desire for your Corporate Resolution Texas Withholding Tax (PDF, DOCX, RTF) and save the document on your device.

- Print the template to complete it manually. Alternatively, use an online versatile PDF editor to quickly and accurately fill out and sign your form with an eSignature.

Form popularity

FAQ

Sample Corporate Resolution Adopt a Fiscal Year. Acquire Assets of a Business. Acquire Shares of Stock. Adopt a Trade Name. Approve a Reorganization Plan under Chapter 11 of the Bankruptcy Code. Appoint a Purchasing Agent. Assign a Lease. Authorize Borrowing on a Line of Credit.

7 Steps for Writing a Resolution Put the date and resolution number at the top. ... Give the resolution a title that relates to the decision. ... Use formal language. ... Continue writing out each critical statement. ... Wrap up the heart of the resolution in the last statement.

When you create a resolution to open a bank account, you need to include the following information: The legal name of the corporation. The name of the bank where the account will be created. The state where the business is formed. Information about the directors/members.

Here is an example of a conclusion versus a resolution: Resolution: The team happily celebrated their victory after a challenging face-off with their rival. Here, the resolution marks the end of a story.